(Graphs courtesy of Windermere Commercial Real Estate)

“If there’s one thing that’s certain in business, it’s uncertainty.”

~ Stephen Covey

Global pandemics, changes in the labor force, global supply chain challenges, high interest rates and many other factors are signals to the most resilient large and small companies that transformational thinking is required in considering commercial real estate needs. Here are some factors that local businesses and investors should consider.

Location

Businesses are choosing different strategies for handling market uncertainty depending on location. Some of them downsize significantly such as Meta subleasing significant amounts of their office in Seattle and Bellevue. Microsoft recently announced that they won’t renew office leases in Bellevue as they turn to remote work. Some companies even decide to leave specific markets, like Nordstrom that is leaving Canada. The commercial real estate brokerage company Colliers recently reported that “Portland’s central business district ended 2023 with the highest vacancy rate of any downtown office market in the entire country at 30.2%.”

By comparison, a fourth quarter 2023 report by Compass Commercial shows Bend office vacancy in the 6% range. That is a much more acceptable vacancy rate although demand has slowed and negative absorption is placing downward pressure on lease rates. Even in our local robust market, there is some uncertainty.

Financing Costs

The rapid rise in commercial lending rates over the last two years has caused uncertainty for investors and users of commercial property. Unstable economic conditions caused by COVID resulted in fiscal stimulus and relief packages. Monetary policy actions like quantitative easing and holding interest rates near zero flooded the markets with liquidity.

As the pandemic eased and consumers returned to work and resumed normal purchasing patterns, supply-chain bottlenecks and the stimulus-induced liquidity caused inflation to rise to levels not seen since 1981. These inflationary concerns caused long-term commercial rates to rise from the 4% range to near 8%.

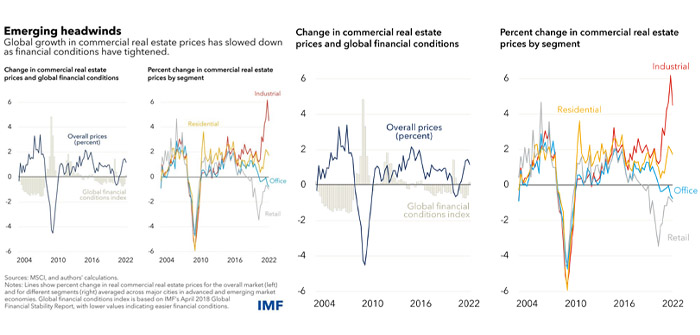

In January 2024, a report by the International Monetary Fund said, “Higher financing costs since the beginning of the tightening cycle and tumbling property prices have resulted in rising losses on commercial real estate loans. Stricter lending standards by U.S. banks have further restricted funding availability. For example, about two-thirds of U.S. banks recently reported a tightening in lending standards for commercial construction and land development loans.” Even with that said, some local developers who own commercial land outright or have adequate equity are moving forward even in the higher interest rate climate.

Supply and Demand

The bright spot on the horizon for Central Oregon commercial real estate is the strong demand. Redmond Economic Development Director Steve Curley recently reported that projects last year are bringing 46 jobs to the area with over $12 million in capital investment. Curley told investors the pipeline for REDI remains strong for 2024 and beyond. Five owner-occupied projects are currently in process with construction in various phases totaling over 340,000 sq. ft. and over $477 million in capital investments.

Travis Browning, First Interstate Bank’s market president in Redmond is also optimistic. He reports that business lending is up compared to the first quarter of last year. He thinks businesses in Redmond are generally doing well and are responding to improving market conditions. Businesses are finding ways to adapt to uncertain market conditions.

Evidence of that can be seen throughout the region as several sectors are seeing growth, including aviation, aerospace, warehousing, and distribution, as more goods are being brought into the region to serve the growing population. Curley also noted a new supply chain semiconductor business will be starting in the area soon leveraging federal CHIPS Act funding as well as Business Oregon funding.

Above all, in the next two years alone, Curley says he expects to see over half a billion dollars in new public projects coming out of the ground.

Although there remains a high level of uncertainty in the commercial real estate industry, property owners are finding ways to meet demand including repurposing retail space, upgrading office buildings to encourage back-to-work efforts, adding environmentally friendly amenities to cut operating costs and more.

Commercial real estate experienced a year of transition in 2023 that left markets in uncertainty. In Central Oregon, the main challenges remain the lack of available credit and increased pricing that are limiting deal flow. However, Central Oregon’s desirable location, stabilizing financial conditions and strong demand will continue to present opportunities for those who are resilient.