Finding Purpose After Exiting Your Business

At Rosell Wealth Management, we specialize in guiding successful business owners through the six crucial opportunities that can make or break the transition from business ownership to life beyond the sale. Our signature program, The 6% Advantage, is designed to ensure owners are not just prepared for the transaction but for everything that comes next. Why 6%? Because only 6% of business owners plan their exit two or more years in advance — and we believe preparation is where the magic happens.

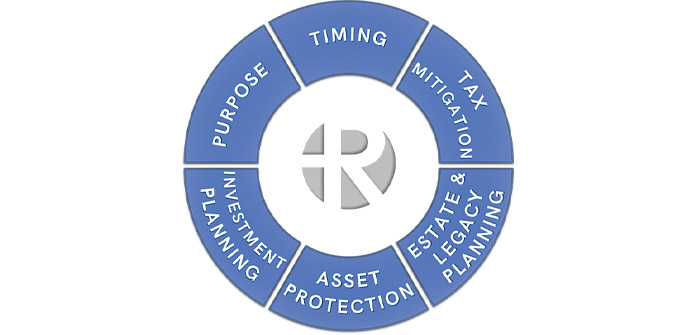

The opportunities within The 6% Advantage include Timing, Tax Minimization, Family Legacy, Asset Protection, Personal Investments, and Purpose. While most people get caught up in the financial and legal intricacies of a sale, today we want to talk about something deeper: your purpose. Because after the numbers settle and the ink dries, it’s the non-financial aspects of life that often carry the greatest weight.

Central Oregon, known for its craft breweries, snowy slopes, and entrepreneurial spirit, has no shortage of go-getters launching businesses fueled by passion and hard work. But what happens when it’s time to hang up your entrepreneurial hat? Just because you’ve mastered the art of growing a business doesn’t mean the next chapter will come with a pre-written script. Many business owners know what they’re retiring from but lack the clarity of what they are retiring to.

For many local business owners, stepping away from the company they built can feel like handing over the keys to Peaches, a classic car they’ve spent years restoring — there’s excitement about what’s next, but also a sense of unease about not being in the driver’s seat anymore.

The Post-Sale Identity Crisis: You’re Not Alone

While the allure of post-exit freedom sounds enticing, many entrepreneurs find the transition to be a double-edged sword. Here are some common challenges business owners face after selling their businesses:

- Loss of Identity — You weren’t just a business owner; the business was a big part of who you were. Now that it’s sold, you might be asking, “Who am I without it?”

- Loss of Purpose — Your business goals were your personal goals. Without those targets to hit, what’s the new mission?

- Feeling Adrift — Your relationships — whether with customers, suppliers, or employees — blurred the lines between business and social life. Now, you’re left wondering: Who’s my new tribe?

- Loss of Validation — The respect and pride you earned as a business owner didn’t come with a retirement package. Without the business, where do you find that sense of achievement?

This transition can be overwhelming, but fear not — much like hitting the trails at Mount Bachelor, it’s all about preparation, strategy, and embracing the unexpected bumps.

Plan Ahead for the Next Chapter

One of the biggest mistakes entrepreneurs make is spending years preparing their business for sale but forgetting to plan for their own lives post-sale. If you’re in the early stages of considering an exit — or even if the closing date is fast approaching — now is the time to start thinking about what comes next. Here are some strategies to smooth the way forward.

1. Define Your New Purpose

Running a business leaves little time for hobbies or non-business-related goals, and that’s okay — until it isn’t. In this next chapter, personal goals can become your North Star. Think of it as a business plan, but for your life.

- Is there a passion project you’ve always dreamed of starting?

- Are there skills you want to learn or adventures you want to pursue?

- How about giving back to the community through mentoring or philanthropy?

Much like launching your first business, building purpose after your exit takes planning and vision.

2. Create New Routines (And Stick to Them)

The daily grind of running a business gives structure to your life — morning meetings, emails, employee check-ins. Without that framework, the days can feel disjointed. But here’s the good news: You get to design a new routine.

- Morning bike ride at Phil’s Trail? Yes, please.

- Midday coffee at Looney Bean with old friends? Why not.

- Evening wine at Va Piano? Absolutely.

New routines can offer rhythm and stability, helping you adjust to this new chapter.

3. Embrace the Power of Community

While you may not miss payroll Fridays, you will miss the camaraderie of your business relationships. That sense of connection doesn’t have to disappear when your business does. Find or build new communities that align with your interests.

- Join a networking group, ski club, or volunteer organization.

- Reconnect with old friends or dive into hobbies you’ve sidelined.

- Find mentorship opportunities — your years of experience could be invaluable to the next wave of entrepreneurs here in Bend.

4. Discover New Sources of Validation

Let’s face it — being known as “the boss” has its perks. You earned respect, status, and pride through years of hard work. After the sale, it’s time to find new ways to experience that fulfillment. Whether it’s through pursuing personal achievements, helping others, or exploring creative outlets, there are endless ways to reclaim that sense of pride.

5. Allow Time for the Transition

Selling a business is like summiting South Sister — it takes preparation, endurance, and a moment to catch your breath at the top. Transitioning to life post-exit isn’t a quick sprint; it’s a marathon. Give yourself permission to feel the mix of emotions that come with leaving behind a big part of your life.

Moving Forward with Purpose and Joy

While the transition from business owner to the next phase of life may feel like navigating a river without a guide, it doesn’t have to be daunting. With a little planning and a willingness to embrace the unknown, this chapter can be just as rewarding as the one before it.

As Bend’s business community grows, more and more entrepreneurs will face this transition. So whether you’re handing over the keys to your brewery, retail store, or consulting firm, the message is clear: You don’t have to go it alone, and your best days might just be ahead of you.

The trails are calling, the rivers are waiting, and life after business is yours to create. Are you ready to enjoy the ride?

David Rosell is the pPresident of Rosell Wealth Management in Bend. RosellWealthManagement.com. He is the au-thor of three books. Find David’s books at local bookstores, Amazon, Audible as well as Redmond Airport. Invest-ment advisory services offered through Valmark Advisers, Inc. an SEC Registered Investment Advisor Securities of-fered through Valmark Securities, Inc. Member FINRA, SIPC 130 Springside Drive, Ste 300 Akron, Ohio 44333-2431. (800) 765-5201. Rosell Wealth Management is a separate entity from Valmark Securities, Inc. and Valmark Advisers.