(Photo courtesy of ValuePenguin.com)

Oregon, the Beaver State, is one of the few states located in America’s Pacific Northwest and has a diverse geographical landscape including lush forests, deserts, and basins. To assist homeowners in the state, ValuePenguin analysts looked at home insurance prices throughout Oregon using a benchmark, 2,000 square foot property. Bend is 18th on the list at $855, Prinevile 36th at $922, Madras 38th at $931and Sisters at 46th, of the highest at $960.

The purpose of the study was to present potential homeowners with the major, long-term cost of owning a home in any one of the 57 cities included in the study.

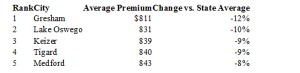

Cities with the Cheapest Homeowners Insurance in Oregon

The cities with the cheapest homeowners insurance in Oregon are all located along the western part of the state. A majority of these cities are clustered around the Portland area. However, Portland itself is not among the cheapest in the state – far from it, the city is the most expensive! The average annual cost of a home insurance policy in these five cheapest cities is $833 – 9% below the Oregon mean.

Rank City Average Premium Change vs. State Average

Gresham, OR

Gresham is Oregon’s fourth largest city, and home to some of the best home insurance rates in the state. The city had below average homeowners insurance premiums for our benchmark house of $811 per year – that is 12% better than rates found in a typical Oregon city! Gresham’s namesake is Walter Quinton Gresham, famed American Civil War general. The city is located just outside of Portland, which has the state’s highest home insurance rates. Despite being just 15 miles apart, the homeowners premiums in the two cities differ by as much as 30%!

Lake Oswego, OR

Lake Oswego is a town located just south of Portland. It has a population of roughly 37,000 residents, and the second cheapest home insurance rates in Oregon. The cost of insuring our sample property in Lake Oswego was just $831. The town is engulfed by the 420-acre Oswego Lake, which is also where the town gets its name. Lake Oswego has been the hometown of many illustrious individuals – from NBA players, to Nobel Laureates.

Keizer, OR

Keizer, a city of 36,000 found in Marion County, has the third best homeowners insurance rates in Oregon. Insurance premiums for our model home in Keizer were approximately 9% below the Oregon state average, at just $839 annually. Hard rock fans will be interested to know that Keizer is the hometown of drummer Deen Castronovo, who performed for such bands as Journey, Social Distortion, and Black Sabbath.

Tigard, OR

Tigard, a city in Washington County, is part of the Portland metropolitan area. Despite its close proximity to Portland, Tigard’s has some of the lowest home insurance prices in Oregon. The average price of a homeowners insurance premium for our sample house came in at $840 per year. The city hosts the Festival of Balloons, every year in Cook Park, between June 26th and June 28th. The festival consists of music, food, games, as well an impressive display of hot air balloons.

Medford, OR

Medford is the fourth largest metro area in Oregon, and has the state’s 5th cheapest homeowners insurance rates, coming in at an annual average of $843 for our example unit. The city has experienced rapid growth over the last several decades. Along with this increase in population, Medford has seen a rise in gang activity and organized crime – despite these factors, which tend to correlate with high property insurance rates, the homeowners insurance prices in Medford have stayed low relative to the rest of the state.

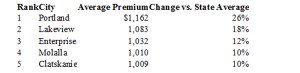

Places with the Most Expensive Homeowners Insurance in Oregon

The average cost of insuring our benchmark property in the five most expensive cities for homeowners insurance in Oregon was $1,059 per year. These cities had no geographical commonality and were spread all throughout Oregon. The price difference in home insurance policies between the most expensive Oregon cities and the cheapest was as high as 30%.

Rank City Average Premium Change vs. State Average

Portland, OR

“Rose City”, Portland is the largest city in Oregon, with a population of over half a million. Generally, major cities in each state tend to have that state’s highest home insurance rates; Portland is no different. For our benchmark property, the average cost of homeowners insurance was $1,162 – 26% higher than the Oregon mean. One reason behind the elevated insurance premiums is the crime rate. Statistics indicate that the chances of becoming a victim of property crime in Portland are 1 in 20, compared to the 1 in 32 state average. Home insurers tend to increase their rates when this is a case, to compensate for the increased risk of having to pay out damages for a claim.

Lakeview, OR

Lakeview, nicknamed “The Tallest Town in Oregon” due to its high elevation (4,802 ft), is a small city of 2,294 residents. The city’s high elevation might be the reason behind its title of the “hang gliding capital of the West” in previous years. Over the last few decades, Lakeview has hosted national championships in both hang gliding and paragliding. When partaking in these activities, you might get a bird’s eye view of the city’s high home insurance prices. The average cost of insuring our sample house in Lakeview was $1,083 per year, making it the 2nd most expensive city in Oregon for homeowners insurance.

Enterprise, OR

With a population of 1,895, and a total area of 1.53 square miles, Enterprise is one of the smallest city on our list. Despite its small size, Enterprise has some of the highest rates for homeowners insurance in Oregon. Rates across 4 major insurers averaged $1,032 annually, making it approximately 12% costlier than premiums in the typical Oregon city.

Molalla, OR

Molalla is found in Clackamas County, approximately 35 miles south of Portland. It has the fourth highest home insurance rates in the state of Oregon, with an average premium of $1,010 per year – or $91 above the annual mean price found in the state. Despite its fairly low population (8,000 residents), Molalla has a property crime rate that’s slightly above the state average. Elevated property crime rates correspond with high home insurance rates – insurers tend to see these statistics and, in turn, respond by raising their prices.

Clatskanie, OR

Clatskanie is last on our list of most expensive cities for homeowners insurance rates Oregon. The average home insurance rate in Clatskanie is $1,009. Despite being a small city, Clatskanie has many outdoor activities for residents, and visitors alike. These range from kayaking to windsurfing. The area around Clatskanie is home to many deer, elk, and game birds, making it an ideal hunting ground.

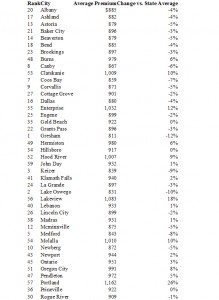

Cost of Homeowners Insurance in Oregon

Through the 57 cities included in this study, the mean annual homeowners insurance premium for our profiled 2,000 square foot house in the state of Oregon was $920. For a full list of the average premiums for each of the cities that were part of our study, refer to the list below (ordered from least to most expensive).

(Click chart to view)

Map of Homeowners Insurance Rates in Oregon

Methodology

For the purposes of our study, we looked at home insurance prices for the same benchmark home. This property was 2,000 square feet in size, was constructed in the year 2000, and had a reconstruction cost of $200,000. Our model homeowner was a single, 41 year-old male, non-smoker, who did not own any pets. The insurance companies we obtained from included Progressive, Liberty Mutual, State Farm, and Farmers. You can view the full list of cities, in alphabetical order, below, along with their corresponding average annual home insurance premium.

Rank City Average Premium Change vs. State Average

(Click chart to view)

By Brian Quinn

http://www.valuepenguin.com/best-cheap-homeowners-insurance-oregon