(Graphics courtesy of Compass Commercial Real Estate Services)

Commercial real estate has always been a relationship-driven profession. Relationships form between the broker and the client to open and close commercial transactions. But what happens when Artificial Intelligence (AI) propels itself into this relationship-centered ethos?

You’ve likely used AI without even realizing it. Automation exists in everyday programs, chatbots have been around for years, and virtual assistants such as Siri, Alexa and Google are a part of our day-to-day lives. It made headlines with generative AI programs like OpenAI’s ChatGPT and imagery generators like DALL-E. It can streamline various processes, decrease human error, automate tasks, and increase efficiency.

How is AI Used in the CRE World?

The analytical side of AI and property technology (proptech) are the leading forces in the commercial real estate world. Proptech is redefining how brokers conduct transactions and manage properties, and automation is at its core. CRM platforms and project management software are prime examples of AI automation. These automation tools enhance efficiency and allow real estate brokers to focus on building relationships with their clients. AI and proptech tools contribute to the democratization and transparency of the real estate industry, allowing small-scale investors to perform at the same level as experienced real estate investors, reported Forbes.

Another powerful ability is predictive analysis. Various programs can analyze historical property sales, current economic factors, property information, location, trends, and more to provide an in-depth market analysis. Other programs use photo analysis to perform property valuations quickly and efficiently.

Challenges

Confidentiality remains top-of-mind for commercial real estate professionals. Be cautious of what you allow AI to know, as it continuously learns from the information we input into the system. Another challenge, referred to as an AI Hallucination, is when the AI provides convincing yet highly inaccurate data. Most commercial real estate professionals are hesitant to implement these new technologies. They rightfully overanalyze what technologies are available before making a decision. Despite these challenges, 65% of U.S. executives believe AI will highly impact their organization in the next three to five years, KMPG reports.

How can we tell what is AI and what isn’t? Companies such as Adobe and Microsoft have established a symbol to include with AI-generated content, distinguishing it from human-made content. Adobe calls it “an icon of transparency.” According to Forbes, The University of Kansas developed an AI detector with 99 percent accuracy. It is one of the only detectors designed for academic papers.

Compass Commercial is starting to embrace AI to remain at the forefront of serving our clients. Staying on top of new AI technologies is crucial to avoid falling behind in the rapidly evolving landscape. Brokers who adapt to these technologies can focus on what they do best: building relationships with their clients.

BEND OFFICE MARKET

(by Jay Lyons, SIOR, CCIM, Partner & Broker — Compass Commercial Real Estate Services)

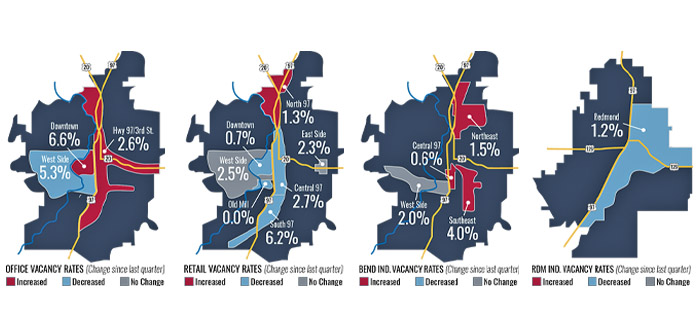

Compass Commercial surveyed 227 office buildings totaling 2.79 million square feet for the third quarter office report of 2023. The market experienced 12,125 SF of negative absorption in Q3 2023 with an increase in vacancy rate from 4.29% in Q2 2023 to 4.88% in Q3. This is the third consecutive quarter with negative absorption and an increase in vacancy. The amount of available sublease space increased from 83,014 SF in Q2 to 106,427 SF this quarter. This inventory, added to the 136,027 SF of vacant office space, results in an availability rate of 8.70%.

LEASING: Leasing demand remains slow across all submarkets and suite sizes. The West Side submarket experienced 4,163 SF of positive absorption this last quarter. This was offset by the Downtown and Hwy 97/3rd Street submarkets which experienced 6,600 SF and 9,688 SF of negative absorption respectively.

