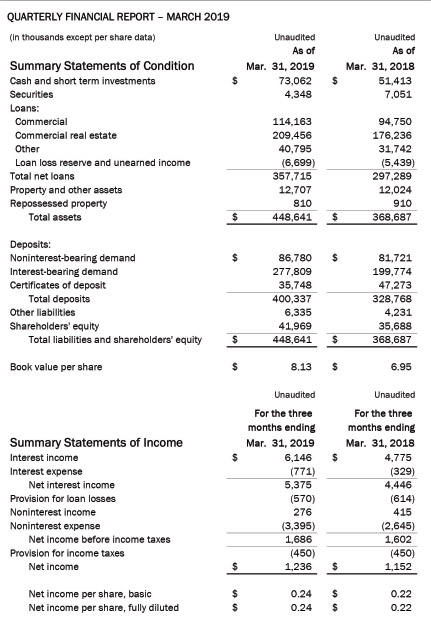

Summit Bank (OTC Pink: SBKO) reported net income for the first quarter of $1.24 million or 24 cents per fully diluted share. Comparable earnings for the first quarter of 2018 were $1.15 million or 22 cents per fully diluted share, representing an increase of 7.3 percent to earnings and 6.6 percent to earnings per fully diluted share. All of Summit’s operating units performed strongly during the quarter which allowed the Bank to achieve solid growth in earnings per share inclusive of first quarter startup investment associated with its new office location in downtown Portland. The earnings impact of the Portland operation was 5 cents per share. Earnings per fully diluted share (EPS) for the trailing four quarters ended March 31 were $1.12 and represented the ninth consecutive quarterly increase in EPS for the Bank.

Summit has been successful in growing its balance sheet concurrent with earnings. Q1 2019 represented the 16th consecutive quarter during which the Bank achieved year over year growth in total net loans of at least 17 percent. Total net loans as of March 31 2019 were $357.7 million, an increase of $15.6 million for the quarter and an increase of $60.4 million or 20.3 percent over March 31 2018. Deposit growth continues to be robust as well. Total deposits as of March 31 2019 were $400.3 million, an increase of $28.9 million or 7.8 percent and $71.6 million or 21.8 percent over December 31 2018 and March 31 2018, respectively.

“We are excited to report strong growth in the first quarter in both of our core markets,” said Craig Wanichek, president and CEO. “The reception of the team in Portland has been very positive. Not only did we already experience bookings in Portland in the first quarter, but we established a solid pipeline for loans and deposits.”

The Bank reported $76.9 million of cash & short-term investments in securities as of March 31 2019. This is a 32.1 percent increase over the $58.2 million held in cash & short-term investments in securities at the end of Q1 2018. The Bank continues to hold very low levels of non-performing assets. Total non-performing assets at March 31 2019 consisted primarily of one parcel of other real estate owned and represented just 0.4 percent of total assets, a decrease from 0.5 percent at December 31 2018 and a slight increase from 0.3 percent as of March 31 2018.

With offices in Eugene and Bend and a loan production office in downtown Portland, Summit Bank is a business bank that specializes in providing high-level service to professionals and medium-sized businesses and their owners. Summit Bank is quoted on the NASDAQ Over-the-Counter Bulletin Board as SBKO.