The word retire comes from the root word Retirer which means to “retreat” or “withdraw.” The Webster’s dictionary defines it as – to withdraw from use or service.

The word was fitting for individuals who retired in the early 20th century when life expectancies averaged 65 for males and 72 for females and most people only lived a few years into their years of retirement. My great grandfather retired at the age of 65 and at the age of 72 was deceased. His years in retirement were short and a pension and social security were able to sustain both him and my great grandmother until they had passed away.

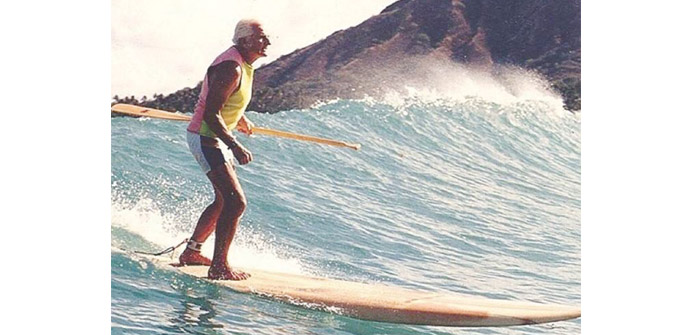

Retirement began to change over the last several generations. Healthcare improved and retirees began to live much longer. Today people retire and instead of “withdrawing” or “retreating” into a quiet retirement home, they are traveling, volunteering their time, spending precious moments with their grandchildren and pursuing their life passions.

The longevity of retirees has forced US companies to eliminate their pension plans and begin using employer sponsored plans such as 401(k)s. With our overburdened social security system, self-retirement savings is playing a much larger role with today’s retirees. Planning for thirty years of income, healthcare and long-term care have become vital components for a successful financial plan.

There are three distinct stages of retirement. This includes the Go-Go, Slow-Go and No-Go stages.

Go-Go- This first stage of retirement is when you are still quite active. It typically lasts until age 75 and often involves world travel, spending time with grandchildren and pursuing your new passions. You tend to spend more money in this stage of retirement than in any other.

Slow-Go- In this stage people may start having a decreased energy level. I tend to see this shift take place around the ages of 75 to 85. Many aren’t buying new cars and often look to downsize their homes. They just aren’t spending as much money. Annual expenses typically declines by twenty to thirty percent, but inflation must continue to be accounted for.

No-Go- This stage of retirement usually begins at age 85 and last for the remainder of life. One’s world tends to get smaller and expenses decrease dramatically except for medical and long-term care costs. Managing these uncertain expenses and planning appropriately is one of the principal challenges of a successful retirement.

Preparing for your golden years requires you to have a plan in place that will give you the confidence to enter the second half of your financial journey. When it comes to your financial planning it is recommended to hope for the best but plan for the worst and I believe it is imperative to take the three stages of retirement into consideration.

I will leave you with a beautiful quote written by Howard Salzman; “Retirement is a time to make the inner journey and come face to face with your flaws, failures, prejudices, and all the factors that generate thoughts of unhappiness. Retirement is not a time to sleep, but a time to awaken to the beauty of the world around you and the joy that comes when you cast out all the negative elements that cause confusion and turmoil in your mind and allow serenity to prevail.”

If you plan appropriately, you can hopefully live the life you have always imagined during this exciting stage of life.

Rodney A. Cook CFP is the Director of Financial Planning at Rosell Wealth Management in Bend. www.RosellWealthManagement.com.

Investment advisory services offered through ValMark Advisers, Inc. an SEC Registered Investment Advisor

Securities offered through ValMark Securities, Inc. Member FINRA, SIPC 130 Springside Drive, Ste. 300 Akron, Ohio 44333-2431. 800-765-5201. Rosell Wealth Management is a separate entity from ValMark Securities, Inc. and ValMark Advisers, Inc.