The crude oil and natural gas markets traded on the defensive through April, but now appear to be searching for a bottom. The market experienced a trading anomaly in April with WTI crude oil futures trading below zero for the first time in history. The sharp drop in prices have been in response to the spread of the coronavirus which has destroyed demand. In response, OPEC and Norway have cut output, and several US active rigs have been shut in. While it will take some time for demand to fully recover, as consumers begin to move around following quarantine, demand will naturally move higher.

Oil Prices are Beginning to Rise

Current demand figures from the US Department of Energy show that product demand has been hammered by severe declines in gasoline. The agency reports that total products demand during the past month is down by 28.0% year over year. Most of the declines come from a sharp decline in gasoline demand and jet fuel demand. Gasoline demand in the US during the summer months rises to more than 10-million barrels a day. Currently the figure shows that gasoline demand has averaged 5.3 million barrels a day, down by 43.7% year over year.

What is interesting is the drop in diesel fuel in the US is only down 15% year over year. Diesel fuel is generally used in trucking and non-electric rail. Distillate fuel demand, which includes diesel and heating oil averaged 3.2 million barrels. This reflects a weaker than normal but stabilizing trucking industry in the US that shows that commerce remains intact.

Natural Gas Production Surges

A strong global oil market was derailed in February 2020 which lead to a drop in production. In the US, the reduction of oil rigs has also reduced byproduct natural gas production. The issue with natural gas prices is that the US produces more natural gas than it needs. Despite rising liquid natural gas exports, demand has failed to keep up with supply. In certain parts of the US, such as North Dakota and Texas, natural gas flaring, which is the burning of the gas, increased to 1.25% of total gross withdrawals from the ground. Despite natural gas prices falling to 28-year lows, production had remained elevated until oil prices started to fall.

Inventories Remain Elevated

Both crude oil and natural gas inventories remain elevated. According to the Energy Information Administration, crude oil inventories in the US are hovering near 527.6 million barrels, which puts them at 10% above the five year average for this time of year. Natural gas in storage in the United States was 2,210 Bcf as of Friday, April 24, 2020, according to the EIA. Natural gas inventory levels were 783 Bcf higher than last year at this time and 360 Bcf above the five-year average of 1,850 Bcf.

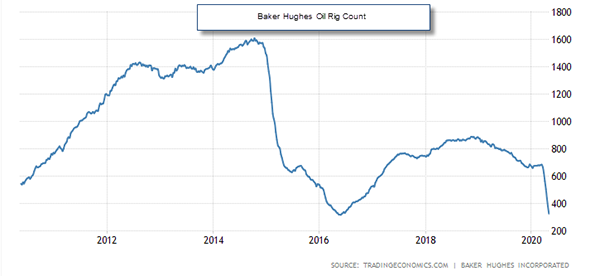

Rig Count Drops

While the reduction in OPEC oil cuts could help buoy prices, large declines in US active oil rigs in conjunction with stronger demand, will probably be the catalyst to drive prices higher. The rig count has fallen off a cliff and will likely substantially reduce US crude oil output. Natural gas rigs have also declined sharply. The oil rig count has revisited the 10-year lows and despite increases in productivity should generate declines in output. US output is currently at 12.1-million barrels a day. This compares to production levels as low at 8-milion barrels a day when the rig count last hit these levels in 2016. That could remove an additional 4-million barrels a day off the market. The upshot is that the US rig count will go a long way toward improving the prospects for crude oil and natural gas. Unfortunately, without a return of demand, prices will remain subdued.