As a lifelong traveler to other countries, I have witnessed firsthand the consequences of governments that oppress their people, where there is not a vote for every person. As hard as this election has been, in the U.S. we are very privileged to participate in the political process that shapes our future. Sure, our systems are anything but perfect. They’re broken in many ways. And yet…show me a system that works better.

It was a long November for everyone as we awaited the results of the presidential election and now, we gear up for a tricky transition. There are many of you who are overjoyed by the results, and others who feel deflated. For months leading up to the election, I heard clients and people on the streets talk about the possible repercussions to the markets depending upon who would prevail: “What happens if there’s a blue wave and Biden takes control? The markets will tank!” Others feel the markets were in for a COVID rollercoaster if the incumbent were to stay in office. I’m going to share with you how the markets truly feel about these presidential elections. This might surprise you — as well as benefit you — by removing some of the fears and emotions that so many people seem to experience every four years. Before I get into the details, I’m going to take us on a road trip through Africa, where I had an opportunity to meet a prominent and now notorious president on what was a serendipitous day.

Africa

My entire world opened up when I spent the second semester of my junior year of college traveling through Europe by Eurail. I was astonished to enter buildings many times older than the United States’ mere two-and-a-half-century history. I would cross borders into countries that were similar in size to states back home, and discover different languages, currencies and cultures. As a 20-year-old, I found this thrilling. My first taste of travel expanded my sense of possibilities and I knew I just had to see as much of the globe in this lifetime as possible. I had caught that infectious condition called the travel bug, so after graduating from college, I continued working my driveway-sealing business and then traveled in the off-season. Since I could only work during the months where the temperatures climbed to the mid-50s and above, that meant that the world was mine to savor for six months out of each year. There were so many people to meet, sights to see and flavors to taste. I started my travel stints in trouble-free countries where English was the language of choice and the United States government was not an adversary — places like Australia, New Zealand and Fiji. By my second winter, I had built up enough courage to visit more adventurous places, such as Southeast Asia. 1994 marked my fifth winter season, and 30 countries under my belt. I finally felt I had enough solo world-traveler experience — and enough guts, or so I hoped — to spend six months meandering down the world’s largest continent traveling by thumb, bus and train. My journey through Africa would take me from Nairobi, Kenya to the Cape of Good Hope, which is the southern tip of Africa where the Atlantic and Indian Oceans meet. This was not going to be an ordinary journey, to say the least.

I have always found that the most oppressed countries often have some of the kindest people. Uganda was no exception; however, I felt an unsettled nervous tension as machine gun-toting soldiers greeted me with late-night stares as my bus from Nairobi finally arrived into the capital city of Kampala. I was one of only a few Mzungus in sight. Mzungu is a common expression dating back to the 18th century, when Europeans began to explore the continent. It translates to “someone who roams around aimlessly.” Today, it refers in a non-derogatory way to someone with white skin. The next day, adorable children ran over to greet me in the streets as I exited my guesthouse. “Hello Mzungu! What is your name? Where are you from?” As I walked around the city, I eventually found myself at the base of what we would call a butte here in Central Oregon; a small mountainous outcrop not far from the city center. It was surrounded by armored tanks and soldiers with the ubiquitous AK47’s in hand. No one without permission was going to get past the ropes and up the sinuous road that led to Namirembre Cathedral.

Dumbfounded is an understatement when suddenly, a soldier noticed me and without saying anything lifted up the rope and used his hand gestures for me to follow him. Minutes later, he escorted me to the very front of this beautiful cathedral that dates back to 1890. It was filled with 4,000 guests. By the time I realized I was in the press box, I assumed that the soldier thought I was part of Reuters or AP News because I was a mzungu with a camera around my neck — even though it was just an inexpensive point and shoot. A real member of the press informed me that the new Archbishop of Uganda was being sworn in and church leaders from around the world had gathered, including Uganda’s eminent President Yoweri Museveni, most famous for overthrowing one of the cruelest dictators in world history, Idi Amin, in the late 1970’s before capturing power in 1986. I was upfront, under the stage and facing the enormous audience. President Museveni, who was perched on his ornamental deacon’s chair just 15 feet away, was facing me! I had learned so much about this man who, during his early tenure, had brought relative peace and significant success in battling AIDS to Uganda. There he was right in front of me. At one point, we caught eyes. I gave him a thumbs up and he responded with a wink. I love the unexpected, good happenings that occur when you travel the world solo! Today, Museveni is the longest-sitting president of his country, and sadly he is accused of human rights violations, voter fraud, a lack of freedom of speech and oppressive inflation rates.

As bad as we may feel things are here at home in the United States, I am grateful to be an American and proud that we have an election system in place for a peaceful transfer of power with eight-year term limits. Even though this most recent election may have felt unique, we have sort of been here before. The 2000 presidential election between George W. Bush and Al Gore was too close to call when the polls closed on election day. The winner wasn’t declared until six weeks later — following a recount in Florida that was ultimately settled by the Supreme Court. During this election limbo, uncertainty increased market volatility as the S&P 500 index fell by more than 6 percent within two weeks following election day. This time around, the markets shot up to hit all-time highs since the election.

