Notice 1: Implementation of Modifications to the 7(a) Loan Program in the Economic Aid to Hard-Hit Small Businesses, Nonprofits and Venues Act

On December 27, 2020, the Economic Aid to Hard-Hit Small Businesses, Nonprofits and Venues Act (Economic Aid Act) (P.L. 116-260) was signed into law. The purpose of this Notice is to inform SBA employees and 7(a) Lenders of modifications to the 7(a) Loan Program contained in the Economic Aid Act, including temporary higher guaranty percentages and fee reductions on eligible 7(a) loans, and an increase in the maximum SBA Express loan amount.

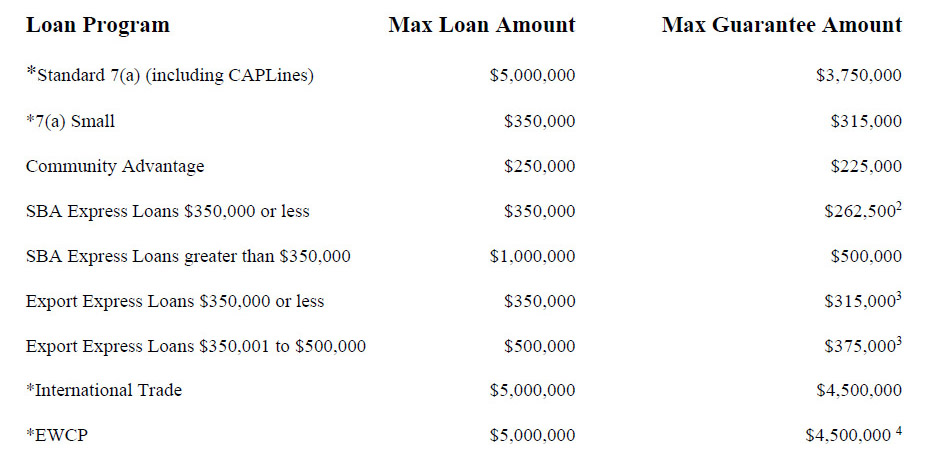

Modifications to 7(a) Loan Program Guaranty Percentages and Maximum SBA Express Loan Amount (Section 326 of the Economic Aid Act)

1. For Standard 7(a) Loans, 7(a) Small Loans, CAPLines, Preferred Lender Program (PLP) Loans, and Community Advantage Pilot Program Loans (Community Advantage):

Effective December 27, 2020, and through September 30, 2021, SBA participation (i.e., the guaranty percentage provided by SBA) is increased to 90 percent. (See discussion below on Guaranty Percentages and Loan Amounts for effective guaranty rates for loans once SBA reaches the statutory limit for total guaranteed loan amount to a borrower.) On October 1, 2021, the guaranty percentages will automatically revert to previous levels.

2. For SBA Express Loans:

a. Maximum Loan Amount: The current $1,000,000 maximum loan amount provided forin section 1102(c) of the Coronavirus Aid, Relief, and Economic Security Act (Pub. L. 116- 136) will be extended through September 30, 2021. On October 1, 2021, the maximum loan amount will permanently change to $500,000.

b. Guaranty Percentage:

i. Loans of $350,000 or less: Effective December 27, 2020, and through September 30, 2021, the maximum SBA guaranty percentage is increased from 50 percent to 75 percent. On October 1, 2021, the maximum guaranty percentage will automatically revert to 50 percent.

ii. Loans greater than $350,000: The maximum SBA guaranty percentage remains at 50 percent.

Guaranty Percentages and Loan Amounts

The Economic Aid Act did not increase the statutory aggregate amount of the SBA portions of all loans to a single borrower (including affiliates as defined in 13 CFR § 121.301(f)), which is $3,750,000.(1) Once the maximum level of participation of $3,750,000 is reached for 7(a) loans (except for EWCP and IT loans), the guaranty percentage must be reduced to ensure this maximum level of participation is not exceeded. For example (except for EWCP and IT loans):

1. In order to receive a 90 percent guaranty, the maximum loan amount cannot exceed $4,166,666 ($3,750,000 divided by 90 percent).

2. In order to determine the guaranty percentage when the total loan amount to one borrower (including affiliates) is greater than $4,166,666, the maximum guaranty will be calculated by dividing $3,750,000 (SBA guaranteed amount) by the loan amount, and then rounding down to the second decimal. For example, if the loan amount is $4,500,000, then the guaranty percentage would be $3,750,000 divided by $4,500,000, which equals 83.3333 percent, rounded down to 83.33 percent.

*Delegated (PLP) and non-delegated

3. The E-Tran system will automatically make guaranty and fee adjustments retroactively for 7(a) loans approved on or after December 27, 2020. Additionally, SBA will rebate the ongoing annual fees and upfront guaranty fees that have been received for those loans approved on or after December 27, 2020, to be applied as follows:

a) If a lender paid the upfront guaranty fee from the borrower’s 7(a) loan proceeds, the funds rebated by SBA shall be deemed to have been approved for working capital and shall be disbursed to the borrower for that purpose within 10 business days of receipt by the lender and the lender must retain documentation of the disbursement in its loan file.

b) If a borrower paid the lender the upfront guaranty fee from funds other than loan proceeds, the Lender must pay the funds rebated by SBA to the borrower within 10 business days of receipt by the lender and the lender must retain documentation of the payment in its loan file.

