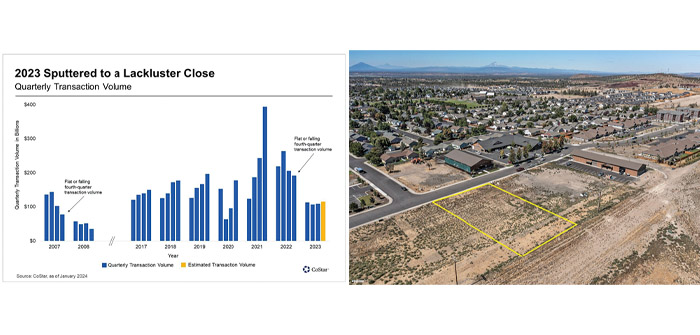

((Left) COSTAR 2023 Quarterly Transaction Volume (Right) 2648 NW 7th, Redmond, OR. One of several commercial development properties recently sold on the North End of Redmond | Photo and graph courtesy of Windermere Real Estate)

Historians can trace the term “Splitting Hairs” back to 1674 when a writer coined the phrase that meant “to make oversubtle or trivial distinctions.” If the hair is equally split, we might expect the result to be “about the same” as last year. With this image in mind, here are three of many factors that will influence this year’s Commercial Real Estate Markets.

Commercial Property Availability

Bend is notoriously short of undeveloped commercial land. High demand and limited ability to expand the Urban Growth Boundary has created this situation. Don Myll, EDCO’s Bend Area director says, “Industrial space vacancy was .5% but has recently grown to around 2%.” More capacity is needed to serve the steady demand. Myll cited one new opportunity on the horizon. “Juniper Ridge will accommodate primarily industrial companies with a small component for local retail services.100 acres of the total 500 acres are being offered to developers early this year.” Remaining vacant land in Bend will come with higher development costs.

Redmond is similar with slightly over 1% industrial vacancy. Several companies are waiting for space to come online. Nearly 50,000sf of industrial space will be available by mid-year. Last year, about that amount of space was leased so even with these new options, Redmond might end up at year end in about the same predicament.

Human Resources and Housing

A recent trend with long-term impact on Oregon’s business climate was addressed by Josh Lernher from the Oregon Office of Economic Development in his January 10, 2024 update. He started by saying that, “Population growth is the main reason Oregon’s economy outperforms the typical state over time. The influx of young, working-age residents allows local businesses to hire and expand at a faster rate. He went on to say, “So far, Oregon’s population expansion has not picked up. In fact, the Census Bureau estimates Oregon lost population in 2022 and 2023. These are the first estimated losses in nearly 40 years.” This will be a long-term problem for the State but on the other hand, Central Oregon continues to be one of the fastest-growing areas on the West Coast. These two factors might balance out so expect employee constraints to remain in 2024.

Chris Piper is the Area Manager for BBSI. In a recent conversation, he acknowledged the already existing competitive environment for scarce Human Resources. He works with businesses of all sizes but says, “The average business that we work with has nine employees. Retaining existing employees is key.” His advice is to “treat each person on the team as an individual by identifying a career path, providing work/life balance and tailoring the job to individual needs.” He also recommends partnering with a service like BBSI that can help you create a “preferred employer” status to compete for limited HR resources.

Cost of financing new and existing projects

Office buildings in Bend are following the national trend with four consecutive quarters of increased vacancy. Leasing demand has slowed for office space and lenders are cautious of speculative projects. However, Bend retail and Bend /Redmond industrial still have strong demand and markets favor the landlord. The region continues to see speculative building in these two sectors.

Steve Ferber, senior vice president, and Nick Zachariasen, commercial relationship manager at Idaho First Bank, shared that, “Building material costs have leveled off or declined, but interest costs remain high compared to the past 15 years. Builders/developers now feel that interest rates have hit a plateau and they can live with that.” Also, Ferber says, “We saw sticker shock from the impact of interest rates and building materials costs more in 2022. Last year, and for 2024, we expect those to become more normalized.” He expects commercial loan rates to be in the low to mid 7% range for 2024 with a possibility of rate reductions. Expect interest rates to remain moderate and become less of a barrier.

The Umpqua Bank Leadership Team shares this insight on commercial lending: “In general, and not just centered in Central Oregon, the ability to attract investment into Real Estate projects has dampened quite a bit in the past 12 months. Investors are demanding 8-10% minimum returns, but cash flows after debt service (mainly due to increased interest rates) are on average equating to 5-6% returns. That simply isn’t enough when compared to other investment vehicles with much less risk. Population and employment growth factors do drive demand, so in general, Central Oregon is positioned well, but we’re not immune to general investor sentiment and return demands.”

There are several economic factors influencing the outcome of the 2024 Commercial Real Estate Market in Central Oregon. COSTAR commentators expect another “Meh” year based on last year’s subdued fourth quarter. It might be safe to predict more of the same and then leave it to the commentators to “split hairs.”