RENTS: Lease rates remain flat with the high end of the market ranging from $2.00 to $3.05/SF/Mo. NNN and more affordable spaces ranging from $1.40 to $2.00/SF/Mo. NNN. While the market has seen a few rate reductions due to limited leasing activity, rate reductions are more the exception than the rule.

CONSTRUCTION: Building A of Shevlin Crossing, an 18,939 RSF Class A office building in NorthWest Crossing, is now complete and occupied by two tenants on the second floor. The first floor is in shell condition and available for lease. Building B of the Shevlin Crossing development is still in the planning stages. There are no other speculative office developments under construction.

SALES: A 1,974 SF office building located at 373 NE Greenwood Avenue sold in August for $750,000 or $380/SF to an owner/user. A 2,246 SF medical office building sold in July for $1,1,35,000 or $505/SF. There were no other notable sales this quarter.

BEND RETAIL MARKET

(by Eli Harrison, Broker — Compass Commercial Real Estate Services)

Compass Commercial surveyed over 4.61 million square feet of retail space across 267 buildings in Bend to compile the third quarter retail report of 2023. On the leasing front, the Bend retail market remained solid through the third quarter of 2023, experiencing a slight dip in overall vacancy, from 2.81% in Q2 of 2023 to 2.54% in Q3. There is now 116,948 SF of available retail space for lease in Bend.

LEASING: Recovering from a slight increase in overall vacancy in Q2, the Bend retail market responded with a steady third quarter. The Central submarket in Bend experienced positive absorption of 1,435 SF, which caused the vacancy rate to decrease from 2.93% in Q2 to 2.72%. The West Side and East Side submarkets experienced no change in overall vacancy rate, while the North 97 submarket saw a slight increase in overall vacancy with 42 SF of negative absorption. The Southern submarket still maintains the highest vacancy rate in Bend, although it experienced a decrease in vacancy from 7.10% to 6.19% in Q3 of 2023.

RENTS: The asking rental rates for Bend retail space continue to hold steady between $1.30 and $4.00/SF/Mo. NNN with the highest rates associated with drive-thru sites and new construction.

CONSTRUCTION: Vertical construction has begun for Killian Pacific’s new multifamily complex, The Jackstraw, across from the Box Factory on the west side of Bend. The new project will feature 313 high-end residential units and 16,976 SF of ground-floor retail space, with the shell scheduled for completion in the fall of 2025. The new 129-unit multifamily development at 515 SW Century Drive and the adjacent 1,625 SF retail building are on track with construction. The project is still on pace to be completed in February of 2024.

SALES: The former 11,500 SF Walt Reilly’s restaurant and entertainment venue located at 225 SW Century Drive sold for $4,130,000 or $358.70/SF at the end of August to Top Chef alum Brian Malarkey and his brother James Malarkey. The brothers will be opening their new concept called Hawkeye and Huckleberry Lounge around Q1 2024.

BEND INDUSTRIAL MARKET

(by Graham Dent, SIOR, Partner & Broker — Compass Commercial Real Estate Services)

Compass Commercial surveyed 321 Bend industrial buildings totaling 4.65 million square feet for the third quarter of 2023. The market experienced 53,239 SF of negative absorption during the quarter. At the end of Q3 2023, the overall vacancy rate stood at 2.40%, the highest vacancy rate recorded in the Bend industrial market since Q3 2020 and an increase from 1.26% in Q2 2023. There is now 111,781 SF of industrial space currently available in Bend.

LEASING: Leasing velocity continued to cool during the third quarter, even among the smaller bay industrial units which are typically the most sought after in the Bend industrial market. Tenants have many more options than they did just six months ago. There are currently 20 available industrial units between 1,500 SF and 3,000 SF. Increasing supply and slowing demand will begin to have an impact on asking lease rates as landlords begin to compete for fewer tenants.

RENTS: Despite the increase in vacancy and slowing demand, the average asking lease rates remained largely unchanged at the end of the third quarter down just $0.03 from $1.12/SF/Mo. NNN to $1.09/SF/Mo. NNN. There are a handful of highly specialized industrial/flex spaces commanding between $1.25 and $1.40/SF/Mo.

