(David Rosell & Ed Viesturs, Bend, OR — 2014 | Photo courtesy of Rosell Wealth Management)

Are you setting yourself up for financial failure — disaster, really — even though you often think about money? Are you headed for the financial death zone?

The death zone is the name mountain climbers use when referring to extreme high altitudes above 8,000 meters (26,247 feet) where oxygen is so scarce that most humans can’t even breathe. At this altitude, your body begins to feel like you are about to meet your maker, as it cannot acclimate to the incredibly harsh environment. Many climbers become weak and lose the ability to think straight. They struggle with making decisions — especially under stress. Staying at this altitude for too long significantly increases the risk of fluid accumulating in the brain or lungs, a fate that has killed many. Most of the more than 300 climbers who have died on Mount Everest have died in the death zone.

In order to overcome the extremely thin air in the death zone, most mountaineers draw on bottled oxygen. Ed Viesturs is one of the few exceptions. As one of the most notable and accomplished mountaineers of all time, he’s demonstrated that it’s possible to stand atop the world’s 14 8,000-meter peaks without the support of bottled oxygen. It is also worth mentioning that he has achieved these remarkable feats without endangering himself by taking the reckless chances that so many do in their manic to reach the summit without succumbing to summit fever and the glory to be on top of the world.

Let’s go on an adventure. Imagine that you’re at Mt. Everest Base Camp and you’ve come upon a group of mountaineers about to start their expedition to the summit.

“What’s your ultimate goal?” you ask them.

How would they answer?

If you’re like most people, you probably assume that their ultimate goal is getting to the top.

As you’re about to find out, this assumption is incorrect.

Reaching the summit is not an answer that experienced climbers, including Viesturs, would ever give when asked about their ultimate goal. You see, veteran climbers know that 80 percent of climbing accidents and deaths occur on the descent. At that point, most climbers are fatigued and dehydrated. The availability of bottled oxygen and sunlight is often limited. So before these climbers even set out, they are fully aware that the second half of their journey is the riskiest and needs the most planning

Who cares? you might say to yourself. I have no intention of climbing Mt. Everest. In fact, I probably don’t ever want to climb any mountain.

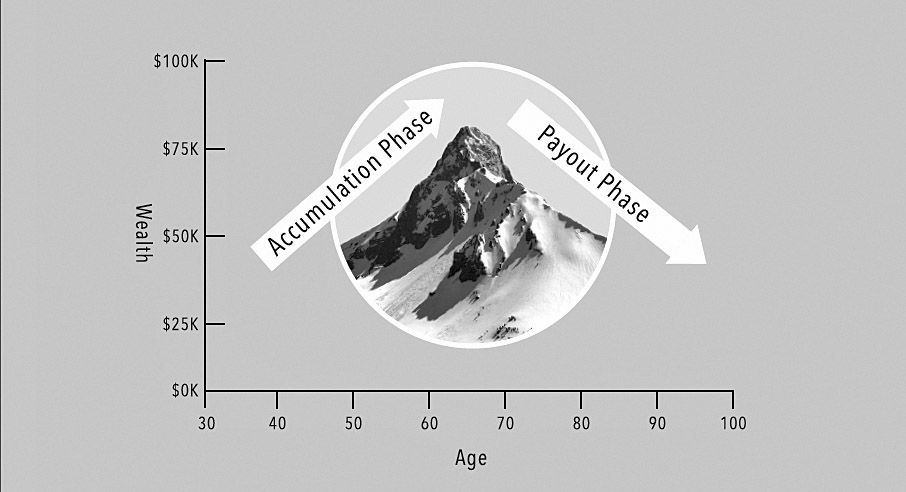

Hold on. There is one mountain you’re going to need to scale even if you’re not an outdoor enthusiast. This ascent involves making sure you have enough money to live the life you’ve always imagined in the years to come. I am here to tell you that if you don’t get it right, this endeavor could make climbing Mt. Everest feel like a stroll in the park.

(Mt. Washington, Central Oregon | Graphic courtesy of Rosell Wealth Management)

(Mt. Washington, Central Oregon | Graphic courtesy of Rosell Wealth Management)

Even the Downhill Needs to Be Uplifting

In today’s world, you must successfully navigate through the financial death zone since your future retirement income needs to last the rest of your life — often more than three decades after your earning years end! This is even harder since this second half of your financial journey encompasses the greatest risk and requires the most planning. I believe that there are eight main risks that one faces on the financial descent and it is imperative to possess the financial ice axes and crampons required to overcome them. I share these eight risks in more detail in my free podcast, Recession-Proof Your Retirement.

In this day and age, however, too few will have the luxury of worrying about this risky financial descent from the top. Only 30 percent of climbers who attempt Everest ever reach its summit. Will this be a similar statistic when millennials reach retirement? Frighteningly, I believe that’s certainly a possibility.

You must first make it to the summit before you can descend. When it comes to our financial lives, this means creating a well-funded retirement. Just like mountaineering, unless we adequately plan and prepare for that retirement, we will not reach the top.

Every generation has had its own set of trials and adversities to conquer. However, today’s generation of young adults faces a uniquely challenging environment.

In the past, if you emulated the admirable examples of your parents and grandparents as they prepared for their years of retirement, your chance of achieving success was very high. Similarly, if you followed the step-by-step advice of the many how-to books on retirement, your chances of success were also quite strong.

So far, the 21st century has turned much of the traditional wisdom regarding financial planning upside down simply because the rules of engagement have been completely rewritten. Gone are the days of pensions and defined benefit plans. Social Security has become Social Insecurity. Student loans are now the second-largest debt class, behind only mortgages. And saving for retirement is a luxury that many just can’t afford. Can you imagine what it must be like for graduating seniors trying to enter the workforce during the pandemic and economic hardships upon us?

Launching into adulthood is never an easy task, but millennials have it pretty rough — at least compared with recent generations. But don’t give up. There’s hope.

Learning key financial lessons can provide you with the financial foundation that’s critical to financial success. Unfortunately, unlike in the past, I can’t guarantee or even assure you that the financial coaching contained in my books and many others will enable you to reach your lifestyle and retirement dreams in today’s new-fangled world. What I can pledge is that if you don’t learn, understand and implement the important concepts, your chances of reaching your monetary goals — or even being able to retire and cash in your fun coupons — are likely to shrink to the point where you could very well find yourself in the financial death zone.

Just like climbing a mountain — those of you who recognize and address the unique risks faced by today’s generation are most likely to safely and successfully meet your financial goals. So fasten your seatbelt, hold on tight and do your best to enjoy the journey.

David Rosell is president of Rosell Wealth Management in Bend. RosellWealthManagement.com. He is the creator of Recession-Proof Your Retirement Podcast and author of Failure is Not an Option — Creating Certainty in the Uncertainty of Retirement and Keep Climbing — A Millennial’s Guide to Financial Planning. Find David’s books on Audible and iBooks as well as Amazon.com and Barnes & Noble. Locally, they can be found at Newport Market, Sintra Restaurant, Bluebird Coffee Shop, Dudley’s Bookshop, Roundabout Books and Sunriver Resort.

Investment advisory services offered through Valmark Advisers, Inc. an SEC Registered Investment Advisor Securities offered through Valmark Securities, Inc. Member FINRA, SIPC 130 Springside Drive, Ste. 300 Akron, Ohio 44333-2431. 800-765-5201. Rosell Wealth Management is a separate entity from Valmark Securities, Inc. and Valmark Advisers, Inc.