What is Cyber Liability?

The insurance industry has adopted the term Cyber Liability to address liability issues involved with cyber-attacks and data breach issues that organizations face on a daily basis. We all hear stories about how a cyber-attack took down a large network or stole information, but what does this mean for small local businesses?

Who Does it Effect?

Every business large or small that has valuable information can be a target. The most commonly targeted information is Payment Card Industry Data, Personal Health Information and Personally Identifiable Information. This does not mean that trade secrets and other valuable information are not at jeopardy as well.

What is the Cost?

In a recent survey by NetDiligence the average cost per record that was stolen or jeopardized was $17,035. This includes crisis services, legal defense costs, legal settlement costs, regulatory defense costs and PCI fines. All these costs pile up and the more records that are jeopardized the more cost is involved.

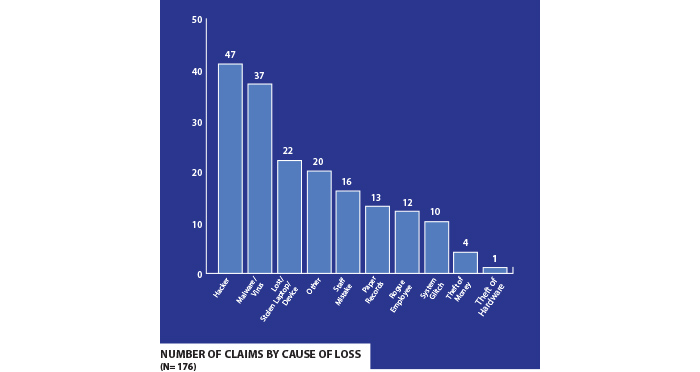

Cause of loss?

Hackers are the most frequent problem at 23 percent of all claims in 2016, followed by Malware/Virus claims at 21 percent. However, we are seeing more and more human error type of claims with lost and/or stolen laptops or devices at 13 percent, other claims at 11 percent, staff mistakes at 9 percent, loss of paper records at 7 percent, rogue employees at 7 percent.

Your IT system is not the only vulnerability you should be concerned about. The human aspect of allowing access to organizational information is growing faster and criminals are getting more sophisticated in the approach to gaining access to your information though employees.

What Can I do?

Making sure your IT system is up to date is very important, but what is often downplayed is the training of employees and making sure the correct policies and procedures are followed. Making sure that your staff knows how to keep information secure is vital.

Insurance carriers have developed many different products and policies to protect your organization from the costs involved in a Cyber or Data Breach. The coverages can include liability, forensic costs, notification expense, certain fines and regulatory implications. They can even provide a breach councilor that will help you understand the next steps your organization needs to take in the event a Cyber or Data Breach occurs in your organization.

For more information about Cyber Liability Insurance Products you can contact PayneWest Insurance at 541-306-2080