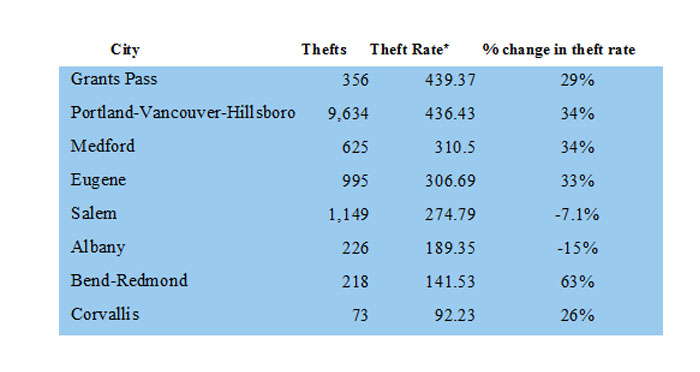

(Chart above: Top eight Oregon cities with the highest theft rates in 2016 and how they compare to 2015 data (percentages rounded)*The theft rate is based on the number of thefts per 100,000 inhabitants using U.S. Census data)

63 Percent Higher in Bend-Redmond

-Number of vehicles stolen in Oregon up 19 percent statewide

-Owners of vehicles stolen are on the hook without Comprehensive Insurance Coverage

-Drivers are recommended to follow the “four layers of protection” to guard against vehicle theft

Several Oregon metropolitan areas posted increases in the number of auto thefts in 2016, and the state’s overall auto thefts rose 19 percent, according to the National Insurance Crime Bureau’s (NICB) recent annual Hot Spots Report.

Preliminary data from the FBI’s Uniform Crimes Report show that auto thefts were up across the country by 6.6 percent in 2016. The NICB compares auto thefts per 100,000 inhabitants to develop an even comparison in metropolitan areas across the country. Auto theft increased in most Oregon metropolitan areas last year, which means an increase in both the number of vehicles stolen and auto theft rate per 100,000 residents.

The Bend-Redmond metropolitan area saw the steepest increase in the number of vehicles stolen with a 63 percent increase in 2016 compared to 2015. Medford increased by 27 percent and the Portland area rose by 24 percent. Some areas did have a decrease in auto theft, however. The Albany area decreased by 15 percent, Salem saw a 5 percent drop, and Grants pass is down by almost 2 percent.

Auto theft continues to be a widespread and costly crime, particularly if the vehicle owner does not have the right insurance coverage. The NW Insurance Council encourages drivers to consider optional Comprehensive or Other than Collision Coverage. This type of policy pays – up to the limits of the policy (typically after a deductible has been paid by the policyholder) – for vehicle damage not caused by a collision with another vehicle or by depreciation and normal wear and tear, including damage from fire, hail, windstorm, auto glass breakage and even if the vehicle hits a deer. Importantly, comprehensive insurance is the only policy that will pay to help pay for a stolen car.

“Vehicle theft is a $5 billion-per year crime in the US,” said Kenton Brine, NW Insurance Council president. “Guarding against vehicle theft and making sure you are protected against the loss of your own vehicle are two ways for consumers to help reduce risks and manage insurance costs.”

Vehicle theft is the nation’s number-one property crime, costing an estimated $4.9 billion in 2015, according to the FBI. In 2016, 13,276 vehicles were stolen in Oregon. That’s more than 36 vehicles per day and more than one vehicle stolen every hour.

Brine recommended drivers employ the National Insurance Crime Bureau’s “Four Layers of Protection” to guard against auto theft. “The more layers a driver can employ, the less chance his or her vehicle will be targeted by car thieves,” Brine said. The protections include common sense measures like locking your car, adding warning devices like light and sound auto alarm systems, adding an immobilizing device such as a fuse cut-off or kill switch, or using an onboard tracking device.

The persistent high number of thefts means vehicle owners continue to pay millions of dollars for auto theft through their insurance premiums.

How to Help Stop Auto Theft & Insurance Fraud

In some cases, auto theft is a form of insurance fraud when vehicle owners arrange to have their vehicles stolen with hopes of collecting the insurance money. If you witness or have knowledge of an auto theft, you can report it anonymously by calling toll-free 1-800-TEL-NICB (1-800-835-6422) or by texting keyword “fraud” to TIP411 (847411).

For more information about the Hot Spots Report and insurance fraud, visit National Insurance Crime Bureau and NW Insurance Council.

NW Insurance Council is a nonprofit, public-education organization funded by member insurance companies serving Washington, Oregon and Idaho.

National Insurance Crime Bureau is the nation’s leading not-for-profit organization exclusively dedicated to preventing, detecting and defeating insurance fraud and vehicle theft through data analytics, investigations, training, legislative advocacy and public