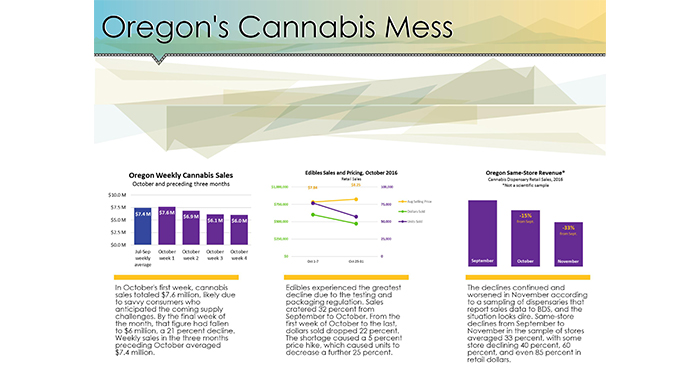

(Graph above courtesy of BDS Analytics, the cannabis industry’s No. 1 source for market research and data analytics)

BDS Analytics say dispensary sales tanked after regulations took effect October 1 — situation appears even worse during November.

Oregon’s implementation of testing and packaging rules have created significant problems for dispensaries and brands, as state agencies struggle to complete testing of products and the stringent rules make it increasingly difficult for brands to achieve full compliance in a timely manner according to BDS Analytics.

An analysis of retail sales by BDS Analytics since the rules took effect shows dramatic drops in sales in many dispensaries and overall declines that “threaten the economic health of businesses in the short-term.”

Among the findings:

-Dispensary sales declined 8.5 percent to $29.5 million in October compared to September.

-Sales decline makes October the worst-performing month since May.

-Same-store declines between September and November average 21 percent.

-Edibles sales in particular cratered, down 32 percent between September and October

Implementing the New Oregon Cannabis

Rules Has Been Bad for Business

-When Oregon implemented more stringent testing and packaging regulations for its nascent cannabis market on October 1, many in the industry speculated that the new rules would have a negative impact on the market. Now, with the availability of BDS Analytics’ detailed data for the month of October, we can objectively review the effect. Unfortunately, the numbers show that those pessimistic predictions were accurate.

-Oregon dispensaries’ cannabis sales dropped 8.5 percent from September to October, to $29.5 million, the first time the market fell below $30 million since May. (Sales spiked to $31.5 million in -June when adult-use dispensaries began selling concentrates and edibles, and averaged $32.6 million per month July through September.)

-As disappointing as this news is, it’s not the worst of it. A more detailed look at weekly sales in October reveals a disturbing pattern: sales trended downward as October progressed. In October’s first week, cannabis sales totaled $7.6 million. By the final week of the month, that figure had fallen to $6.0 million, a 21-percent decline. Weekly sales in the three months preceding October averaged $7.4 million.

-Sales in the first week of October increased over the preceding three-month weekly average, likely because savvy consumers anticipated the coming supply challenges. But as the month wore on, the

Implementing the New Oregon Cannabis

Rules Has Been Bad for Business

-Data show a clear decline as dispensary supply diminished through October.

-The declines continued and worsened in November according to a subset of dispensaries that report sales data to BDS. Same-store declines from September to November averaged 21 percent, with some stores declining more than 60 percent in retail dollars.

-The greatest October declines occurred in the edibles category, which cratered 32 percent from $3 million in September to $2 million in October, the lowest level since adult-use stores began selling the category in June. September’s number was an all-time high for edibles, which was the category that endured the greatest challenges after October 1 due to more frequent and more expensive testing being required throughout the supply chain.

-As with the overall market, edibles sales declined steadily as October progressed, with dollars sold dropping 22 percent from the first week to the final week. As supply diminished throughout the month, prices rose 5 percent, so units declined even more than dollars did, dropping 25 percent.

-Concentrates saw a similar price effect from October’s first to final week: Aver-age selling price rose 6 percent and the de-cline in units, at 23 percent, exceeded the 18-percent de-cline in dollars sold.

-It is clear from these data that Oregon’s new rules have had a major impact on re-tail cannabis sales and on the viability of businesses across the industry. New temporary rules designed to ameliorate testing challenges will help, but they may have come too late for some businesses.

BDS Analytics: Relying upon powerful technologies, partnerships with cannabis companies and a team of data and business veterans, BDS Analytics provides the cannabis industry with data analysis and market research. The consumer research division answers important questions about consumers and consumer behavior for industry stakeholders. And for most companies competing in the blossoming world of commercial cannabis, BDS Analytics’ GreenEdge service offers vital business information — essential intelligence for marketplace success.

http://www.bdsanalytics.com