For the past three years my CBN forecast was for noticeable year-over-year improving economic conditions in our region. For a number of reasons, that trend could change in the year ahead. But not to worry, don’t expect a repeat of 2008-10, rather a chance to catch our breath from the torrid pace of recent growth.

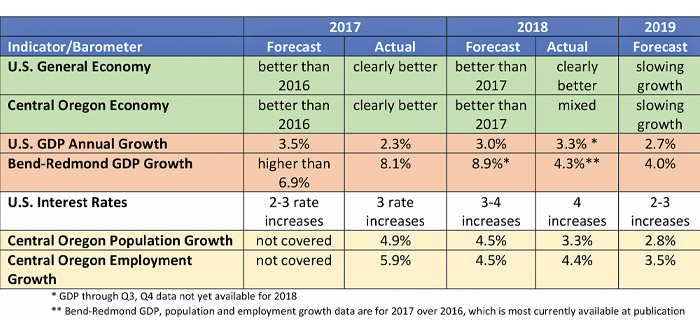

The table below is not something you see done often by economists – comparing forecasts with results, but then again, I’m not really an economist. We have a saying at EDCO – “economists study the economy, economic developers work to change it.”

The forecast for 2018 predicted that both the U.S. and regional economies would improve — that is to say that the rate of growth for things like jobs and GDP would accelerate. That held true for the national economy, but we saw mixed results in Central Oregon. GDP growth, which was #1 fastest growing in the nation over the previous year, was much more measured; only a percentage point above the U.S. as a whole. It was expected that population and job growth rates would be less than those in 2017, and while my job growth estimate was very close to the actual, we did see a larger than expected drop in population growth rates. No doubt housing costs and availability impacted in-migration, the driver of our population increases for the past three decades. Still, for perspective, our “slower” population growth was three times that of Oregon which usually sits in the top 10 fastest growing states in the nation.

For the past 20 years, Santa Monica-based Milken Institute has produced a comprehensive report of how large and small metros are performing economically, entitled “Where American Jobs are Created and Sustained.” The Best Performing index looks at a bundle of economic factors including short and long-term job growth, wage gains, diversification, and technological advances to annually determine the relative growth of metros. For the third consecutive year, the Bend-Redmond MSA (Metropolitan Statistical Area) ranked #1 for small cities, which is unprecedented. Historically, other metros have had back-to-back #1 showings, but never a three-peat.

What about 2019? We expect a further slowing of growth rates. Keep in mind, even with declining growth rates, these are numbers that most rural areas and isolated metros hope to, but rarely ever achieve. Nationally, with the current economic expansion the second longest (so far) in the past 100 years (1991-2001 was longer, but now only by five months), we expect the Federal Reserve to ease up on rate increases. Our forecast, which has been dead-on for several years, is for 2-3 increases in 2019 as the economy cools.

Further Down The Road

While 2019 will be a year of slowing economic growth, not all sectors will be impacted. Medical, wholesale trade and multi-family construction industries are all forecast to do well nationally, while single family housing, retail and financial sectors are more at their apex now and are headed toward a phase of declining growth. Importantly, the anticipated national “recession,” or slowdown, is expected to be short, arriving in the latter half of the year and potentially into the first part of 2020 before recovery begins later that year. Particularly in view of the long expansion we’re currently still enjoying, the post ‘19-‘20 recession recovery is expected to also be short before the next national and global recession begins in late 2022 and extending into 2023.

Headwinds

While there are always challenges and opportunities in any point in the business cycle, we see a number of factors — national, state and local — that when combined, are expected to further slow our pace of growth. For the U.S. economy, protectionism (trade wars), immigration policy (and its impact to source labor/talent), government shut-downs, and rising interest rates all have a dampening effect. More often than not, lawmaking in Washington, D.C. is a distant activity that appears to have little effect on EDCO’s business development efforts. That said, local manufacturers are seeing raw material costs jump dramatically due to tariffs, tech companies are unable to fill certain technical positions due in part to immigration issues, and developers have pulled the plug on some renewable energy and commercial construction projects due to rising interest rates.

