(Photo courtesy of David Rosell)

It’s hard to believe we’re into the second quarter of 2018! Spring fever is in full force as temperatures have already reached 80° here in Central Oregon. The grass is turning green and flowers are starting to bloom and even my hops are already growing six inches each day as they begin to take over my fence. The markets were just as sunny and budding in 2017, having experienced strong returns and record-low price volatility. Although this continued in January of this year when the Dow surpassed a milestone of 25,000 and it seemed the markets were poised for another strong year, we experienced a change to falling stock prices, high volatility and rising interest rates in February and March. The past quarter was the first negative quarter for a broad range of equity market indexes since Q3 2015. It’s still hard to believe that the Dow was at 6,443 at the Great Recession’s low in March of 2009.

Nothing horrible happened to start the year but there was nothing to brag about either. In short, there were not a lot of hiding places for investors but there were a few spots for our well-diversified portfolios. For the first quarter, the S&P 500 had a modest loss of -0.8 percent and the FTSE All-World Ex-US Index was down -1.2 percent. Stock index leaders included FTSE Emerging Markets +1.3 percent, S&P 500 Growth +1.9 percent, Ex-US REITS -0.3 percent and S&P Small Cap +0.6 percent. The worst laggards were U.S. REITS -8.1 percent and S&P 500 Value -3.6 percent. The primary fixed income index, the Barclay’s U.S. Aggregate Bond Index recorded a very poor first quarter at -1.5 percent and investment grade corporate bonds were largely responsible as they returned -2.9 percent.

During Q1, the Federal Reserve continued to slowly unwind its massive $4.4 trillion investment in bonds, raised its Fed Funds Rate to 1.50 percent-1.75 percent and indicated two additional Fed Funds rate increases were likely in 2018. The yield on the U.S. Treasury ten-year bond rose slightly from 2.40 percent at yearend to 2.74 percent at the end of Q1.

As I noted last year in my market summaries, the steady advance of stock markets and modestly positive bond market returns resulted in a favorable environment for the well-diversified portfolios.

What’s caused the markets to settle down?

1) In early February became concerned that wages were finally reacting to a 4.1 percent unemployment rate and were going to cause rising inflation. The extended period of low volatility had encouraged trend-followers to place bets on the continuation of the low volatility we had previously experienced

2) Market participants were obviously nervous and selling pressure immediately returned when President Trump announced a second round of trade tariffs specifically targeting China. While many economists would not generally favor trade tariffs, the global trade situation is not quite following the textbook model of free trade. China has outlined their goal of becoming a leader in advanced technologies by 2025 and it is difficult to outline a legal, free market path to that goal. While the probability of an all-out trade war still seems low, the recent tit-for-tat actions have put a spotlight on lingering issues with no clear answer or timeline. I believe this uncertainty may continue to be a driver of market volatility.

Last month, the Bank of America Merrill Lynch conducted a survey. They asked fund managers what the number one stock market risk was and 30 percent replied Trade War, while 23 percent said Inflation and 16 percent were fearful of a slowdown in global economic growth.

Potential Market Scenarios Going Forward

In March, we celebrated the ninth birthday of the Bull Market that began in the 2009 depths of the Great Recession. The wild swings of the past few months have investors wondering whether that will be the Bull’s final birthday. Investors had been enjoying low inflation, low interest rates, benign bond markets, synchronized global economic expansion, low volatility, and rising equity prices. That positive scenario is in the past, but that does not mean that each of those trends will reverse to the downside in 2018.

The best scenario would be another march upward to new all-time highs which would require a continuation of several of those enjoyable trends. The worst scenario going forward is an immediate Bear Market which would require discounting the reversal of each factor listed above. The reality seems more likely to land somewhere in between the best/worst scenarios.

Wall Street firms and the Federal Reserve indicate recession risks have risen slightly but are still quite low. In fact, the economic consensus is that the synchronized global growth of 2017 is clearly continuing into 2018. A major trade war could short circuit this factor, but that would likely take time to develop. One factor that has clearly shifted from the bullish side to bearish is volatility. Increased volatility is not favorable, so we will continue to monitor it closely. One factor on the bullish side is that U.S. tax reform is only slowly being worked into EPS estimates, so positive revisions may continue this spring. The Q1 earnings announcements are just getting underway and management expectations for the rest of the year will be important. If they are optimistic, this factor will stay in favor of rising stock prices.

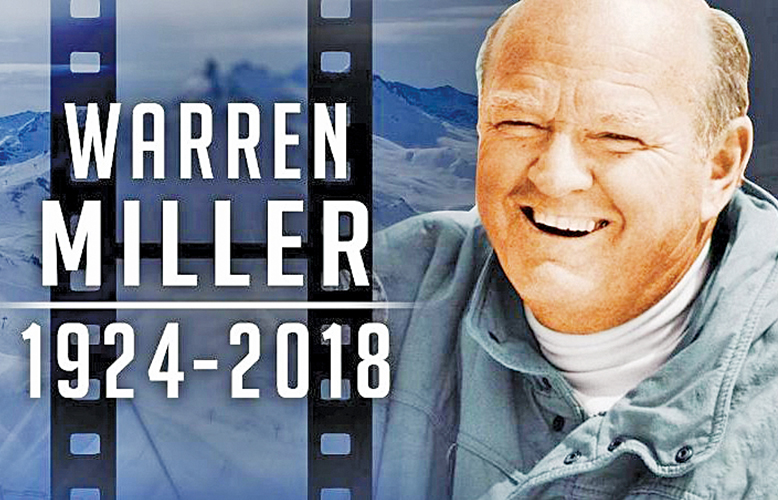

I hope you have an opportunity to get outside and enjoy the beautiful weather upon us. Ski-film pioneer Warren Miller, who has traveled the globe in search of the wild steep and deep, has always had the uncanny ability to capture the adventure, wonder and beauty that is skiing and that is life. Sadly, he passes away in January. He always ended each and every film with the same statement, which impacts me just as strongly today as it did in my youth:

If you don’t do it this year, you’ll be one year older when you do.

I believe the best is yet to come. Let’s make that happen, starting today.

David Rosell is President of Rosell Wealth Management in Bend. www.RosellWealthManagement.com. He is the author of Failure is Not an Option — Creating Certainty in the Uncertainty of Retirement and his latest book Keep Climbing — A Millennial’s Guide to Financial Planning. Ask for David’s book at Newport Market, Sintra Restaurant, Bluebird Coffee Shop, Dudley’s Bookshop, Roundabout Books, Sunriver Resort, Amazon.com or Barnes & Noble.

Investment advisory services offered through Valmark Advisers, Inc. an SEC Registered Investment Advisor Securities offered through Valmark Securities, Inc. Member FINRA, SIPC 130 Springside Drive, Ste 300 Akron, Ohio 44333-2431. 800-765-5201. Rosell Wealth Management is a separate entity from Valmark Securities, Inc. and Valmark Advisers, Inc.