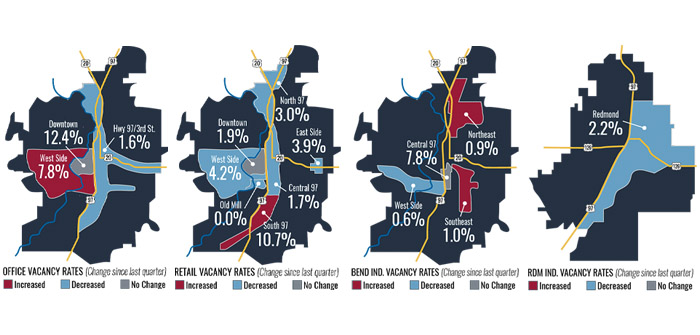

(Graphics | Courtesy of Compass Commercial)

Much debate and speculation have surrounded potential changes to the IRS Section 1031 law, otherwise known as a Like-Kind Exchange. Section 1031 has 100-year-old roots, starting with The Revenue of Act of 1921. It evolved over the 1920s and ‘30s, and in 1954 the IRS defined the current 1031 section of the IRS code. This important law has fueled job and business growth for the last century and is an effective tool for economic recovery across the country.

A 1031 Like-Kind Exchange is not a “loophole” in the tax code. It is a tax deferment, not a tax abatement. While some see it as a means to avoid paying taxes in the short term, we must not ignore the economic benefits of deploying those funds for local communities.

The proposed legislation would cap the deferment to $500,000 for individuals and $1,000,000 for married couples. While it appears the complete elimination of the 1031 exchange is not currently at risk, it would have significant negative impacts.

A PROBLEM BEND KNOWS ALL TOO WELL

What happens when land prices, SDC fees and construction costs are so high that tenants who are able and willing to pay rent cannot support them? Developers must rely on other third-party or government subsidies (i.e., affordable housing) to make projects work. The 1031 Like-Kind Exchange is one of the best vehicles developers have to solve this problem.

Developers can build a healthy development environment by putting their tax-deferred funds to work. This environment occurs when a project produces enough income to justify the expense, and it provides a return for taking on the associated risk.

Over the last decade, hundreds of millions of dollars have flowed into the Central Oregon market due to Section 1031. The benefits of the 1031 Like-Kind Exchange are far-reaching, and there are many reasons to keep this long-standing legislation in place without significant alterations. It encourages job creation, boosts tax revenues, helps business owners relocate or grow and expand their business, and farmers and ranchers rely on it. It is an integral part of retirement savings plans, and it brings stability in areas of economic uncertainty.

THE FUTURE OF 1031 LIKE-KIND EXCHANGES

According to the Federation of Exchange Accommodators (FEA), 1031 Like-Kind Exchanges will contribute to 568,000 jobs and $27.5 billion in labor income with $55.3 billion to the U.S. gross domestic product. Research conducted by Ernst and Young shows that 1031 exchanges will generate approximately $7.8 billion in federal, state and local taxes this year.

It is hard to imagine the need to change such successful legislation. With 100 years of success to point to, the jury is no longer out on this one. In an era of rethinking and reinventing the use of hotels, office buildings and retail buildings, now is not the time to rethink the legislation that will help facilitate this transformation.

If you have any questions regarding your property and Like-Kind Exchanges, contact us at Compass Commercial.

Bend Office Market

Compass Commercial surveyed 223 office buildings totaling 2.76 million square feet for the third quarter office report of 2021. The market experienced 13,193 SF of absorption in the third quarter, but the vacancy rate ticked up slightly from 7.07 percent to 7.12 percent due to the delivery of two new developments in NorthWest Crossing: the MacPac Building and Grove. There is now 196,497 SF of office space available in the market.

LEASING: The office leasing market seems to have stabilized, but leasing activity remains hit or miss. The Highway 97/Third Street submarket experienced the most activity this quarter, with 8,465 SF of positive absorption. Two notable leases this quarter include, Tumalo Industries leased 4,133 SF at the Brooks Building, and Bestcare Treatment Services leased 3,700 SF at 358 NE Marshall Avenue. The Downtown submarket reported no change in vacancy for the quarter, while the West Side increased vacancy slightly from 7.20 percent in Q2 to 7.83 percent in Q3.

RENTS: Average asking rates on office space in Bend range between $1.70 and $2.15/SF/Mo. NNN with a handful of first-generation spaces exceeding this range. In those instances, the higher asking rates are a direct reflection of the cost associated with building new office product in today’s market. The highest asking rates continue to be located within the West Side submarket with more affordable options available within the Highway 97/Third Street submarket.

CONSTRUCTION: There are no new speculative office developments currently under construction.