Earlier I mentioned rhetoric of where investors thought the market was going to go based on which party took the presidency. Here’s what I have to say to this: It’s nonsense! The markets always seem to do a little dance during the election, and yet before long, they forget there was even an election and they revert back to some form of normalcy. This may surprise you, but take a look at the historical facts. One way to try to factor in the impact of elections is to consider which party controls not only the White House, but also Congress. JP Morgan has shown that historically, the best backdrop for stocks has always been a split government whereby the President’s party does not have majorities in both the Senate and the House. Basically, investors seem to prefer the checks and balances of even a highly partisan sharing of power versus an unchecked one-party situation. JP Morgan has plotted how the markets have performed in every combination regarding which political party controls the Presidency and Congress. The years when there has been a democratic President with a split congress, the markets have average over 16 percent per year. The results are slightly lower when there’s been a republican President with a split congress. The markets are more resilient that we may think over the long-term, and I believe it would have been a big mistake to have created a short-term investment strategy on a plan that necessitates accurately predicting who will be in the Oval Office come January 20.

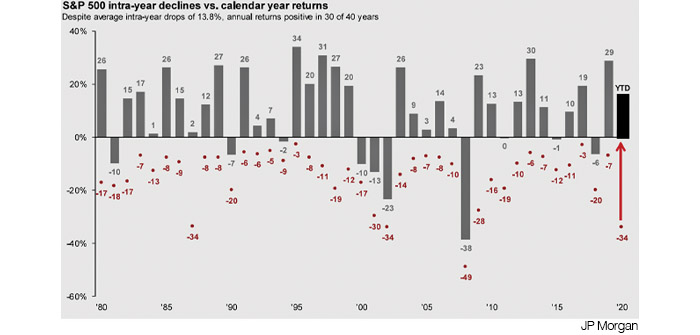

The chart tracks the S&P 500 since 1980 to the present. It illustrates how the markets ended 30 of the past 40 years in positive territory, or 75 percent of the time. However, it also illustrates the intra-year lows in any given year. For example, in 2009, the S&P 500 reacted to some negative news and at one point in the year they were down 28 percent, and yet they finished the year up 23 percent! In March of this year, the same index was down 34 percent, and as of this writing, it is up almost 10 percent YTD. Please remember that it’s not about timing the markets, but time in the markets.

I believe the four most expensive words in the English language are “This time is different.” Do you remember October 19, 1987? It was that ominous date known as Black Monday. After that day people would say: “You don’t understand — never before have the markets plunged almost 23 percent in one morning, making it the largest one-day percentage decline in stock market history. “This time is different.” Who would have ever known at the time that the markets would end that year at an all-time high. In 2008, when the markets experienced their worst decline in history, I heard people say: “you don’t understand — never before have the largest financial firms in all financial sectors declared bankruptcy or no longer exist. This time is different.” So many people got out of the markets due to fear. Today, the markets are up over 400 percent from lows in March of 2009. Today, the conversations continue — “Never before have we had a global pandemic in our lifetimes; this time is different.” Hmm…. a repetitive story for sure.

Whether you live in Kampala, Uganda or Bend — life is certainly not straightforward and trouble-free. But things have a way of working out. They just do. We’ve made it through continual financial downturns including the Great Depression and the Great Recession, and we’ll make it out of this current recession and pandemic. We’ve also made it through the never-ending changes in government parties and policies. The list of challenges goes on and on. In the end, it’s important to recognize that difficult times often bring out the best in us as it enables us to develop resiliency. Even during what seems to be a dark time in our country, it’s imperative to remember that winter always precedes spring. As I look out the window here in Bend, snow continues to fall. During all this chaos, it is important to appreciate the fact that the snow insulates the ground so that things will grow and bloom in the spring. Maybe that’s what’s happening in general with our country right now. James Baldwin said: “Not everything that is faced can be changed. But nothing can be changed until it is faced.” This is where we are. The spring will not be here for months, but it will come. We just need to make sure to face our challenges and do the right thing until then.

David Rosell is President of Rosell Wealth Management in Bend. He is the creator of Recession-Proof Your Retirement Podcast and author of Failure is Not an Option — Creating Certainty in the Uncertainty of Retirement and Keep Climbing — A Millennial’s Guide to Financial Planning. Find David’s books on Audible and iBooks as well as Amazon.com.

Past performance does not guarantee future results. Indices are unmanaged and do not incur fees, one cannot directly invest in an index. Investment advisory services offered through Valmark Advisers, Inc., an SEC Registered Investment Advisor Securities offered through Valmark Securities, Inc. Member FINRA, SIPC 130 Springside Drive, Ste. 300 Akron, Ohio 44333-2431. 800-765-5201. Rosell Wealth Management is a separate entity from Valmark Securities, Inc. and Valmark Advisers, Inc.