Bend’s Evolving Construction Market

by Rich Reese, VP of Construction — Compass Commercial Real Estate Services

The Central Oregon region is experiencing a robust commercial construction market, fueled by economic growth, population increases, and a thriving business environment. This surge in demand encompasses retail, office, industrial, hospitality, and residential sectors, painting a picture of dynamic expansion.

Growth Drivers

Several key factors contribute to Bend’s construction boom. Significant population growth, particularly in Bend and Redmond, increases demand for new commercial spaces and housing. The region’s strategic efforts toward economic diversification by attracting tech companies and other industries, beyond tourism and outdoor recreation, further fuel the demand for construction projects. This includes the rise of mixed-use buildings, combining residential and commercial spaces, reflecting the evolving needs of the community.

Investment in infrastructure, including transportation upgrades and public facilities, play a vital supporting role. These improvements are critical for accommodating the growing population and supporting new developments to make the region even more attractive for businesses and residents. The focus on sustainable building practices and green construction methods further highlight a commitment to responsible development.

Headwinds: Labor, Materials & Regulation

Despite the positive trajectory, Bend’s construction industry faces significant headwinds. Labor shortages, rising material costs, and complex regulatory hurdles pose considerable challenges. These factors can impact project timelines and budgets, potentially slowing down the pace of development. Furthermore, the potential passage of Measure 118 in Oregon, with its compounding sales tax, could dramatically increase construction costs by a staggering 964%, significantly impacting project feasibility.

The high cost of living and housing affordability issues present another obstacle. Attracting and retaining skilled workers becomes increasingly difficult when faced with high living expenses, potentially hindering the industry’s capacity to meet the growing demand.

Technological Transformation: The Role of AI

The construction industry is undergoing a profound transformation driven by the adoption of artificial intelligence (AI) technologies. AI has the potential to significantly improve efficiency, reduce costs, enhance safety, and promote sustainability across all stages of a project, from design and planning to construction management and maintenance.

AI applications are envisioned to streamline processes, optimize resource allocation, improve risk management, and enhance supply chain efficiency. However, successful AI adoption requires collaboration between technology providers, construction companies, and stakeholders. Addressing challenges such as data quality, system integration, and workforce training is essential to unlock AI’s full potential within the construction sector.

A Collaborative Approach

Successful construction projects rely on strong collaboration and communication. Compass Commercial Construction provides comprehensive support to clients from initial concept to project completion. Our focus on teamwork, experienced leadership, innovative solutions, and an understanding of diverse market dynamics underscores the collaborative approach required to navigate the complexities of Bend’s dynamic construction landscape.

Looking Ahead

The future of Bend’s construction market appears promising, despite the challenges. The continuous growth, diversification efforts, infrastructure investments, and the embrace of AI technologies contribute to a positive outlook. However, addressing the labor shortages, material cost increases, and regulatory complexities remains crucial to ensure sustainable and responsible growth in the years to come. A collaborative approach, focused on innovation and addressing the industry’s challenges head-on, is key to realizing the full potential of Bend’s dynamic construction environment.

BEND OFFICE MARKET

by Jay Lyons, SIOR, CCIM Partner, Broker — Compass Commercial Real Estate Services

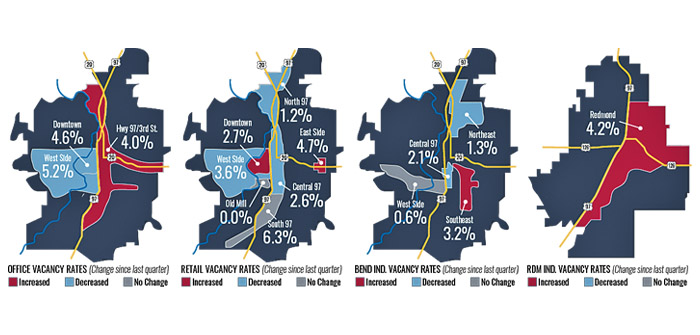

Compass Commercial surveyed 225 office buildings totaling 2.78 million square feet for the third quarter office report of 2024. The market experienced 18,537 SF of positive absorption in Q3 which decreased the vacancy rate from 5.46% in Q2 to 4.79% in Q3. This is the second straight quarter of positive absorption. Unfortunately, that positive absorption was mostly offset by available sublease space increasing from 70,278 SF in Q2 to 84,143 SF in Q3. The current availability rate, which includes vacant space and sublease space, sits at 7.81%. There is now 133,144 SF of available office space for lease in Bend.