SALES: There was one notable office sale this quarter. The Cascades Building, located at 233 SW Wilson Avenue, was purchased for $6,800,000 or $332/SF.

Bend Retail Market

Compass Commercial surveyed over 4.51 million square feet of retail space across 259 buildings. During the quarter, 89,206 SF of positive absorption was recorded, resulting in the citywide vacancy rate dropping from 5.86 percent in Q2 to 4.18 percent. There is now 188,671 SF of available retail space for lease in the Bend market.

LEASING: Demand in the retail leasing market continues to remain strong, with limited options for tenants to select from. The North 97 submarket experienced the most activity this quarter, due to Ashley HomeStore relocating from their 15,515 SF suite to the 51,257 SF former JCPenney’s space in Cascade Village Shopping Center. The Downtown submarket noted no change during the quarter, which was primarily due to the limited amount of space available.

RENTS: Asking rental rates for Bend retail space range between $1.50 and $3.33/SF/Mo. NNN* with the highest rates in the Downtown and West Side submarkets.

CONSTRUCTION: Three construction projects are in the planning and permitting phase. Pioneer Marketplace at 1474 NW Wall Street is projected to house 6,000 SF of retail space. The former Sonic site at 61165 S Hwy. 97 is expected to be 4,793 SF in size. Reed South, an approximately 30,000 SF retail site located on the corner of Reed Market Road and 27th Street, is expected to begin construction imminently. Pahlisch Commercial is in the preleasing stages of Petrosa, a 21.2-acre, 231,301 SF retail development in NE Bend slated for development as early as Q4 2022.

SALES: There were three notable retail sales this quarter. 220 SW Scalehouse Loop was purchased for $2,200,000 or $310/SF. The mixed-use retail/residential building at 831 NW Wall Street was purchased for $2,000,000 or $467.51/SF and 523 NW Colorado Avenue, another mixed-use retail/residential building was purchased for $1,600,000 or $466.20/SF.

Bend Industrial Market

Compass Commercial surveyed 320 industrial buildings in Bend, totaling 4.61 million square feet. The market recorded negative absorption of 4,572 SF resulting in a slight increase in the vacancy rate from 1.50 percent in Q2 to 1.60 percent in Q3. This marked the first increase in vacancy in the industrial market since Q2 2020. Year to date, a total of 83,511 SF has been absorbed, leaving only 73,939 SF of industrial space currently available in the market.

LEASING: The slight increase in vacancy is not an indicator that demand has slowed whatsoever. The most notable leasing activity occurred in the West Side submarket, where approximately 18,000 SF of leasing occurred. A large lease transaction took place at the Quad at Skyline Ridge, totaling 11,170 SF, and a 6,739 SF deal was completed at District 2 in Northwest Crossing. Those transactions alone caused the vacancy rate on the West Side to drop from 6.47 percent in Q2 to 0.56 percent in Q3.

RENTS: Average asking rates on industrial space in Bend are between $0.85 and $1.25/SF/Mo. NNN*. The rental rates on the high end are generally for new construction or highly improved spaces with office space or with quasi-retail exposure. The ever-increasing cost of construction and tightened land supply are the primary reasons for increasing industrial rental rates.

CONSTRUCTION: There are two speculative industrial projects under construction in the market totaling 25,225 SF, of which only 20,480 SF is available.

SALES: There were three notable sales during the quarter. One property, located at 63830 Clausen Road sold to an investor for $3,260,000 or $124/SF. A building located at 63049 Lower Meadow Drive sold to an owner/user for $2,225,000 or $203/SF. Another investor purchased a building at 63026 Plateau Drive for $2,000,000 or $199/SF. Several other buildings are currently under contract in the $200/SF range. Reporting for those buildings will be recorded in subsequent quarters.

Redmond Industrial Market

88 buildings totaling 1.66 million square feet were surveyed in the third quarter of 2021. In this quarter, the Redmond industrial market recorded positive net absorption of 2,400 square feet. The entirety of this absorption was at 1480 NE Jackpine Avenue. The vacancy rate decreased as a result from 2.34 percent in Q2 to 2.19 percent in Q3. There is now 36,474 SF of industrial space available for lease.

LEASING: Activity in the Redmond industrial market continues to increase. Noteably, two 9,000 SF suites were leased at 494 SW Veterans Way. The minimum downtime on the market for this deal indicates the need for additional supply.

RENTS: Average asking lease rates in the Redmond industrial market are between $0.75 and $1.10/SF/Mo. NNN*.

CONSTRUCTION: There is currently 90,000 to 100,000 SF of industrial space in the pipeline for 2022. Two industrial buildings at 2505 SE First Street totaling 58,568 SF is projected to be complete in spring of 2022. Another 40,000 SF industrial building located at 2502 SE 1st Street is also slated to break ground at the end of 2021.