EDCO reports valuable incentives to spur job growth and investment in Bend economy

Economic Development for Central Oregon (EDCO) announced that Business Oregon recently approved a major expansion to the existing Bend Enterprise Zone (E-zone). The newly expanded zone, which now encompasses most of the industrial, commercial and mixed use land concentrations in the city allows many more companies to take advantage of temporary property tax relief as they expand or relocate to Bend.

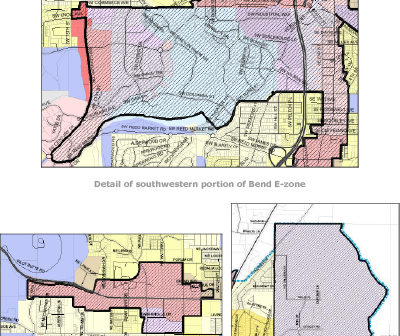

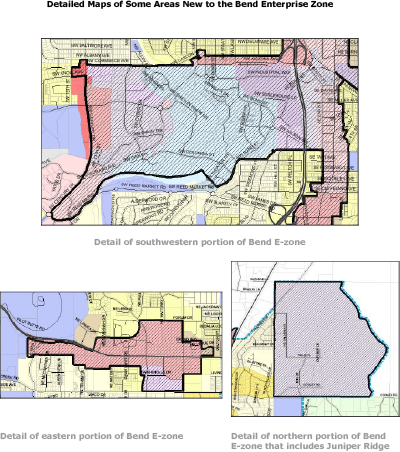

The incentive offers traded-sector employers and other eligible companies three to five year property tax exemptions on certain new capital investments that create jobs. The zone is sponsored by the City of Bend and is managed by EDCO. Notable new additions to the zone include 1) an area in southwest Bend around SW Industrial Way, 2) an area in eastern Bend along Greenwood Avenue, and 3) the entirety of Juniper Ridge. With a ten-year life span, the zone is set to terminate June 30, 2021.

“Each year, thousands of communities across the U.S. and even abroad compete for a limited number of expansion and relocation projects,” said Roger Lee, executive director of EDCO. “Oregon’s Enterprise Zone program is one of the strongest tools in our toolkit.”

The Enterprise Zone program is among Oregon’s oldest and most frequently used economic development tools to attract and retain traded-sector employers in the local area. Traded-sector employers are typically manufacturers, high technology or creative services employers who sell goods or services outside the local area, thereby expanding the economic base.

The E-zone program is also available for existing local companies. EDCO expects it will work with many local traded-sector companies and help them plan for growth. By state statute, most retail, commercial and professional services businesses are not eligible for the state’s enterprise zones. Land and property already on the tax rolls is also ineligible from being exempted through the program.

“With a much larger E-zone in place, Bend is that much more attractive to a company interested in the area for relocation,” said Nate LiaBraaten, Bend Business Development Manager for EDCO. “Local employers now have added motivation to expand their employment, equipment and operations.”

Initially approved by Business Oregon in 2010, LiaBraaten reported that the Bend E-zone has been used by seven companies, adding 81 jobs with average weighted salaries of $62,840. A total of $18.2 million in capital investment tied to existing E-Zone projects is anticipated. When this temporary tax abatement ends in three to five years, these previously approved projects will be on the tax rolls. “In most of these cases the investment in people and jobs would likely not have happened without the E-zone,” added LiaBraaten.

About Economic Development for Central Oregon

Economic Development for Central Oregon (EDCO) is a private non-profit corporation founded over 30 years ago and dedicated to building a vibrant and thriving regional economy by attracting new investment and traded-sector jobs (manufacturing, professional, headquarters and high technology businesses) through marketing, recruitment and substantive assistance to existing companies. Learn more about EDCO at www.edcoinfo.com.

Business Oregon works to create, retain, expand and attract businesses that provide sustainable, living-wage jobs for Oregonians through public-private partnerships, leveraged funding, and support of economic opportunities for Oregon companies and entrepreneurs. Visit www.oregon4biz.com for more information on doing business in Oregon.