(Graph | Courtesy of Cornerstone Financial Planning Group)

Even for the most experienced investment professionals, accurately predicting the ups and downs of the financial markets is virtually impossible. In fact, the only thing the experts can tell you with certainty is that although stocks have historically provided higher long-term returns than other types of investments, they have also experienced periods of decline. While it is hard to feel good about any stock market decline, investors who utilize a dollar cost averaging strategy may be able to see a bright side.

How Does it Work?

The concept of dollar cost averaging is simple. You just invest a fixed dollar amount every month, quarter or other regular interval. This type of systematic investing is a built-in benefit to 403(b), 457(b), 401(k), and other workplace retirement plans where contributions are taken automatically from each paycheck. You can also integrate a dollar cost averaging strategy into your IRA and other savings plans by making equal contributions that are automatically deducted from your bank account at regular intervals.

What are the Benefits?

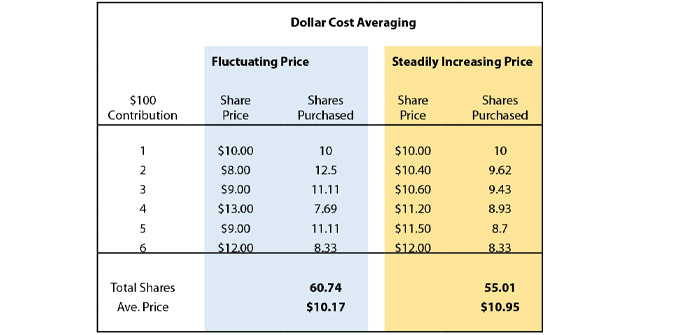

The benefits of dollar cost averaging are best realized with longer-term investments in fluctuating markets. When the market is down and prices are lower, your fixed contribution amount buys more shares. When the market is up, your systematic contributions purchase fewer shares at higher prices. In markets that fluctuate in the short term but rise over the long term, the results can be more shares purchased, a lower average price per share, and a higher ending value. To see how this works, take a look at the table that compares an investment that fluctuates in price to an investment with a steadily increasing price. Notice that when share prices are lower, each $100 contribution buys more shares. Also notice that when share prices fluctuate up and down, the end result is more shares purchased and a higher ending value. Dollar cost averaging also encourages discipline and helps take the emotion and guesswork out of investing. However, dollar cost averaging does not ensure a profit nor protect against loss in declining markets. And because dollar cost averaging involves continuous investment in securities regardless of fluctuating price levels, you should consider your financial ability to continue your purchases throughout periods of market fluctuations.

Provided by Ed Wettig, CFP, Cornerstone Financial Planning Group, which offers investment management, financial planning and retirement income strategies. Representative is registered with and offers only securities and advisory services through PlanMember Securities Corporation, a registered broker/dealer, investment advisor and member FINRA/SIPC. 6187 Carpinteria Ave, Carpinteria, CA 93013, 800-874-6910. Cornerstone Financial Planning Group and PlanMember Securities Corporation are independently owned and operated. PlanMember is not responsible or liable for ancillary products or services offered by Cornerstone Financial Planning Group or this representative.