Mastering the strategies of a 1031 Exchange offers investors the chance to optimize and strengthen their portfolios for increased cash flow and long-term financial gains. While navigating this complex landscape, you need to evaluate the tax consequences of the sale. If you are willing to reinvest those proceeds into another investment property, you can defer the capital gains tax by using a 1031 Exchange. This will allow you to preserve capital and give you additional purchasing power to reinvest for increased cash flow and greater flexibility to grow or change the property mix in your portfolio.

A 1031 EXCHANGE is defined as tax deferral on the sale of a property used in a trade or business or held for investment when exchanged for a like-kind replacement property. To get the full benefit of the tax deferral, the seller must acquire one or more like-kind replacement properties of equal or greater value than the sale of the relinquished property.

The definition of like-kind property is broad. For example, an industrial building may be used in an exchange with a duplex, apartment or office building. It is important to note that personal residences and properties held primarily for sale do not qualify for a 1031 Exchange.

If the seller does not invest all the proceeds in the replacement property, the additional value is considered boot. Any value considered boot will be subject to tax.

EXECUTING A SUCCESSFUL 1031 EXCHANGE requires adherence to specific requirements. One of the requirements is that the seller cannot take constructive receipt of the proceeds from the sale of their relinquished property. Be sure to contact a 1031 accommodator early in the process to ensure you follow all the rules and meet all the deadlines.

Another key requirement of a 1031 Exchange has to do with timing. Following the sale of the relinquished property, you have 45 calendar days to identify a new replacement property or multiple properties. The total transaction must be completed by closing the replacement property within 180 days of the sale of the relinquished properties. These are strict timelines with few exceptions.

Some of the pitfalls of a 1031 Exchange are finding a suitable replacement property, the pressure of meeting tight deadlines and deals falling through after they are in contract. If a deal fails and no backup property is identified, this can put the exchanger in a situation where they may have to decide whether to pay taxes on the proceeds of the sale or purchase a replacement property that is not an optimal investment.

A 1031 Exchange is a powerful tool to defer taxes and manage real estate investment portfolios. Work with a qualified intermediary, tax accountant and an experienced commercial broker early in the process to help you navigate to a smooth tax deferred exchange.

Bend Office Market

by Jay Lyons, SIOR, CCIM, Partner & Broker — Compass Commercial Real Estate Services

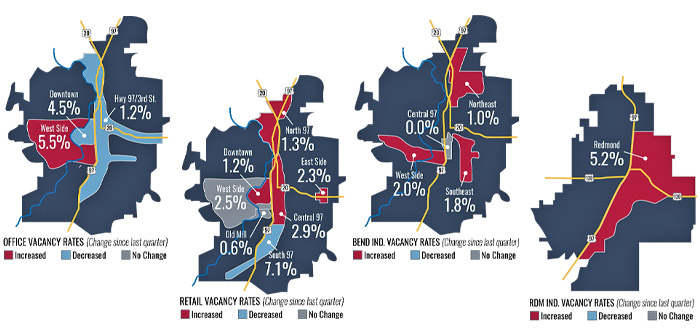

Compass Commercial surveyed 225 office buildings totaling 2.78 million square feet for the second quarter office report of 2023. The market experienced 7,088 SF of negative absorption in Q2 2023 with an increase in vacancy rate from 3.94% in Q1 2023 to 4.29% in Q2. This is the second consecutive quarter with negative absorption and an increase in vacancy. Perhaps more concerning is the amount of available sublease space increasing from 60,988 SF in Q1 to 83,014 SF this quarter. This inventory, added to the 119,065 SF of vacant office space, results in an availability rate of 7.28%.

LEASING: Leasing demand cooled in the last quarter with slower activity across all suite sizes. The West Side submarket, the largest of the three, experienced 17,737 SF of negative absorption. This is largely due to 12,000 SF becoming available at the Navis Building in the Old Mill District. The Downtown and Highway 97/3rd Street submarkets experienced modest positive absorption of 6,848 SF and 3,801 SF respectively.

RENTS: Lease rates remained flat with the high end of the market ranging from $2.00 to $3.05/SF/Mo. NNN and more affordable space ranging from $1.40 to $2.00/SF/Mo. NNN.

CONSTRUCTION: Shevlin Crossing, an approximately 45,054 SF two-building Class A office project in NorthWest Crossing, is under construction with the shell of the first building nearly complete. There are no other speculative office developments under construction.

SALES: There were no notable office sales this quarter.

