It’s always terrible when you get misinformation about something, especially if it’s finance related. In regards to your mortgage, the ramifications of doing something wrong unintentionally because you were misinformed can be dreadful. But there are things that you can do to handle this problem, take a look below at what you can do if you’ve been misinformed about your mortgage sale or if you’re at risk of negative equity.

Whose Fault Is It?

In cases like this, most of the blame should be directed at the financial advisor or bank representative who has given you misinformation or bad financial advice. The possible risks were not explained to you in a clear way or not at all, or you were not given the information you needed and ended up with a mis sold mortgage situation on your hands. Although it might be a headache, you should have had a second and third opinion about matters like this. Even if it were from your family members who have dealt with this sort of thing for years and could have told you what’s best for your situation. Overall, don’t be too hard on yourself and you should know that it’s mostly the advisor’s fault.

How It Could Have Happened

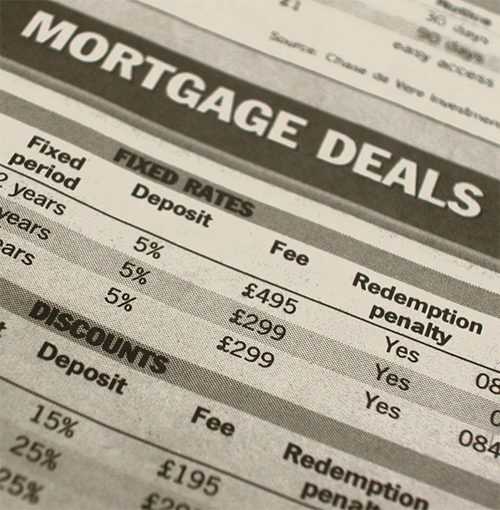

There are several ways that you could have been mis-sold your mortgage. It’s possible that you were told to borrow money in order to self-certify, but did so without proving your own income. This is bad because overstating your income means that you would borrow more and have a ton of debt that you simply cannot pay back. Or maybe the deal was made in a way that the mortgage end date is way past the date of your retirement. Evidently, this is a terrible situation because if the advisors didn’t discuss this with you, and they didn’t take into consideration your retirement plan, it’s possible that you might not be able to continue paying. Another way of misleading you is that the advisors didn’t disclose the fact that they would be getting a hefty commission from the lender, or not telling you about the big penalty fees of switching lenders as well. And speaking of penalties, if the advisor didn’t tell you about the fees you would pay when you remortgage to a different and better one, then that’s a huge red flag also.

What You Can Do

Whichever the reason that might have happened to you, it is possible to file for a claim to stop this and save you from a disastrous situation. You need to act quickly on this and not waste any time, you should start by complaining to your bank or the financial advising company that you had dealings with. You need to gather all the information you have about all the meetings and advice that you’ve been given and if dates are available, that would help you in the long run. You need to be clear and give out all the facts you can to help with your case. If your advisors won’t help fix this then you should start finding a public advocate or official to investigate this matter thoroughly, state officials can help greatly and could get you a nice claim to compensate for all the damages that happened. These investigators will advise you well and would tell you if this needs to be taken to court or not. But hopefully, they can deal with it without resorting to unwanted legal battles because these cases can get very expensive.

Protect Yourself And Always Ask Plenty Of Questions

This is a terrible situation to be in, but just remember to ask about everything; the ins and outs of the entire plan and deals. Make sure you have your bases covered, and that you aren’t being misinformed. Have hope, there’s always a way around solving your mortgage problems.