Removes Need for Life Insurance

After years of changes, political arm-twisting, and the indecisiveness of our polarized Congress, the federal estate tax rules have recently changed once again. These new rules are now set permanently into the tax code—at least until the tax code changes again. Thanks to The Tax Cuts and Jobs Act enacted last December, the amount an individual can exclude from estate taxes has more than doubled in 2018 to a generous $11.2 million per person. After all, with smart estate planning, a couple could exclude $22.4 million from estate or gift taxes. Transfers in excess of the exemption amount are subject to tax at a 40 percent rate. The increased exemptions also mean that few people will actually be subject to this tax. According to an estimate from the nonpartisan congressional Joint Committee on Taxation only 1,800 estates are expected to be big enough to owe any federal estate tax in 2018.

In 2001 the estate tax exception was only $675,000. At that time, the portion of your estate upon one’s death, greater than this exception amount was taxed at a maximum amount of 55 percent! Many of those living in high-priced real estate located in places like San Francisco, New York and Boston would have fallen into the estate tax bracket, since they already had taxable estates worth much more than that before even figuring in their other retirement assets. As Uncle Sam wasn’t their beneficiary of choice, this prompted many people to purchase life insurance policies to cover this tax burden so that their children would not be liable. Today, many are paying premiums that continue to increase for policies they that they just don’t need. This is compounded as the complexity of life insurance products is overwhelming for consumers and most policies are not even being managed by a professional — instead they come with a built-in “set it and forget it” approach.

Insurance companies won’t tell you of an option that has the potential to greatly benefit appropriate policyholders. A life settlement is an option for individuals or businesses who no longer need or want their life insurance policy or who may require funds for other needs. There are many examples of situations where a life settlement option shines however in this article I am focusing specifically on estate planning.

Just like your home, automobile or business, life insurance is a capital asset. So what is a life settlement? It’s the sale of an existing life insurance policy on the secondary market to a third party for fair market value. The owner sells the policy in exchange for a lump sum that can be higher than a cash surrender value. The third party institutional investor, who becomes the owner of the policy, makes premium payments and collects the death benefit at the insured’s death. With institutional investors, policies are owned in large blind trusts with other policies, so you don’t have to worry about someone having an incentive to hasten your demise.

To have a better idea of how this strategy can significantly benefit people, here is a real-life example.

THE SITUATION

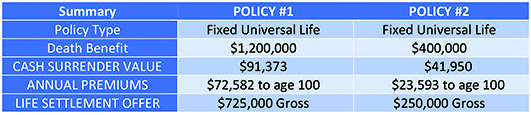

Jerry1 is an 88-year-old former owner of a successful manufacturing company. He has a net worth of approximately $4 million. Jerry bought two insurance policies in 2002 when the Federal estate tax exemption was $1 million and the maximum estate tax rate was 55 percent.3 Since the time he purchased the policy, the estate tax exemption has increased as I shared above. Jerry no longer needs the insurance for his estate planning. When meeting for his annual policy review, Jerry decided to surrender his policies.

THE OUTCOME

On Jerry’s behalf, we investigated the option to sell Jerry’s policies. Our team worked with multiple providers to negotiate settlement offers resulting in a total gross offer of $975,0002 for both policies (before expenses and commissions). The decision to sell the policies resulted not only in the savings of future premiums needed to maintain the policies but the settlement, in lieu of surrendering the policy, resulted in gross offers of more than 60 percent of the death benefit for each policy.

THE TAKEAWAY

With the enactment of the 2017 Tax Cuts and Jobs Act, the estate tax exemption for individuals has increased to $11.2 million. You may want to consider a life settlement for policies that may no longer be needed for estate planning. Each client’s experience varies but in the case described above, the gross offer was six times the cash surrender value on the smaller policy and more than seven times the cash surrender value on the larger policy.

Rosell Wealth Management is the only Oregon firm licensed in the State of Oregon to offer Life Settlements. You can learn more about Life Settlements at www.RosellWealthManagement.com or in my latest book Failure is Not an Option — Creating Certainty in the Uncertainty of Retirement. Ask for it at Newport Market, Cafe Sintra, Bluebird Coffee Shop, Dudley’s Bookshop, Roundabout Books, Sunriver Resort, Barnes & Noble and online at Amazon.com

Valmark Securities supervises all life settlements like a security transaction and its’ registered representatives act as brokers on the transaction and may receive a fee from the purchaser. Once a policy is transferred, the policy owner has no control over subsequent transfers and may be required to disclosure additional information later. If a continued need for coverage exists, the policy owner should consider the availability, adequacy and cost of the comparable coverage. A life settlement transaction may require an extended period to complete and result in higher costs and fees due to their complexity. Policy owners considering the need for cash should consider other less costly alternatives. A life settlement may affect the insured’s ability to obtain insurance in the future and the seller’s eligibility for certain public assistance programs. When an individual decides to sell their policy, they must provide complete access to their medical history, and other personal information.

1Client name has been changed to protect confidentiality.

2The gross offer will be reduced by commissions and expenses related to the sale.

3Internal Revenue Code Section 2001. Each client’s experience varies, and there is no guarantee that a life settlement will generate an offer greater than the current cash surrender value. In such cases, the client can always surrender their policy to the carrier if the coverage is no longer needed. This material is intended for informational purposes only and should not be construed as legal or tax advice or investment recommendations. Consult a qualified attorney, tax advisor, investment professional or insurance agent about the issues discussed herein. Securities offered through ValMark Securities, Inc. Member FINRA/SIPC.