Bend Retail Market

by Eli Harrison, Broker — Compass Commercial Real Estate Services

Compass Commercial surveyed over 4.60 million square feet of retail space across 266 buildings for the second quarter retail report of 2023. The Bend retail market experienced a slight uptick in overall vacancy in Q2 2023, with 7,487 SF of negative absorption, resulting in an increase in the citywide vacancy rate from 2.60% in Q1 2023 to 2.81% in Q2. There is now 129,297 SF of available retail space for lease in Bend.

LEASING: After a strong first quarter, leasing in the retail sector slowed during the second quarter of 2023, with only one of the seven submarkets experiencing positive absorption. The South 97 submarket was the only region in Bend to experience positive absorption this quarter with The Little Gym leasing 4,780 SF at the Bend Factory Stores and Great Clips taking over 2,780 SF of the former Payless Shoes location at the Big 5 Center. Both the West Side and Old Mill District submarkets experienced no change in overall vacancy rate, while the North 97 submarket experienced the largest change, with 8,080 SF of negative absorption, due largely to the 7,000 SF former Knecht’s building coming available at 63011 N Hwy 97. The Central 97 submarket also noted 5,641 SF of negative absorption in Q2, despite a new lease being signed at Wagner Mall for 6,122 SF.

RENTS: The asking rental rates for Bend retail space continue to hold steady between $1.15 and $4.00/SF/Mo. NNN with the highest rates associated with drive-thru sites and new construction.

CONSTRUCTION: The Cascade Lakes Brewing building at Reed South is open with limited capacity and is scheduled to be fully open for business in August 2023. The new multifamily development at 515 SW Century Drive, featuring a 129-unit apartment complex and an adjacent 1,625 SF retail building, has begun vertical construction and is on pace to be completed in February of 2024.

SALES: The 15,154 SF building located at 63195 Jamison Street sold for $7,000,000 or $461.92/SF. Additionally, the 2,647 SF building located 1346 NW Galveston Avenue sold for $1,367,500 or $516.62/SF.

Bend Industrial Market

by Graham Dent, SIOR, Partner & Broker — Compass Commercial Real Estate Services

Compass Commercial surveyed 321 Bend industrial buildings totaling 4.64 million square feet for the second quarter of 2023. The market experienced 15,779 SF of negative absorption during the quarter. At the end of Q2 2023, the overall vacancy rate stood at 1.26%, a slight increase from the 0.80% recorded in Q1 2023. There is now 58,542 SF of industrial space currently available in Bend.

LEASING: As evidenced by the negative absorption for the second consecutive quarter, leasing activity has begun to cool down in the industrial market in Bend. Although there are still a good number of tenants in the market looking for space, the urgency to make decisions has been tempered by the increased inventory and sense that the market has peaked.

RENTS: Despite the additional inventory on the market today compared to last quarter, the average asking rate for Bend industrial space remained unchanged at $1.12/SF/Mo. NNN. First generation and specialized industrial spaces are commanding rates north of $1.25/SF/Mo.

CONSTRUCTION: In Bend, there is one speculative industrial project underway at the corner of SE Wilson Avenue and SE 9th Street. This is the Midway project consisting of three buildings, one of which will be occupied by Blackstrap. The remaining two flex buildings total 27,789 SF and will be delivered in spring 2025.

SALES: There were no notable sale transactions during the quarter. The increasing cost of financing has made it difficult for investors and owner/users to make new purchases pencil.

Redmond Industrial Market

by Pat Kesgard, CCIM, Partner & Broker — Compass Commercial Real Estate Services

Compass Commercial surveyed 89 buildings totaling 1.72 million square feet for the second quarter Redmond industrial market report of 2023. The Redmond industrial market experienced 47,975 SF of negative absorption, resulting in the vacancy rate increasing from 2.45% in Q1 2023 to 5.24% in Q2 2023. There is now 90,251 SF of available space. While concerning on the surface, the significant uptick in the vacancy rate was caused by Traeger vacating a 72,000 SF facility at 601 E Antler Avenue. Aside from this significant vacancy, the Redmond industrial market experienced 24,025 SF of positive absorption.

LEASING: Activity in the Redmond industrial market continues to show movement. We currently have demand for industrial space that includes yard space. In general, the market remains tight with very limited spaces available between 1,500 SF and 5,000 SF.

RENTS: The Redmond industrial market continues to be very strong with a slight increase at the top of the market. Average asking rates in the Redmond industrial market are between $0.85 and $1.25/SF/Mo. NNN depending on the condition of the space. Asking rates for new projects under construction will be between $0.95 and $1.25/SF/Mo. NNN.

CONSTRUCTION: There is currently 30,000 SF to 50,000 SF of industrial space in the pipeline for Q3 and Q4 2023, which will be for lease in various sizes.