It’s 10 Percent What Happens and 90 Percent How You React

July 2016

A few weekends ago, my younger sister graduated from Linfield College with a bachelor of science in Nursing. My family and I spent the weekend celebrating with her, which included two graduation ceremonies and some delicious wine tasting in the beautiful Dundee hills of the Willamette Valley. During the nursing school pinning ceremony, the commencement speaker started her speech by telling the graduates that she could not remember a single speaker or speech from her own college graduation many years prior.

She went on to tell the graduating class that what she did remember was how she felt that day—excitement and fear for her unknown future. She explained that while the graduates may be feeling a slew of emotions about the unknowns in their own futures, they could control their worry by trusting the strong education they received from Linfield, believing in their abilities, doing their best and knowing that in the long haul, everything will work out okay. Essentially, she was telling the graduates to have a positive mindset as they go through this new transition into adulthood and it will all be ok. The graduates and many people in the audience nodded in agreement.

Her message was sincere and I appreciated her bite size tidbits of advice to the wide eyed graduates. We all know that over the course of our lives we will experience many highs and many lows which could possibly include marriage, divorce, promotions, layoffs, births and deaths of loved ones and so much more. To get through the hard times we tout messages about keeping a positive outlook and staying the course to get through the lows. As the adage goes, life is ten percent what happens to us and 90 percent how we react to it.

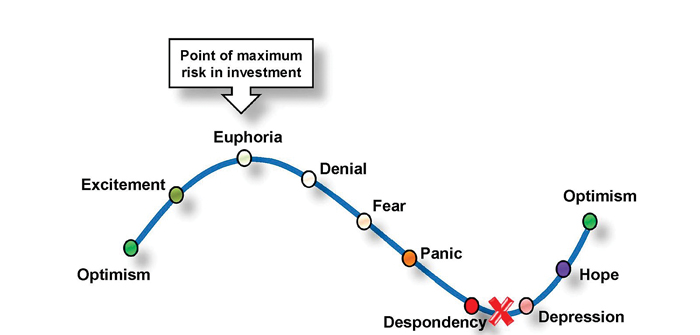

In my profession, the stock market is a source of fear for many investors. A quick Amazon search brings up dozens of books addressing this very topic of fear and finance. Most of us are programmed to avoid things that cause fear for good reason — thousands of years ago, this is what kept our ancestors alive. Good reason or not, basing your investment behavior on the reactions to your emotions is bound to be a detriment to your retirement portfolio.

It’s human nature, in challenging times, for our emotions to take control and tell us to pull our money out of the markets when things go awry. However, this creates bigger problems for a retirement portfolio. Selling during periods of market decline may cause you to feel the pain of loss twice.

First, you lock in your losses and then you run the risk of missing out on the market’s eventual recovery, and you end up paying more to reinvest when prices have risen. When markets are at their lowest, it is actually a point of maximum opportunity for investors. For example, if you purchased a home in 2009/2010 in Bend, when the housing market was at its lowest and despondency was at its highest, I imagine you are feeling very good about that investment right now.

A better alternative to emotional investing is to consult with your financial advisor to develop a diversified long-term strategy and stick to it. When we face challenging times in life, we often turn to a coach or therapist to help us process the challenges and transition smoothly through the changes. Since money is also a source of a wide range of emotions for most people, the same approach should be taken when dealing with your retirement nest egg. Your long-term goals don’t change overnight and neither should your portfolio.

When the markets go askew or face a temporary setback from BREXIT, having an investment professional to help ensure you have a diversified, long term strategy to stick to will help you ride out the waves and keep the long term goal in mind. Whether you are graduating college and just starting out, or wrapping up a successful career and preparing to pass the baton, it can be a scary, overwhelming time, but guidance from trained professionals and a positive mindset can help you navigate through as you work towards living the life you have always imagined.

Brenna Hasty is a retirement investment counselor and director of operations at Rosell Wealth Management in Bend. www.RosellWealthManagement.com

Securities offered through ValMark Securities, Inc. Member FINRA, SIPC.130 Springside Drive, Suite 300, Akron, OH 44333 800-765-5201 Investment Advisory Services offered through ValMark Advisers, Inc., a SEC-registered investment advisor. Rosell Wealth Management is a separate entity from ValMark Securities, Inc. and ValMark Advisers, Inc.

The opinions expressed in this article are those of the author and should not be construed as specific investment advice. There can be no assurance that the views and opinions expressed in this article will come to pass. Investing involves the risk of loss, including the loss of principal. All information is believed to be from reliable sources, however, no representation is made to its completeness or accuracy. Diversification does not prevent or guarantee against loss.”