(Graphs courtesy of Bruce Barrett)

George Patton was a famous Army General known for success in battle during WWII. Much of his success was due to a thorough knowledge of the battlefield and careful study of successful strategies on those fields dating back to Roman times.

Having a historic perspective, combined with successful strategies is also helpful in understanding the regional commercial real estate market.

Here are some targeted perspectives and strategies for fourth quarter, 2024.

Commercial RE Values in Central Oregon are stable for now, and will continue to grow.

According to the Oregon Office of Economic Analysis, Deschutes County has the fourth most diverse economy in Oregon. According to BNL Appraisal, a national appraisal company, “Areas with a strong and diverse economy, thriving business sectors, and a growing population are more likely to attract businesses and investors. High-demand areas typically experience increased competition for commercial properties, driving up their values.”

Central Oregon has been a high demand growth area for the last decade. The Deschutes County Assessor forecasts a growth rate in 2025 of all real estate in the County at 5.2%, down slightly from 2024’s 5.5%. However, overall market valuation has increased 300% since 2013.

Recently in the US, commercial real estate has been characterized by the Commercial Reserve Bank of St Louis as, “lackluster with pockets of opportunity.” Taylor Thompson, vice president and commercial loan officer for SELCO Community Credit Union adds, “Central and Eastern Oregon are those pockets of opportunity. Businesses, building owners and developers see opportunities to expand and establish new offices, retail stores and industrial sites.”

On the other hand, the St. Louis Federal reserve bank is concerned about Commercial Real Estate’s ability to sustain growth on a national level showing sharp variation over the last two years.

Headwinds to Sustained Growth

Labor Market Challenges: One major “headwind” for small business including those in Central Oregon is in the area of Human Resources.

“Along with interest rates, job growth is probably the single biggest driver of growth in the real estate market,” said Richard Barkham, global chief economist at CBRE.

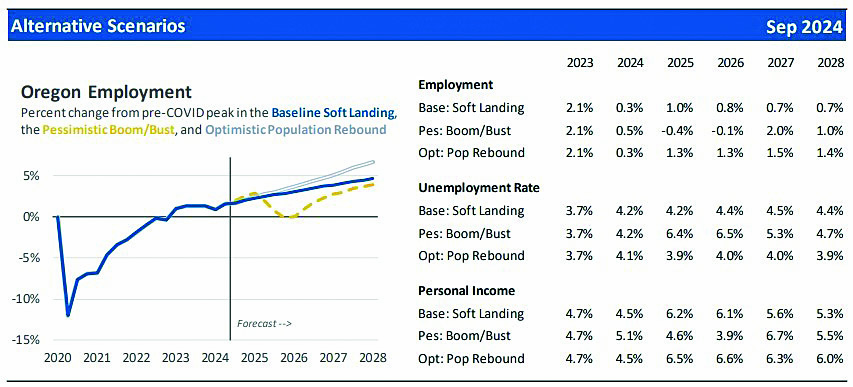

With the current net negative in-migration in the State of Oregon, the labor participation rate through the second quarter as reported by the Oregon Labor Department has remained at 63% over the last three years. Gains were realized in government, education and health services sectors. Slight job growth has been realized in Oregon through small business startups. State Economists are hoping for a population rebound to provide projected employee demand.

New and growing businesses in Oregon are not only finding an increasingly shallow labor pool but also face increasingly complex labor laws. For example, Chris Piper, area manager for BBSI Central Oregon commented recently on Oregon Family Leave Act (OFLA) and the introduction of Paid Leave Oregon. He says, “The administrative burdens they impose can be significant, especially for small businesses with limited resources.” Piper lists the following issues that small businesses in Oregon will need to navigate:

Administrative Complexity — Requirements for OFLA, PTA and Worker’s Compensation can be overwhelming,

Financial Impact — Mandatory employer contributions for small business over 25 employees and the potential for increased leave utilization will have a financial impact on the business,

Employee Management — Expect disruptions in productivity and employee scheduling challenges when employees take extended leaves.

Vacant Offices: Nationally, One-fifth of all offices stood vacant in the first quarter this year, the highest percentage in history. Office construction has declined 63% since the pandemic

Central Oregon has not experienced the same office vacancies as other regions. Bend’s third-quarter vacancy rate hovers around 6% compared to a nationwide rate that has reached a 30-year high. However, in downtown Portland, U.S. Bank just announced that they will vacate 222,000 square feet inside Portland’s U.S. Bank tower, according to real estate analytics firm CoStar.

Central Oregon is not exempt from economic changes influencing office vacancy. In Redmond, a regional call center recently vacated over 77,000sf of flex space.

High interest rates helped push nationwide CRE delinquency rates to 5% in May, up from 3.6% in the same month a year ago. However, a quick survey of local bankers indicates very few commercial mortgages are in default.

Shortage of Industrial buildings and land: Redmond Industrial vacancy rate was steady at less than 3% throughout 2024 with new space coming on line at about the same pace as space being leased. It remains a tight market for tenants who typically need 1,500sf to 2,000sf. This will be a serious headwind for new and expanding businesses throughout Central Oregon.

Retail Building Evolution: “The move toward smaller concept stores is a key part of retail’s evolution,” according to a market professional. “The best performing retail properties will have owners and operators who are flexible and willing to adapt to what their most important tenants need.”

More high traffic shopping districts in Bend experience no vacancy over extended periods with other areas seeing extended vacancy. New shopping areas like Costco are unique to that market with the most desirable space appealing to local merchants.

Expect More of the Same

The local commercial real estate outlook for fourth quarter, 2024 is largely positive — industrial and retail will continue to be stable in Central Oregon. But the higher interest rate environment appears to be staying, while office vacancies are a factor that investors and lenders will eye with caution.

“Until tenants start leasing more space than they are giving up, prices are projected to remain flat at best, according to CoStar Group’s Commercial Repeat-Sale Indices.

Victor Calanog with Manulife Investment Management says, “With the Fed’s rate reductions, the price index for major markets with fewer high-dollar transactions moves sideways for a while, while the indicator of more numerous but lower-priced property sales is expected to continue to soften slowly.”