I’m sure you’ll find the following information on website FinmaxFX and article about Shooting Star Candle will be useful for traders. It is quite common on Forex charts, so it will allow you to get your share of profit from the market more than once. Start studying it now, it will not take much time, we promise.

DESCRIPTION OF THE Shooting star candle pattern

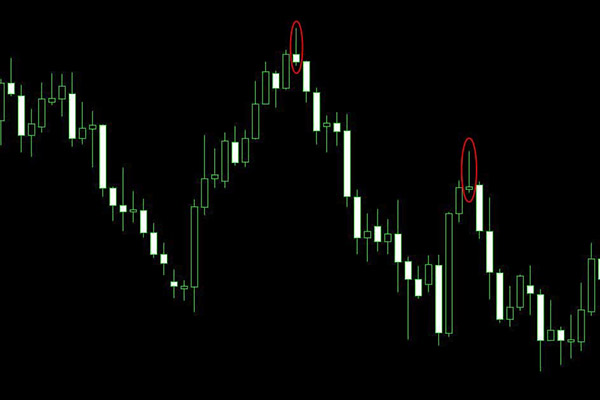

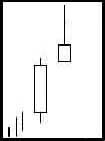

In Japanese candles, the figure of the Shooting Star consists of one candle. This model appears at the top of an upward trend. In order for the signal to be considered correct, this candle must have a small body and a shadow at least 2 times larger than the body. The Japanese called this signal because it looks like a star falling from the sky or a meteor with a tail.

In Japanese candles, the figure of the Shooting Star consists of one candle. This model appears at the top of an upward trend. In order for the signal to be considered correct, this candle must have a small body and a shadow at least 2 times larger than the body. The Japanese called this signal because it looks like a star falling from the sky or a meteor with a tail.

MODEL CRITERIA

The Shooting Star model must meet the following parameters:

- The upper shadow should be two or more times larger than the body of the candle.

- The candle should be at the top of the upward trend. The color of the body is not important, although the black body is slightly more preferable

- There should be no lower shadow at all, or it should be very small.

- The next candle should give a confirmation signal – it should be a bearish candle with a sufficiently large body.

SIGNAL ENHANCEMENT

- The longer the upper shadow (Star’s tail), the higher the turning potential.

- The star on both sides is surrounded by gaps..

- A large volume during the formation of the model increases the chances of success, although it is not necessary

PSYCHOLOGY AND PATTERN VALUE

After a strong bullish trend, the candlestick opens and trades high, but before it closes, the bears begin to open sell positions and reduce the price to the bottom of the trading range, creating a candlestick with a small body and a long upper shadow, similar to a Star, or a falling comet with a tail. The long upper shadow represents the fact that further upward movement of the price encountered strong resistance, which exceeded the ability of buyers to raise the price further. If a small tail candlestick is followed by a black candlestick with a larger or smaller body, for Forex, this fact will confirm that the bulls’ strength has dried up and it is time to open short positions. The formation of the Morning Star pattern can be considered complete and the trend has changed.

By the way, the Morning Star pattern is very similar to the Inverted Hammer. Actually, it is almost the same! Follow this link and find out all the details right now!