Welcome to the Oregon FBI’s Tech Tuesday segment. This week: building a digital defense against email loan frauds.

Fraudsters have been trying to find ways to steal money for as long as people have been using money. Not surprisingly, every day these scam artists are testing new methods to separate you from your hard-earned cash. This year alone the Better Business Bureau has seen a large number of scam reports involving fake loan email messages.

Here’s how it works: You are perusing through your email inbox and notice that you have received an unexpected email stating that you have pre-qualified for a loan or been approved for a loan. All of the information regarding the loan – including the final payback amount—are included in the email. Many of these messages will include an attached file that appears to be an official document approved by several government agencies. However, you will come to find out that there is a tiny little requirement before you can receive your loan – an “upfront” fee of $150. If you pay this, you are likely to lose your 150 bucks and never get the loan itself.

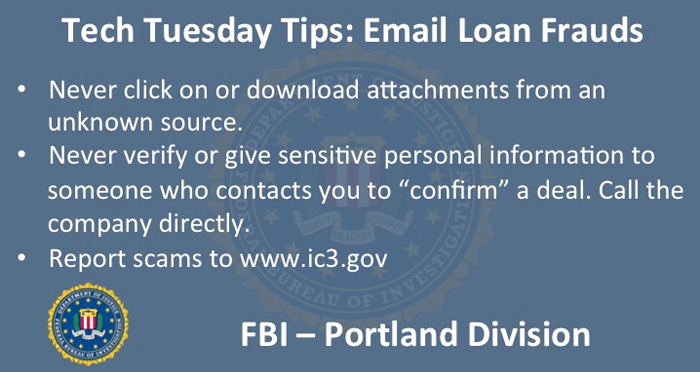

Here are some tips to avoid email phishing scams:

If someone you don’t know unexpectedly contacts you with an amazing deal, be cautious. It is probably too good to be true.

Never click on or download attachments from an unknown source. Scam artists will often camouflage malware in these attachments, and if you click on them, they will have access to your computer and your personal information. If you do choose to click on the link, hover over it first to see what the real destination is.

If you receive a request to “verify that your account information is correct in order to send the loan proceeds”… watch out. You should never provide account information or other sensitive personal information to a solicitor.

Look for some dead giveaway signs. If there is no personal information in the email, such as your name, than it could be a mass email that the scammer sent out. Additionally, look for spelling errors or typos.