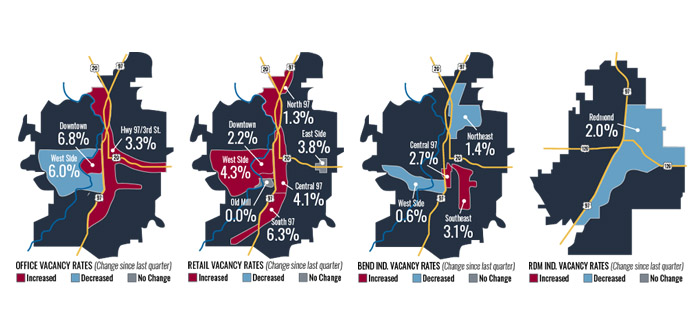

((L-R) Bend Office Market, Bend Retail Market, Bend Industrial Market and Redmond Industrial Market | Graphics courtesy of Compass Commercial Real Estate Services)

Developing Bend’s Future

Bend is witnessing a surge in major land developments as Central Oregon’s rapid growth transforms Bend’s landscape. Significant investments in commercial and residential projects are reshaping the city. Mixed-use projects such as The Jackstraw, Timber Yards, Stevens Ranch, Easton, and Petrosa are at the forefront of this transformation, blending residential units with commercial spaces, creating vibrant and dynamic communities.

JACKSTRAW

Located between the Box Factory and the Old Mill District, Jackstraw is a new mixed-use development project. It encompasses 313 residential units and 17,500 square feet of retail space with a unique “Woonerf”—a shared street for pedestrians, cyclists, and low-speed vehicles. A first-of-its-kind for Bend, concerts and markets can be hosted along the Woonerf creating exciting new leasing opportunities for local shops, restaurants, and services.

TIMBER YARDS

Situated next to Jackstraw, Timber Yards is a proposed 32-acre development. The nine-phase project includes 1,600 housing units, a 180-room hotel, 17,000 SF of retail space, and 120,000 SF of office space. Although the development of the site is currently on hold, plans to move forward in the future are still in place.

EASTON

Easton is a master planned 123-acre mixed-use community designed to meet the growing needs of Bend’s southeast side. Located at SE 15th Street and Knott Road in Bend, the development includes an 8-acre commercial parcel divided into five lots with up to 100,000 SF of potential building size. Easton will feature 847 residential units, comprised of 472 single-family homes, 114 townhomes, 61 mews, and 200 multifamily units, ensuring diverse living options and fostering a vibrant community atmosphere.

STEVENS RANCH

Stevens Ranch, a 375-acre development at the southeast intersection of Stevens Road and NE 27th Street, will feature over 1,500 housing units and 130,000 SF of commercial space. This traditionally residential area offers an exciting opportunity to cater to a historically underserved community. The development will house the new ±100,000 square foot Deschutes Public Library. Approximately 138 acres will be designated for employment with 46 acres for commercial land, 92.73 acres for industrial development, and 50 acres for a large-lot industrial site. Additionally, 44 acres are reserved for parks and open spaces, making Stevens Ranch a central hub for residential, commercial, and industrial growth.

PETROSA

Located at Butler Market and Deschutes Market Roads, Petrosa is a 179-acre live/work/play community designed to accommodate approximately 1,100 residents. The development includes 16.1 acres for commercial use, strategically positioned to support a grocery store and various retail businesses. Petrosa offers a diverse range of housing options, including single-family homes, townhomes, cottages, and 260 multifamily units. Residents will enjoy private amenities such as a pool, clubhouse, and open spaces, with an additional 10 acres reserved for a new elementary school.

These five projects are the largest land developments reshaping the City of Bend, providing essential housing and business opportunities as Central Oregon continues to grow. Over the last five years, Central Oregon has persistently seen an increase in population, earning Bend the number four spot in the top 60 fastest growing cities in America. As Bend expands, these developments are vital in supporting this growth. Compass Commercial remains committed to guiding clients through this dynamic market, ensuring robust investment opportunities and contributing to the city’s continued expansion.

BEND OFFICE MARKET

by Jay Lyons, SIOR, CCIM, Partner and Broker —

Compass Commercial Real Estate Services

Compass Commercial surveyed 225 office buildings totaling 2.78 million square feet for the second quarter office report of 2024. The market experienced 8,450 SF of positive absorption in Q2 which decreased the vacancy rate from 6.18% in Q1 to 5.46% in Q2. This is the first quarter of positive absorption in the last six quarters. Unfortunately, the positive absorption was offset by the available sublease space increasing from 49,838 SF in Q1 to 70,278 SF in Q2. The current availability rate is now 7.99%.

LEASING: Leasing demand remains slow but stable across all submarkets and suite sizes. The West Side submarket bounced back in Q2 with 19,663 SF of positive absorption. The Downtown and Hwy 97/3rd Street submarkets experienced negative absorption of 8,379 SF and 2,834 SF respectively.

RENTS: Lease rates are steady with the high end of the market ranging from $2.00 to $3.05/SF/Mo. NNN and more affordable space ranging from $1.40 to $2.00/SF/Mo. NNN. Rate reductions and leasing concessions continue to be more of the exception than the rule.

CONSTRUCTION: Taylor Brooks recently broke ground on two office buildings. The first is Shevlin Crossing – Building B, a 26,000 SF, two-story office building located in NorthWest Crossing. A 6,413 SF single-story office building directly across the street from Shevlin Crossing also broke ground this quarter. Both buildings are slated to be delivered Q2 of 2025.

