(Photo| Pexels)

Do you own life insurance? Are you paying premiums for a policy that you will probably not use? Have your premiums been increasing over the years?

It is common for business owners to purchase Key Man Life Insurance. This is a policy that provides a death benefit to the business that can help cover the financial burden that occurs at the death and helps assure continuity of the business for both customers and fellow team members. Often this person is a key income generator, has a unique and hard skill set to replace and is vital to the organization. Replacing such an integral team member takes both time and money. As a policy’s term does not typically extend beyond the period of the key person’s usefulness to the business, most policies are surrendered when such a person retires or changes employers.

Insurance companies won’t tell you that another option exists, an option that has the potential to greatly benefit appropriate policyholders. A life settlement may be your most prudent choice. A life settlement is an option for individuals or businesses who no longer need or want their life insurance policy or who may require funds for other needs. Just like your home, automobile or business, life insurance is a capital asset. So what is a life settlement? It’s the sale of an existing life insurance policy on the secondary market to a third party for fair market value. The owner sells the policy in exchange for a lump sum that can be higher than a cash surrender value. The third party institutional investor, who becomes the owner of the policy, makes premium payments and collects the death benefit at the insured’s death. With institutional investors, policies are owned in large blind trusts with other policies, so you don’t have to worry about someone having an incentive to hasten your demise.

To have a better idea of how these strategies can significantly benefit people, here’s a real-life example of the sale of a Key Man policy.

THE SITUATION

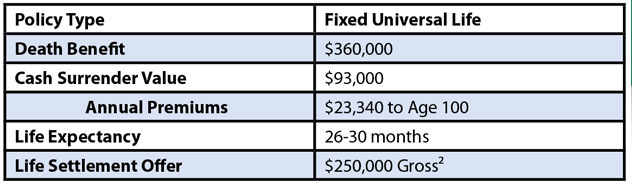

Alan Irvin,(1) an 88-year-old retired executive, owned a $360,000 Universal Life policy that was originally a Key Man Policy funded by his previous employer. Upon Alan’s retirement, the company had transferred ownership of the policy to him. The policy is considered taxable income based on the value of the policy and resulted in Alan having to pay approximately $40,000 in income taxes.

In addition to the taxes, Alan would be responsible for paying an annual premium of $23,340 to age 100. He decided he did not want to pay any premiums going forward and planned to surrender the policy and use its cash value to supplement his retirement. We suggested that he consider a life settlement as an alternative to surrendering the policy. Alan’s life expectancy was estimated at between 26 and 30 months.

THE OUTCOME

Our life settlement team worked with multiple providers to negotiate settlement offers resulting in a total gross offer of $250,000 3 or 69 percent of the Death Benefit and 2.7 X the Cash Surrender Value. The end result is that Alan was able to leverage his $40,000 tax payout into a cash payment of over $200,000 through a life settlement.

The following are examples of other situations where life settlement options shine:

- Your insurance company has unexpectedly increased the cost of your policy making it unaffordable.

- The need for insurance may still exist, but your current policy is underperforming and you want coverage that has better guarantees.

- You think you will outlive the maturity date of your life insurance policy.

- Estate tax exemption thresholds have been raised, making estate planning life insurance unnecessary.

- Funds are needed to focus on retirement, long-term care insurance or family emergencies.

- You have a charity-owned policy that has been under-performing and needs to be replaced in order to preserve the benefit to the charity.

THE TAKEAWAY

Over the years, I have met many people that are paying premiums for policies they will probably not use. This is compounded by the complexity of life insurance products and the fact that most policies are not even being managed by a professional — instead they come with a built-in “set it and forget it” approach.

Approximately 10,000 baby boomers will retire every day over the next 20 years³. As a result, there is a potential for an influx of corporate-owned or key-man life insurance policies that will enter the market. Now is a favorable time to consider a life settlement as an alternative to lapsing or surrendering your life insurance policy.

David Rosell is president of Rosell Wealth Management in Bend. RosellWealthManagement.com. He is the author of Failure is Not an Option — Creating Certainty in the Uncertainty of Retirement and his latest book Keep Climbing — A Millennial’s Guide to Financial Planning. Ask for David’s book at Newport Market, Sintra Restaurant, Bluebird Coffee Shop, Dudley’s Bookshop, Roundabout Books, Sunriver Resort, Amazon.com or Barnes & Noble

Investment advisory services offered through Valmark Advisers, Inc. an SEC Registered Investment Advisor Securities offered through Valmark Securities, Inc. Member FINRA, SIPC 130 Springside Drive, Ste 300 Akron, Ohio 44333-2431. 800-765-5201. Rosell Wealth Management is a separate entity from Valmark Securities, Inc. and Valmark Advisers, Inc.

(1) Client name has been changed to protect confidentiality.

(2) The gross offer will be reduced by commissions and expenses related to the sale.

(3) Washington Post: Do 10,000 Baby Boomers Retire Every Day? July 24, 2014. Each client’s experience varies, and there is no guarantee that a life settlement will generate an offer greater than the current cash surrender value. In such cases, the client can always surrender their policy to the carrier if the coverage is no longer needed. In a life settlement agreement, the current life insurance policy owner transfers the ownership and beneficiary designations to a third party, who receives the death proceeds at the passing of the insured. As a result, this buyer has a financial interest in the seller’s death. When an individual decides to sell their policy, he or she must provide complete access to his or her medical history, and other personal information, that may affect his or her life expectancy. This information is requested during the initial application for a life settlement. After the completion of the sale, there may be an ongoing obligation to disclose similar and additional information at a later date. A life settlement may affect the seller’s eligibility for certain public assistance programs, such as Medicaid, and there may be tax consequences. Individuals should discuss the taxation of the proceeds received with their tax advisor. ValMark Securities considers a life settlement a security transaction. ValMark and its registered representatives act as brokers on the transaction and may receive a fee from the purchaser. A life settlement transaction may require an extended period of time to complete. Due to the complexity of the transaction, fees and costs incurred with the life settlement transaction may be substantially higher than other securities.