Maybe you have heard that it’s time in the market, not timing the market that matters. However, staying there can be difficult when investors are faced with intra-year market drops that bring declining values over a short period within a calendar year. Over time, this short-term “flight to safety” can have a long-term effect on how much money you have when you’re ready to retire.

Think it couldn’t happen to you? Consider these facts: Let’s say you had invested $1,000 in a fund that mirrored the S&P 500 index beginning on 12/31/1994. If you had held it for twenty years until 12/31/2014, it would be worth nearly 5 1/2 times the original amount or $5,355. But if you would have missed the best 10 days during those two decades, your investment would only be worth $3,622 on 12/31/2014.¹

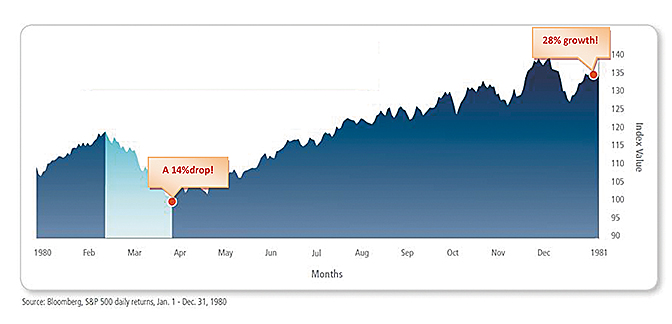

Intra-year drops have an understandable impact on investors’ emotions. As we can see during the severe 1980 downturn illustrated below, over a period of one month, the S&P 500 index dropped 14 percent. But over the entire 12 month period the index grew by 28 percent! Selling out prematurely could mean locking in losses and missing out on potential subsequent growth when the market recovers.

Many investors like to time the markets. A few years ago I was introduced to a gentleman who shared his perceived success story of such market timing. In an excited tone he explained how he liquidated his entire equity portfolio in October of 2007 when the Dow Jones Industrial Average, a price-weighted average of 30 large companies on the New York Stock Exchange, was near its peak-closing price at that time of 14,164. He went on to give details about how the Dow hit a market low of 6,443.27 on March 6, 2009, having lost over 54 percent of its value since the October 2007 high. I asked him when he got back in the market.

He stated in a less fervent tone that he had not done that yet as he was waiting for the markets to decline first. I informed him that the markets had since experienced momentous growth and the Dow had experienced almost 200 percent growth over this period of time achieving a new all-time high.

When you time the markets you have to be lucky twice. You must not only get out of the markets at the right time but you need to get back in at the right time. This gentleman was lucky once but not twice, and consequently now faces a serious dilemma. To be successful over the long term, it is time in the markets not timing the markets that counts. It is imperative to maintain a long-term vision to help overcome short-term volatility.

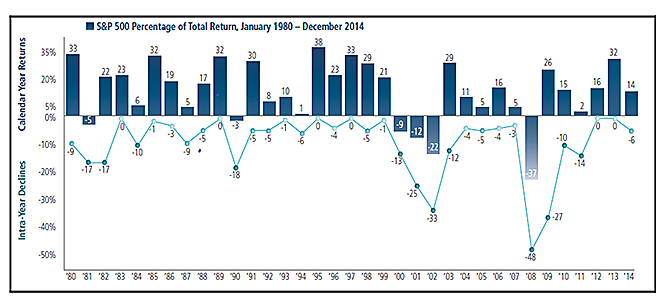

As illustrated in the chart below, from 1980 to 2014, Intra-year drops over 4 percent were a common occurrence. What was almost as common? In 29 out of the 35 years, the market was able to overcome this decline and deliver a positive return. The average intra-year decline was -9 percent. There were ten years where the intra-year decline was -10 percent or more!² Of course, past performance is no guarantee of future results but the intent behind this example to help you take some of the emotion out of long-term investing and the volatile times we find ourselves in.

Ironically, as the economy continues to grow and a foundation of positive momentum takes place, we are faced with a series of challenges here at home as well as around the globe. This currently includes fiscal cutbacks by federal, state and local governments, the Feds looming increase of interest rates, the future of Social Insecurity, a polarized Congress and presidential elections next year. Overseas we face ISIS, continued unrest in places like Syria, the Greek debt crisis, a potential recession in China and strife with Putin’s Russia. This creates significant fear and corresponding market volatility.

Staying calm amid market turmoil is not easy. Fears of further decline can make investors feel skittish. This is absolutely the wrong time for investors to panic and throw in the towel. The cost of missing the next market rebound is significant.

¹ The S&P index in unmanaged and not available for direct investment.

² Lipper, a Thomson Reuters Company, 2015

Investment advisory services offered through Rosell Wealth Management, a State Registered Investment Advisor. Securities offered through ValMark Securities, Inc. Member FINRA, SIPC 130 Springside Drive, Ste 300 Akron, Ohio 44333-2431. 800 765-5201. Rosell Wealth Management is a separate entity from ValMark Securities.