September statistics reveal a Central Oregon real estate market that continues to be strong, but there are some slight drops in numbers that indicates the busy summer season is coming to an end; particularly in the lower-end price ranges.

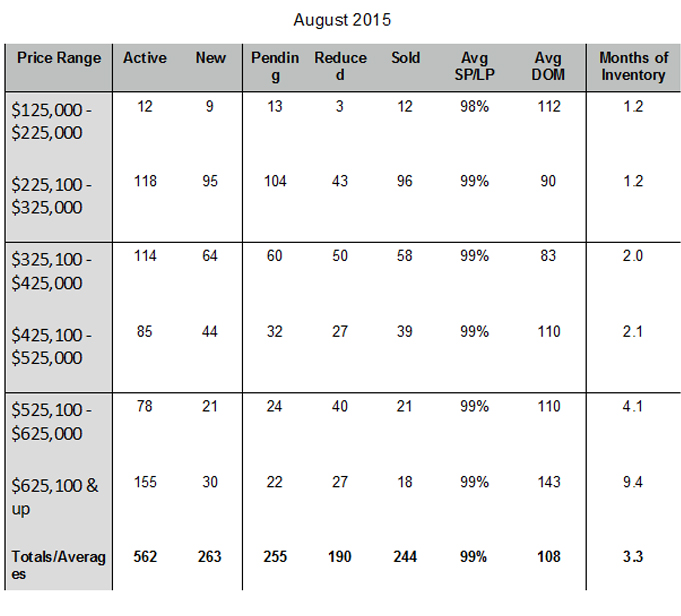

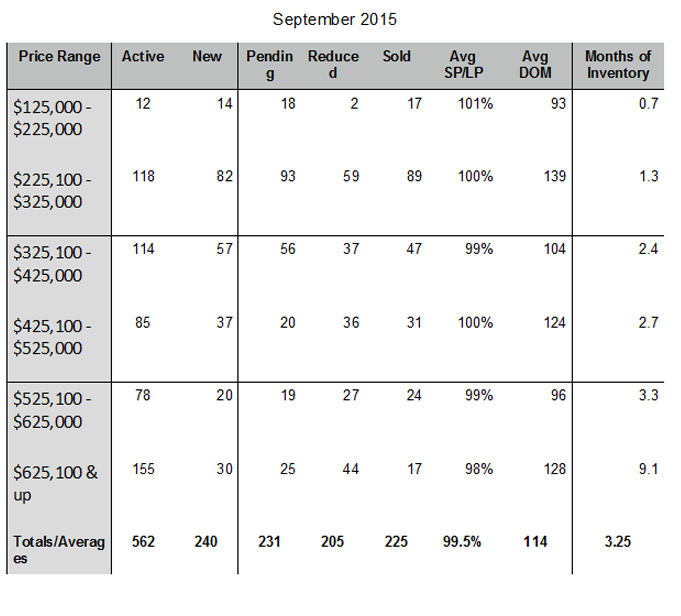

The month ended with a total of 565 Active Listings compared to 562 at the end of August, a 0.5 percent increase. Overall, September saw slight decreases in New, Pending, and Sold listings coupled with a small increase in average days on market and the number of reduced prices, specifically in the $625,000 and up category. The only price range to see a significant increase in new listings was the $125,000 – $225,000 category.

The most significant growth in Active Listings was in the $225,100 – $325,000 range with a 9.3 percent increase. Last month, the biggest increase was in the $425,100 – $525,000 range; so a slight shift in where the most active listings are this month. As with August, the largest decline was in the $125,000 – $225,000 category with a 16.7 percent decrease in Active Listings. Since July, this category has seen continued decreases though less each month.

The number of listings moving to pending status decreased by nearly 10 percent in September compared to August, with most of the decreases happening in the $425,100 – $525,000 category.

The total number of reduced properties had an overall increase of 7.9 percent and this was driven by the large number of increases in price reductions in the $625,100, $425,100 and $225,100 categories.

The total number of properties sold in September was down from August by 7.8 percent which may speak to the season adjustment from Summer to Fall. Properties sold in September were 225 while August was 244 so this is not a huge decline. The largest decline in sales was the in the $425,100 – $525,000 range. The biggest increase in sales was in the $125,000 – $225,100 range with a 41 percent increase. This could be due to the fact that this price range does include lots where homes will be built.

Average sales price to listing price (the percent of properties that enter into contract for exactly what the listing price was) seemed fairly unmoved from August. The standout here was in the $125,000 – $225,000 category. Along with the increase in sales, there was also a 101 percent Average sales price to listing price which means some properties sold for more than the listed price.

The average days on market increased in September by 5.6 percent (108 in August compared to 114 in September). In August, this number was up slightly from July and it appears this has continued into September, though modestly. The largest increase in days on market occurred in the $225,100 – $325,000 category while the $125,000 – $225,000 category saw the largest decrease which is no surprise given the increase in sales.

Overall, there was a very slight decrease in the months of inventory from 3.3 to 3.25. This isn’t a huge change but if we look back at July we see it was at 3.2 months, then increased to 3.3 months and now sits at 3.25.

It could be an interesting market this Fall due to the fact that we are going to be in an El Nino year which means we may see a very mild Winter. It is already playing out with our incredible weather so far. Perhaps we will see a continued active market with more time to build houses and increased tourist activities. Overall, however, September looked about the same as August with a slight increase in active listings and a very slight decrease in inventories so that’s a good thing considering the shift in seasons.

Duke Warner Realty was established in 1967 by Duke and Kitty Warner. Their philosophy was to establish a first-rate real estate company sensitive to their customers’ needs. Duke Warner Realty’s brokers share this philosophy, and today the firm is widely known for its personalized service and reliability. For more information, contact www.dukewarner.com 541- 382-8262.