LEASING: Leasing demand remains slow but steady across all submarkets and suite sizes. The West Side and Downtown submarkets showed signs of life this quarter with 12,321 SF and 10,427 SF of positive absorption respectively. The Hwy 97/3rd Street submarket experienced negative absorption of 4,211 SF.

RENTS: Lease rates continue to be flat with the high end of the market ranging from $2.00 to $3.05/SF/Mo. NNN and more affordable spaces ranging from $1.40 to $2.00/SF/Mo. NNN.

CONSTRUCTION: Construction is well under way on two Taylor Brooks developments. The first is Shevlin Crossing – Building B, a 26,000 SF, two-story office building located in NorthWest Crossing. The second is a 6,413 SF single-story medical office building directly across the street from Shevlin Crossing. Both buildings are slated to be delivered Q2 of 2025.

SALES: There were two notable sales this quarter. An investor purchased a 4,668 SF, single-tenant medical office building located at 2564 NE Courtney Dr. The building sold for $2.50 million or approximately $536/SF. An investor purchased Colorado Terrace, a 19,358 SF, multi-tenant office building located at 1011 SW Emkay Dr. The building sold for $4.46M or approximately $230/SF.

BEND RETAIL MARKET

by Eli Harrison, Broker — Compass Commercial Real Estate Services

Compass Commercial surveyed over 4.65 million square feet of retail space across 272 buildings in Bend to compile the third quarter retail report of 2024. The Bend retail market recovered from the 0.44% uptick in vacancy it experienced between Q1 and Q2 of 2024, with the overall retail vacancy rate decreasing from 3.32% in Q2 to 3.15% in Q3. There is now 146,611 SF of available retail space for lease in Bend.

LEASING: The positive absorption recorded in Bend’s retail market was due primarily to the positive absorption in the Central 97 and West Side submarkets, which offset an increase in vacancy in the East Side submarket. The Central 97 Bend vacancy rate decreased from 4.09% in Q2 to 2.55% in Q3 with 10,488 SF of positive absorption, while the East Side submarket’s vacancy rate increased from 3.77% to 4.71% in Q3.

RENTS: The asking rental rates for Bend retail space range from $1.00 to $3.75/SF/Mo. NNN with an average of $2.20/SF/Mo. NNN. Excluded from these rate ranges are two outliers—a 21,376 SF building at 355 NE 2nd St. is marketed on the low side at $0.50/SF/Mo. NNN, and the inline retail pad buildings under-construction at Gateway North, the new Costco-anchored development on Highway 20 and Cooley Road, are being marketed on the high side at a rate range $4.17 to $5.00/SF/Mo. NNN.

CONSTRUCTION: The new Costco relocation to Gateway North has made significant progress in its development, with Costco’s opening date on October 19th, 2024. Costco’s building, gas station, and car wash will total 185,000 SF. The retail buildings being developed on the adjacent pad sites will total approximately 23,000 SF with 12,000 SF reportedly pre-leased. Killian Pacific’s new mixed-use complex, Jackstraw, is still on pace for an estimated completion date of October of 2025. The 313-unit apartment complex will feature 16,885 SF of ground floor retail space.

SALES: There were several notable sales this quarter. The Mirror Pond Cleaners building at 615 NW Franklin Ave. in Bend sold for $2.60 million or $533/SF. 415 SE 3rd St. sold for $1.56 million or $426/SF. The 3,854 SF retail building located at 357 NE Dekalb Ave. sold for $1.3 million or $339/SF. The property located at 734 NE Greenwood sold for $925,000 or $770/SF.

BEND INDUSTRIAL MARKET

by Graham Dent, SIOR, Partner, Broker — Compass Commercial Real Estate Services

Compass Commercial surveyed 323 Bend industrial buildings totaling 4.67 million square feet for the third quarter of 2024. The market experienced 10,897 SF of absorption during the quarter resulting in an overall vacancy rate of 2.04%, a slight decrease from the 2.09% recorded in Q2 2024. There is now 95,331 SF of industrial space currently available in Bend.

LEASING: As evidenced by the very minor change in vacancy rate, leasing activity was relatively stagnant during the third quarter. The Northeast Industrial market experienced the greatest level of activity experiencing more than 10,000 SF of absorption during the quarter.

RENTS: The average asking lease rate for standard industrial space was $1.12/SF/Mo. NNN at the end of Q3 2024, an increase of $0.06/SF/Mo. NNN from Q2. Asking lease rates for new construction are between $1.35 and $1.75/SF/Mo. NNN.