Statewide, policy-making around rent control, employment law, cap and trade (carbon/energy tax), and new business taxes (gross receipts or something similar) are very real undermining factors of our current, robust economy. The effects are not immediate, but often lasting. Both for Oregon and our own region of the state, other headwinds include: a lack of available built space for office and industrial users, an exceedingly tight labor market (record low unemployment rates) and a persistent undersupply of housing, particularly at prices that a majority of the labor force can afford. These combined thwart job creation, business formation and capital investment that are the foundations of a thriving and vibrant economy. The year ahead will test just how strong our and resilient our more diversified economy really is.

Optimism for Central Oregon

We’ve faced challenges in the past, but the Central Oregon economy has proven to be one of the most resilient in the entire country. So much so that this past summer I was invited to speak to my peer economic development professionals in Australia about how it’s happened. Much of the content of my keynotes were about sustained effort and focus — what I call the “40-year overnight success.” We did not start to do economic development in the depths of the Great Recession, rather we continued to work behind the scenes on strategies and tactics that have proven successful – helping our existing traded-sector companies grow, our entrepreneurs successfully launch new ventures, and by recruiting new, dynamic companies to diversify our employment base. We call it: move, start, grow.

Our portfolio of pending projects for move, start, grow remains strong. We currently have over 200 projects either in the final stage of making location or expansion decisions or those decisions have already been made and they are in the process of executing on them across the tri-county area. Together, these projects represent nearly 1,500 new, well-paying jobs (annual pay ranging from $45,000 – $150,000) and nearly $2 billion in new, taxable investment to support our cities, counties and special districts. For perspective, that’s about the entire sum of all residential, agricultural and business taxable property in Jefferson County.

It is important to note that over the past 3-5 years we’ve seen a shift in what we call “done deals,” or pending projects, that come to fruition. Generally, they are getting smaller in terms of job creation, while at the same time getting larger in terms of capital investment. In some ways this reflects our shrinking supply of existing office and industrial space, but in others it is a reflection of structural changes happening in the broader economy. Automation is helping employers keep pace with market demand in the face of the current acute labor/talent shortage. For example, a local building products company is planning a major equipment upgrade that will eliminate 15 positions this year. It already has 25 hard-to-fill vacancies, so all those displaced will be working elsewhere in the plant, but will have to be retrained. State economist Josh Lehner recently shared research that Bend is essentially the U.S. capitol for distance workers — it had the highest percentage of overall employment for companies that don’t have a physical presence here beyond employees. Using technology, the ability to have teams working across the country and globally is changing the scale of what EDCO is able to recruit to the region. Local hiring is less and less imperative.

For these reasons, EDCO will be getting more engaged with employers and our workforce partners to find creative ways to help our in-migrating and emerging (young) workforce be prepared to succeed in a changing job market.

What Does It Mean for My Business?

In life and business, knowing what to expect next is a huge advantage but only if that advance knowledge is acted upon. Borrowing concepts from our friends at ITR (Institute for Trend Research), who are the real experts in economic forecasting, here are some actions to consider:

• Hire and/or retain the best talent possible, labor shortages will persist

• Start developing new products/services to gain market share or move into new markets

• Weak parts of your business need to be improved or divested in before 2022

• Grow your margins now since they tend to get compressed in economic downturns (i.e. raise prices)

• Invest in your business now — it will be harder to find that capital later, or

• Build cash now to buy land, buildings, equipment, other businesses, etc. in 2022-23

Last but not least, if you’ve not done strategy planning annually or on a multi-year basis — an activity that can help determine if these actions are right for your enterprise — consider doing so. In the words of Thomas Edison, “Good fortune is what happens when opportunity meets with planning.”