(Graphs | Courtesy of Oregon Office of Economic Analysis)

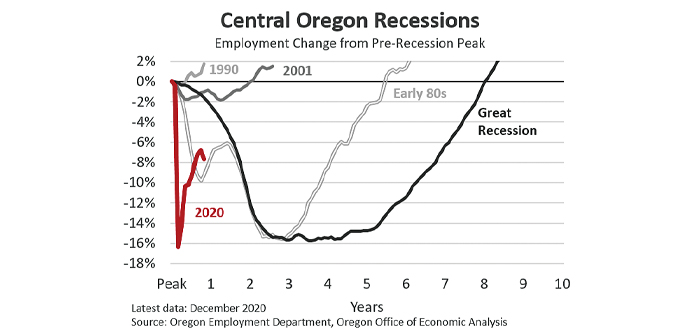

This cycle is different. COVID-19 and the pandemic were an outside force that knocked the economy into a brief, but very severe recession. From a jobs perspective, the current hole nationally and in Oregon remains as large as it ever was during the Great Recession. It’s cold comfort, but Central Oregon’s economy is faring better today than during the early 1980s when the timber industry restructured and in the aftermath of the housing bubble.

Even as the outlook calls for good growth in the years ahead, filling such a deep hole in the labor market will still take time. The good news is household incomes and consumer spending are holding up due to federal aid, and the number of permanent business closures remain much better than first feared. The economy took a step back this winter as the pandemic raged and households were scared to venture out as much. However this was expected, and is temporary. As the pandemic wanes, the stage is set for strong to very strong growth ahead. New COVID cases and hospitalizations are already declining. The outlook brightens with every inoculation.

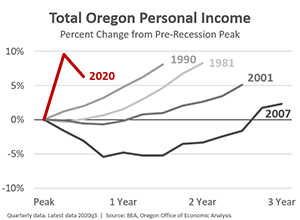

While the labor market remains depressed due to the virus, the same cannot be said for income and consumer spending. The federal aid to households — recovery rebates, and expanded unemployment insurance benefits — actually means incomes are higher today than before the pandemic hit. This level of federal support is unprecedented when compared to recessions in recent decades.

While the labor market remains depressed due to the virus, the same cannot be said for income and consumer spending. The federal aid to households — recovery rebates, and expanded unemployment insurance benefits — actually means incomes are higher today than before the pandemic hit. This level of federal support is unprecedented when compared to recessions in recent decades.

Even so, much of the increase in household savings, and wealth — thanks to the stock market and rising home values — accrues to those higher up the income distribution. Research indicates that lower income households initially built up savings early on but as the federal aid lapsed last summer, they began drawing down their savings. Some began falling behind on paying rent by late in the year. The latest federal relief bill passed at the end of the year and should help keep households’ heads above water for another few months. Low-wage service workers will continue to need assistance as their job prospects remain dim until the pandemic is over.

The key macroeconomic risk remains the permanent damage and business closures that accumulate before the pandemic is over. While solid data on firm closures is months away, what information we do have is relatively encouraging, or at least better than feared. There has been a drop off in OLCC liquor license renewal rates, and the number of video lottery retailers that are open and reporting sales is down a little bit as well. However, at least so far, there has not been a massive increase in closures or business bankruptcy filings. Furthermore, start-up activity has remained strong, indicating the economy will not suffer the double hit of more closures and fewer new businesses as was the experience in past severe recessions.

As the pandemic wanes in the months ahead, households will begin to return to many of their old patterns of going out to eat, to get haircuts, on vacations and the like. Most consumers have the money, but the key will be when households feel it is safe enough to do so. We know cabin fever is real, and we can only buy so many things online, or subscribe to yet another streaming service. As such, when the pent-up demand to resume these currently restricted activities is unleashed later this spring and summer, firms will need to staff up quickly.

Another boost to the labor market will be the return of in-person schooling. There is a direct jobs impact of school districts hiring more staff. Education employment has been down in the past year primarily due to the lack of using substitute teachers will distance learning. These jobs, along with a few more lunch workers and bus drivers will increase employment. Additionally there is the indirect impact from parents being able to return to work, or increase their hours. At a minimum, parents’ productivity will improve as they will not be as preoccupied with simultaneously managing online school.

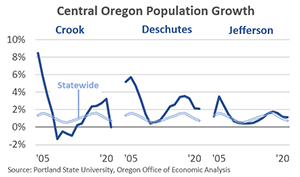

Finally, the strong housing market indicates the prospects of the regional economy remain bright. Long-run economic growth is largely about the number of workers and how productive each worker is. The economic benefits are that most migrants tend to be of working age and bring their talent and skills to Oregon. This allows local businesses to hire and expand at faster rates. Even so, keep in mind that Central Oregon’s double-digit increase in home sales in 2020 does not mean population growth increased by double-digits.

In fact, the latest population estimates from Portland State indicate that through mid-2020, population growth continued to slow across Central Oregon.

In fact, the latest population estimates from Portland State indicate that through mid-2020, population growth continued to slow across Central Oregon.

While not the conventional wisdom of today, this pattern does make sense. Most migrants follow job opportunities. As the business cycle matured in recent years, job growth slowed and so too did migration. Then the pandemic hit, leading to layoffs and the shelter in place phase of the cycle. Hardly anyone moved last spring or early summer. Since then, however, indications are migration has picked back up. Population growth in the latter half of 2020 will show up in the 2021 population estimates released late this year.

That said, home sales overstate population growth as the differences between the types of homebuyers matter considerably. Some local residents sold and moved away. In the big picture, new buyers are simply replacing them. Similarly, local move-up buyers, or renters shifting into ownership represent home sales but no population growth. Likewise an increase in second homes impacts the housing market but not the underlying economy as those households are not bringing their skills, talents and income with them. Ultimately what matters for the regional economy is the growth among the working-age population, many of whom move to the area from elsewhere.

All told, the economy is poised to experience strong to very strong growth in 2021 and into 2022. Even so, it will likely take a year or two for all of the lost jobs to fully return. The current hole is that deep. However such a timeline means the current cycle, while severe, will be much shorter in duration than recent recessions. Much of the bullishness in terms of the outlook is due to the quick development of vaccines, plus the strong federal policy response. Should the new Biden Administration and U.S. Congress pass additional relief to support those most impacted by the recession, to support small businesses further, and/or to boost the vaccine distribution, the outlook would brighten further.