(Graphs | Courtesy of De Alicante Law Group)

Probate is the name for the legal proceedings responsible for distributing your estate — the term for your property — after you die. The state-appointed executor of the estate (AKA a “personal representative” in Oregon) and your attorney will manage this process for you, and the personal representative may be paid a fee for doing so. A probate proceeding takes a very long time, often leading to family fighting over money, and can cost quite a lot. In almost every case, your property isn’t distributed to your beneficiaries until the end of the process.

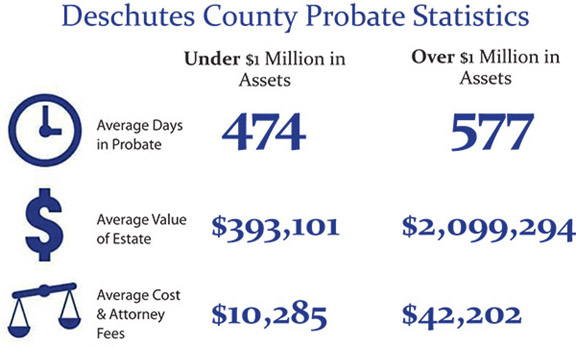

In 2018, the Deschutes County Circuit Court closed 176 probate cases. These cases, opened between the years of 1995 and 2018, vary in the amount of assets and the amount of time required to close the cases.

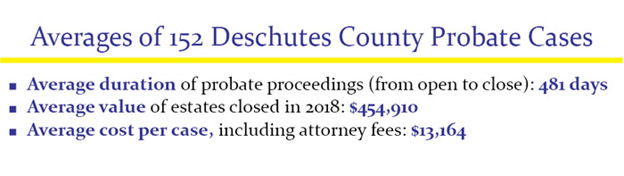

Our analysis excludes cases opened for claims of wrongful death, insolvent estates (those with more debt than assets left over), or estates with no assets at all, opened for some other reason. We also excluded one case opened first in 1995 as it bloated the average time for the rest of the cases closed in 2018. That left us with 152 regular cases, and their following averages: 10 of these cases had assets over the $1 million mark, while the other 142 fell below $1 million.

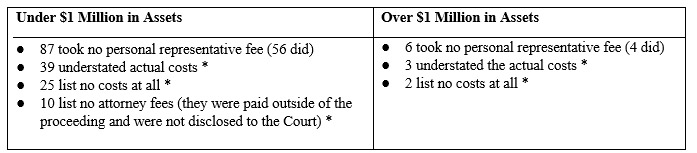

Here are some points about those:

* Many cases understated actual costs and several cases listed no costs or attorney fees, making the average costs and attorney fees less than the actual amounts paid.

As you can see, larger estates typically require more time, and cost much more due to the complexity of those cases.

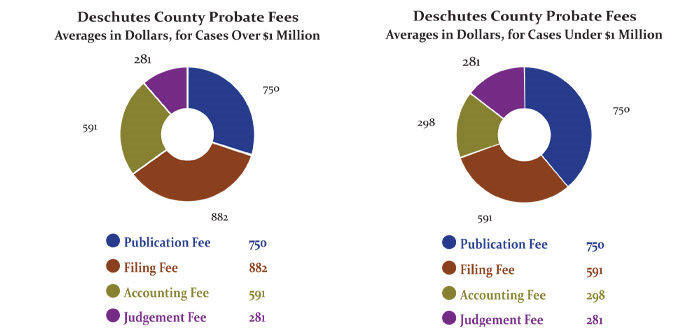

The Average Costs of Probate

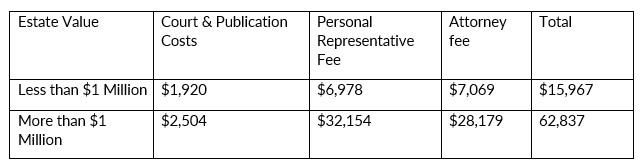

The actual costs for any case vary, but every case has mandatory fees for filing, publication, accounting and judgment. Excluding the costs for a personal representative and/or attorney, the fees mentioned total about $1,920 in Deschutes County for cases falling below $1 million.

If the estate is valued between $1 and $10 million, those same fees aren’t increased by that much: $2,504.

We also included ten cases that list no attorney fees. If we remove those cases from our calculations, a realistic cost estimation for cases under $1 million would be $7,069. This isn’t terribly different from the cases where personal representatives took a fee: $6,978.

Average personal representative fees for cases valued in excess of $1 million were $32,154, while the average attorney fee was $28,179.

We also calculated overall averages for Deschutes County.

Again, individual costs vary from case to case, depending on whether the representative takes a fee, and the actual attorney fees. If a case takes longer than a year to resolve, more than one accounting is required, resulting in an additional fee.

If there is a lot of outstanding debt, contested claims on the estate or challenges brought against it by beneficiaries, this will also boost the cost of these proceedings. There are ways to eliminate the need to probate an estate, but you have to know how to do it and separate fiction from fact. One of the biggest misconceptions is that if you do have a will, your estate doesn’t have to go through probate. This is absolutely incorrect, because your will is an entry ticket to the probate process. Do yourself and your family a big favor by planning your estate properly, ideally keeping your estate all or mostly out of probate.

There are ways to eliminate the need to probate an estate, but you have to know how to do it and separate fiction from fact. One of the biggest misconceptions is that if you do have a will, your estate doesn’t have to go through probate. This is absolutely incorrect, because your will is an entry ticket to the probate process. Do yourself and your family a big favor by planning your estate properly, ideally keeping your estate all or mostly out of probate.

De Alicante Law Group is an estate planning and business law firm based in Bend, Oregon, with an additional location in Tigard. Founded in early 2013 by Oregon native and veteran, Tony De Alicante, De Alicante Law Group is proud to serve people from across the state of Oregon.