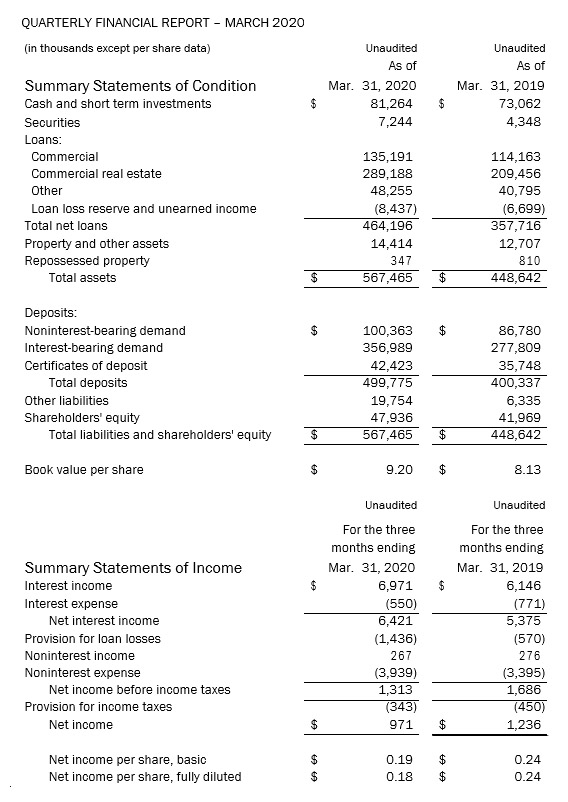

Summit Bank (OTC Pink: SBKO) reported net income for the first quarter of $971 thousand or 18 cents per fully diluted share. Comparable earnings for the first quarter of 2019 were $1.24 million or 24 cents per fully diluted share, representing a decrease of 21 percent to earnings and 22 percent to earnings per fully diluted share. Elevated loan related losses in the Bank’s small business commercial equipment finance group (EFG), as well as, increased provision for future loan losses resulting from the COVID- 19 pandemic were the primary drivers of the lower earnings for the quarter compared to the previous year.

Earnings per fully diluted share (EPS) for the trailing four quarters ended March 31 were $1.02 compared to $1.12 for the four-quarter period ended March 31, 2019.

Despite the challenging economic environment, Summit has continued to achieve solid balance sheet growth. Total net loans as of March 31, 2020 were $464.2 million, an increase of $26.7 million for the quarter and an increase of $106.5 million or 29.8 percent over March 31, 2019. Deposit growth continues to be robust as well. Total deposits as of March 31, 2020 were $499.8 million, an increase of $48.3 million or 10.7 percent and $99.4 million or 24.8 percent over December 31, 2019 and March 31, 2019, respectively.

“While the COVID-19 virus has had a negative effect on economic activity,” said Craig Wanichek, president and CEO. “Summit Bank remains a source of strength. This strength has enabled the Bank to support our clients, colleagues and communities during these unprecedented times. We are extremely proud of the team’s efforts to have approved, underwritten and funded nearly $90 million in PPP loans to approximately 330 clients in the communities we serve. Clients have also benefited from loan modifications, waivers and forbearances as they have worked with Summit’s bankers. We remain steadfast in our commitment to be accessible and responsive to all businesses in our communities.”

The Bank reported $88.5 million of cash and short-term investments in securities as of March 31, 2020. This is a 60.3 percent increase over the $55.2 million held in cash and short-term investments in securities at fiscal year- end 2019. The Bank continues to hold very low levels of non-performing assets. Total non-performing assets at March 31, 2020 represented just 0.2 percent of total assets, a decrease from 0.4 percent as of March 31, 2019.

“As the result of the lower levels of port activities, the Bank’s EFG division experienced losses and slowness in the first part of the quarter,” said Wanichek. “The Bank overall experienced some credit deterioration at the end of the quarter reflected in the increased provision but there were no new loans 30 days past due at quarter-end, outside of our EFG portfolio. In addition, non-accrual levels also remain very low.”

With offices in Eugene and Bend and downtown Portland, Summit Bank is a business bank that specializes in providing high-level service to professionals and medium-sized businesses and their owners. Summit Bank is quoted on the NASDAQ Over-the-Counter Bulletin Board as SBKO.