CONSTRUCTION: The Midway project located at the corner of SE Wilson Ave. and SE 9th St. is under construction in Bend. Midway consists of three buildings, one of which will be occupied by Blackstrap. The remaining two flex buildings totaling 27,789 SF will be delivered in spring 2025. Taylor Brooks has broken ground on a 38,000 SF building in Juniper Ridge. This speculative project is expected to be completed by summer 2025. Another speculative project in Juniper Ridge being developed by Empire Construction & Development is under construction with delivery expected in late 2024. This project consists of approximately 15,410 SF.

SALES: A couple of notable sales occurred during the quarter. An industrial building at 63270 Lyman Pl. sold to an investor for $3.10 million or $109/SF. The previously vacant property was highly improved as a cannabis grow facility and the pricing reflected the risk and expense of re-tenanting the property. 930 SE Textron also traded during the quarter. That property sold to an owner/user for $1.973 million or approximately $182/SF. A shortage in inventory and the higher interest rate environment have contributed to a slower sales market.

REDMOND INDUSTRIAL MARKET

by Pat Kesgard, CCIM, Partner, Broker — Compass Commercial Real Estate Services

Compass Commercial surveyed 94 buildings totaling 1.79 million square feet for the third quarter Redmond industrial market report of 2024. The Redmond industrial market experienced 27,242 SF of negative absorption resulting in the vacancy rate increasing from 2.02% in Q2 2024 to 4.19% in Q3 2024. This change in vacancy is due to the new 11,844 SF industrial building on Badger Rd. There is now 74,952 SF of industrial space available in Redmond. While this is still a tight rental market, the vacancy rate increase is primarily due to new speculative construction and slower absorption.

LEASING: Demand for space in the Redmond industrial market has softened with tenants seeking spaces between 1,500 SF and 5,000 SF. Leasing activity decreased throughout the quarter with more spaces coming available than being leased.

RENTS: Lease rates in the Redmond industrial market have stabilized at the top of the market. Average asking rates are between $0.90 and $1.25/SF/Mo. NNN depending on the condition and size of the space. Due to the new inventory coming on the market, some landlords are offering short-term reduced rates as an incentive.

CONSTRUCTION: A 23,400 SF industrial building on NE Jackpine Ct. is slated for completion in October 2024. We anticipate a slower roll out of new speculative construction in 2025. In the last 10 quarters, we have observed a significant amount of square footage that was built as owner/user buildings or pre-leased space.

MULTIFAMILY REPORT | SUPPLY AND DEMAND

by Ron Ross, Broker — Compass Commercial Real Estate Services

Supply and demand is arguably the most fundamental principle of real estate markets. About 18 months ago, we wrote on this same topic, but an update seems timely. As a refresher: increasing supply puts downward pressure on values, while rising demand drives them upward. The balance between these two forces shapes the market.

PAST

In Bend’s multifamily sector, supply and demand have a direct impact on both rental rates and property values. From the aftermath of the Great Recession (around 2011) to 2022, Central Oregon faced a severe housing shortage, both for single-family and multifamily units. This shortage was driven by two key factors: the slowdown or near halt of development during the Great Recession (affecting supply) and rapid population growth (driving demand).

The COVID-19 pandemic further intensified these issues, spurring a significant in-migration to Central Oregon and once again stalling development. Supply and demand were drastically imbalanced. The result? Skyrocketing rental rates, nearly zero vacancies, and substantial increases in property values—a boon for landlords and property owners, but a challenge for tenants and homebuyers.

PRESENT

Another fundamental principle of business is change. Markets never go straight up or straight down forever. Developers responded to the housing shortage on a massive scale, with thousands of new multifamily units constructed in Central Oregon over the past few years. Many of these units are now just coming online and entering the lease-up phase.

At the same time, population growth has slowed, partly due to the high cost and limited availability of housing, resulting in decreased demand. These trends are now reflecting in the market. Rent growth has stagnated, and in some cases, rents may even be declining. Significant concessions are being offered, vacancy rates have increased, and units are staying vacant much longer — sometimes weeks or even months.

The combined impact of oversupply and rising interest rates has also driven down the market value of multifamily properties. In some areas of the country, property values have decreased by over 20%. While Central Oregon remains a desirable destination to live and invest, the market here hasn’t been immune to these trends, though the decline is likely less severe.

FUTURE

Looking ahead, the wave of new apartment developments will hit the brakes. Several proposed projects have already been shelved. The biggest question mark for the future is population growth. If population growth remains robust, the market could stabilize in the next year or two, with vacancy rates returning to a more typical range of around 5%. Rent rates will likely remain flat, at best, for the next couple of years.

For property values to rise again, we will need to see both increasing rents and declining interest rates.

In the world of real estate, the balancing act of supply and demand is never perfect—that’s what makes the market dynamic. Let’s see what the next cycle brings.