SALES: There were three notable sales this quarter. An owner/user purchased a 7,037 SF vacant multi-tenant office building located at 40 NW Greenwood Avenue. The building sold for $2.08 million or approximately $296/SF. An owner/user purchased an 8,971 SF multi-tenant office/medical office building located at 19785 Village Office Court for $3.28M or approximately $365/SF. An owner/user purchased an 8,882 SF vacant single-tenant office building located at 345 SE 3rd Street. The building sold for $2.50M or approximately $281/SF.

BEND RETAIL MARKET

by Russell Huntamer, CCIM, Partner and Broker —

Compass Commercial Real Estate Services

Compass Commercial surveyed over 4.65 million square feet of retail space across 272 buildings in Bend to compile the second quarter retail report of 2024. After experiencing positive absorption for the first quarter of 2024, the retail market in Bend experienced a slight increase in overall vacancy from 2.88% in Q1 of 2024 up to 3.32% in Q2 of this year. There is now 154,416 SF of available retail space for lease in Bend.

LEASING: The negative absorption recorded in Bend’s retail market for the second quarter was due to an increase in vacancies in the majority of submarkets. The East Side vacancy rate remained unchanged at 3.77% and the Old Mill District maintained its 0.00% vacancy rate for the fourth quarter in a row.

RENTS: The asking rental rates for Bend retail space range from $1.00 to $3.75/SF/Mo. NNN with an average of $2.20/SF/Mo. NNN. Excluded from these rate ranges are two outliers—a 21,376 SF building at 355 NE 2nd Street in Bend is marketed on the low side at $0.50/SF/Mo. NNN, and the inline retail pad buildings under-construction at Gateway North, the new Costco-anchored development on the southeast corner of Highway 20 and Cooley Road, are being marketed on the high side at a rate range $4.17 to $5.00/SF/Mo. NNN.

CONSTRUCTION: The new Costco relocation development, Gateway North, has made significant progress in its development with Costco’s opening anticipated for October of 2024. The surrounding pad sites will be developed after Costco opens. Costco’s building, gas station, and car wash will total 185,000 SF. The retail buildings being developed on the adjacent pad sites will total approximately 23,000 SF with 12,000 SF reportedly pre-leased.

SALES: There were three notable sales this quarter. The former Breakfast Club building, located at 378 NE Greenwood Avenue in Bend, sold for $857,000, which represented $693.37/SF. 838 NW Bond Street in downtown Bend sold for $1.30 million or $393.11/SF. The former 8,298 SF B&D Auto Glass building located at 2115 NE 3rd Street sold for $2.85 million or $343.46.

BEND INDUSTRIAL MARKET

by Graham Dent, SIOR, Partner and Broker —

Compass Commercial Real Estate Services

Compass Commercial surveyed 322 Bend industrial buildings totaling 4.66 million square feet for the second quarter of 2024. The market experienced 3,914 SF of negative absorption during the quarter resulting in an overall vacancy rate of 2.09%, a minor change from the 2.00% recorded in Q1 2024. There is now 97,228 SF of industrial space currently available in Bend.

LEASING: Leasing activity remained relatively flat during the quarter as evidenced by a vacancy rate that remained virtually unchanged from the prior quarter. Due to the lack of inventory and lower priced alternatives, tenants are electing to renew in-place.

RENTS: The average asking lease rate for standard industrial space was $1.06/SF/Mo. NNN at the end of Q2 2024, unchanged from Q1 2024. Asking lease rates for first generation industrial space are between $1.35 and $1.75/SF/Mo. NNN, while rates on flex space or highly improved industrial spaces are between $1.25 and $1.50/SF/Mo. NNN.

CONSTRUCTION: The Midway project located at the corner of SE Wilson Avenue and SE 9th Street is under construction in Bend. Midway consists of three buildings, one of which will be occupied by Blackstrap. The remaining two flex buildings totaling 27,789 SF will be delivered in spring 2025. Taylor Brooks has broken ground on a 44,200 SF building in Juniper Ridge. This speculative project is expected to be completed by summer 2025. Another speculative project in Juniper Ridge being developed by Empire Construction & Development is under construction with delivery expected in late 2024. This project consists of approximately 15,410 SF.

SALES: A couple of notable sales occurred during the quarter. 320 SE Bridgeford Boulevard sold to an investor for $1,975,000 or $185/SF and a building located at 61510 SE American Lane sold to an investor for $2.30 million or $139/SF. Despite continued demand for industrial product from investors and owner/users, sales activity remained slow during the quarter. Higher interest rates and shortage in inventory have contributed to a slower sales market.

REDMOND INDUSTRIAL MARKET

by Terry O’Neil, Broker —

Compass Commercial Real Estate Services

Compass Commercial surveyed 93 buildings totaling 1.77 million square feet for the second quarter Redmond industrial market report of 2024. The Redmond industrial market experienced 23,400 SF of positive absorption resulting in the vacancy rate decreasing from 2.59% in Q1 2024 to 2.02% in Q2 2024. There is now 35,866 SF of industrial space currently available in Redmond.

LEASING: Demand for space in the Redmond industrial market has somewhat softened with tenants seeking spaces between 1,500 SF and 5,000 SF. Leasing activity increased throughout the quarter with over 23,000 SF of industrial space being leased. One new industrial building totaling 13,701 SF was added to the survey this quarter.

RENTS: Lease rates in the Redmond industrial market have begun to stabilize at the top of the market. Average asking rates are between $0.90 and $1.25/SF/Mo. NNN depending on the condition and size of the space. Asking rates for new projects under construction remain between $1.10 and $1.25/SF/Mo. NNN.

CONSTRUCTION: There continues to be between 20,000 SF to 50,000 SF of industrial space in the pipeline, including a 23,400 SF industrial building on NE Jackpine Court slated for completion in October 2024. There continues to be a significant amount of square footage that is being built as owner-user buildings or pre-leased space.