For the 2020 tax year, individual investors can contribute up to $6,000 to either a traditional or Roth IRA. If you’re age 50 or older, you can contribute an extra $1,000. I wanted to remind you so that you can take full advantage of your ability to save toward retirement. Contributing as much as you can as early as possible allows those assets more time to potentially grow and compound. Keep in mind that contributions generally must be made before you file your tax return in April.

You may also contribute up to $19,500 to applicable 401(k), 403(b) and 457 plans, SAR-SEP plans and the federal government’s Thrift Savings Plan. The catch-up contribution limit for individuals age 50 or older increased to $6,500. Employee contributions to qualified plans generally must be made by December 31.

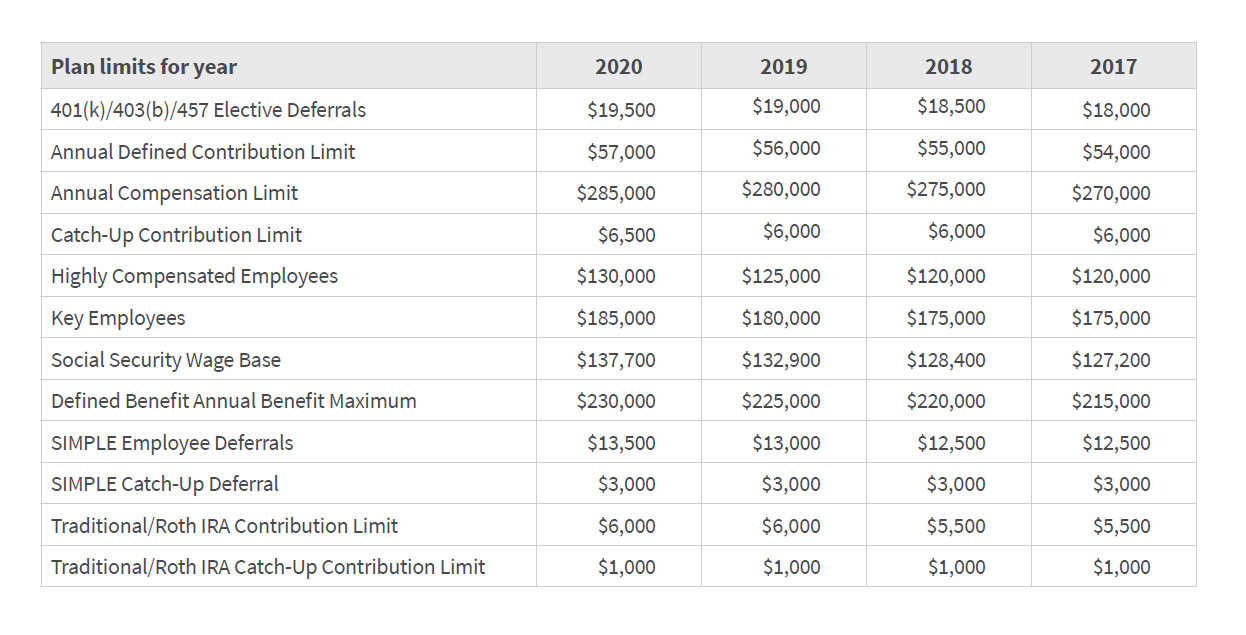

Review the Plan Limits below for 2019 & 2020 Contribution limits.

Chart Courtesy of Clay Trenz

clay.trenz@acuitywealthadvisors.com • acuitywealthadvisors.com