CONSTRUCTION: In Bend, there is one speculative industrial project underway at the corner of SE Wilson Avenue and SE 9th Street. This is the Midway project consisting of three buildings, one of which will be occupied by Blackstrap. The remaining two flex buildings total 27,789 SF and will be delivered in spring 2025.

SALES: One notable sale occurred during the quarter. The property located at 63033 Sherman Road sold to an owner/user for $1,650,000 or $210/SF. The increasing cost of financing has made it difficult for investors and owner/users to make new purchases pencil. Softening leasing fundamentals combined with maturing debt over the next 12 months might spur additional sales activity.

REDMOND INDUSTRIAL MARKET

(by Pat Kesgard, CCIM, Partner & Broker — Compass Commercial Real Estate Services)

Compass Commercial surveyed 91 buildings totaling 1.75 million square feet for the third quarter Redmond industrial market report of 2023. The Redmond industrial market experienced 93,840 SF of positive absorption, resulting in the vacancy rate decreasing from 5.24% in Q2 2023 to 1.16% in Q3. There is now 20,251 SF of available space. In our Q2 report, we noted a significant increase in vacancy rate caused by Traeger vacating a 72,000 SF facility at 601 E Antler Avenue, which was quickly absorbed by BasX Solutions in Q3.

LEASING: Activity in the Redmond industrial market continues to show movement with a demand for industrial space that includes yard space. The market remains tight with very limited spaces available between 1,500 SF and 5,000 SF. This quarter, we added two industrial buildings to the survey increasing our surveyed footage to 1,746,335 SF from 1,722,495 SF in Q2.

RENTS: The Redmond industrial market continues to be strong with a slight increase at the top of the market. Average asking rates in the Redmond industrial market are between $0.90 and $1.25/SF/Mo. NNN depending on the condition and size of the space. Asking rates for new projects under construction are between $0.95 and $1.25/SF/Mo. NNN.

CONSTRUCTION: There is currently 30,000 SF to 50,000 SF of industrial space in the pipeline for Q4 2023 and Q1 2024 which should be available to lease. Most of this square footage will be available in various sizes. This report does not provide square footage of owner user buildings that either have been built or are under construction.

A New Challenge for the Multifamily Market

(by Ron Ross, Broker — Compass Commercial Real Estate Services)

Central Oregon has experienced remarkable population growth over the last decade, driven in part by its appeal to outdoor enthusiasts and a robust job market. As a result, developers have responded by constructing hundreds of new apartment units to meet the demand for housing. These new units have brought modern amenities and lifestyle choices to residents, but they’ve also raised questions about the sustainability of this building boom and the impacts of a potential oversupply.

It is estimated that over 1,000 units could come online in the next 18-20 months.

The current vacancy rate in the Bend/Redmond market is 8.7% (the highest in many years). The projected absorption rate is less than 300 units annually, portending even higher vacancies. Population growth, while still steady is slowing from the meteoric rate of recent years.

This is good news for renters, providing more options, more negotiating power, and potentially lower rents. Concessions like a month or two of free rent will be on the table. Rent growth has slowed dramatically across the board. Many Oregon markets are experiencing flat or negative rent growth.

Most local apartment developers are well capitalized and have long-term time horizons. But the high cost of building and capital, coupled with vacancies, concessions, and lower rents may cause some short-term stress. This trend is not unique to Central Oregon and in fact is a common theme in many cities and areas across the country. As with most market cycles, it will resolve over time as apartment development will slow and population growth will continue.

These factors and higher operating costs will put downward pressure on property values. Sales and values will likely stagnate through 2024. A recession looms. Sellers continue to want yesterday’s prices, remaining at odds with Buyers over property valuations. Expect a reset in 2025 with a recovering economy and a resurgence in sales activity. If you are a potential seller, position your property accordingly. Central Oregon is primed to maintain its standing as one of the fastest growing metro areas in the county. Population growth is almost certain to outpace national trends which bodes well for the long-term outlook of multifamily investors.

If you are a buyer, look for opportunities that have not been available for a long time. More properties are on the market, and many are sitting waiting for offers. Cap rates are moving up and some Sellers will need to make deals.

As always, talk to us anytime about the market, buying or selling, positioning for sale, and how to maximize your property benefits.