4. For a 7(a) loan that was made on or after December 27, 2020 and prior to this Notice, and that will not be sold in the Secondary Market, no action is required by the lender to modify the guaranty percentage or fees in the Loan Authorization.

For a 7(a) loan that was made on or after December 27, 2020 and prior to this Notice, and that will be sold in the Secondary Market, the lender must modify the Loan Authorization in accordance with the procedures set forth in SOP 50 10.

Temporary Fee Reductions (Section 327 of the Economic Aid Act)

Subject to the availability of funds, beginning December 27, 2020, through September 30, 2021, for all 7(a) loans (including Community Advantage loans) for which an application is approved:

- The SBA Guaranty Fee (Upfront Fee) is reduced to zero (including the guarantee fee of one-quarter (1⁄4) of one percent of the guaranteed portion of a loan with a maturity of twelve (12) months or less); and

- The Lender’s Annual Service Fee (SBA On-Going Guaranty Fee) is reduced to zero.

Because the Economic Aid Act provides that the fee reductions are available to the extent that the costs of such reductions are offset by appropriations, SBA will monitor available appropriations and will provide updated guidance on 7(a) fee reductions as necessary.

Lenders are not permitted to cancel any 7(a) loan that was approved but not disbursed prior to December 27, 2020, for the purpose of re-submitting the loan in order to qualify for the temporary fee relief provided in the Economic Aid Act.

Questions

Questions concerning this Notice may be directed to the Lender Relations Specialist in the local SBA Field Office, which can be found at https://www.sba.gov/tools/local-assistance/districtoffices.

John A. Miller

Acting Associate Administrator

Office of Capital Access

1) Section 7(a)(3)(A) of the Small Business Act limits the total amount outstanding and committed (by participation or otherwise) to a single borrower (including affiliates) to $3,750,000, except as provided for Export Working Capital Program (EWCP) and International Trade (IT) loans.

2) Through September 30, 2021. Effective October 1, 2021, the maximum SBA Express Loan guaranty limit reverts back to 50 percent, and the maximum SBA Express loan amount will be reduced from $1,000,000 to $500,000.

3) The Economic Aid Act did not change the maximum guaranty percentages for Export Express loans set forth in 7(a)(34)(C) of the Small Business Act, which are 90% for loans of $350,000 or less and 75% for loans of $350,001 up to and including $500,000.

4) Of which not more than $4,000,000 may be used for working capital, supplies, or financings under section 7(a)(14) of the Small Business Act (EWCP) for export purposes.

Notice 2: Elimination of Certain 504 Loan Program Fees as Authorized by the Economic Aid to Hard-Hit Small Businesses, Nonprofits and Venues Act

The purpose of this Notice is to announce the temporary elimination of certain 504 fees in accordance with Section 327(b) of the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act (Economic Aid Act), enacted December 27, 2020. With respect to each 504 Project for which an application is approved beginning on December 27, 2020 and ending on September 30, 2021, the following 504 fees are eliminated to the extent the cost of such elimination in fees is offset by appropriations:

- The Third Party Lender participation fee paid by the Third Party Lender under section 503(d)(2) of the Small Business Investment Act of 1958 (15 U.S.C. 697(d)(2)) (see also 13 CFR 120.972(a)); and

- The CDC processing fee charged to the Borrower under 13 CFR 120.971(a)(1).

Both fees are eliminated only to the extent the cost of such elimination in fees is offset by appropriations and, consequently, the fees will be eliminated only for so long as appropriations remain available. SBA will provide updated guidance on the availability of appropriations for the elimination of these 504 fees as necessary.

SBA Will Reimburse CDCs for the Waived CDC Processing Fees

To the extent that the cost of such payment is offset by appropriations, SBA will reimburse each CDC that does not collect the processing fee from the Borrower in an amount equal to 1.5 percent of the net debenture proceeds. SBA will reimburse the CDC with two-thirds of the 1.5% (i.e., 1%) at the time of loan approval by SBA or, for CDCs with delegated authority to approve a loan under the Premier Certified Lenders Program or the ALP Express Loan Program authorized under Section 328(b) of the Economic Aid Act, upon SBA’s issuance of a loan number. The remaining amount owed to equal 1.5% of the net debenture proceeds will be paid to the CDC immediately following debenture funding.

If a Borrower has already paid any portion of the processing fee to a CDC for a 504 loan that was approved on or after December 27, 2020, the CDC must fully reimburse the Borrower within 10 business days of the CDC’s receipt of the fee from SBA and the CDC must retain documentation of the payment in its loan file.

In addition, if the Third Party Lender has already remitted the Third Party Lender participation fee to SBA for a 504 loan for which appropriations are available to offset the cost of the fee, SBA will refund the fee to the Third Party Lender.

CDCs do not need to request that Loan Authorizations executed on or after December 27, 2020 be modified to reflect the fee eliminations addressed in this Notice. SBA will reflect the appropriate fee relief in E-Tran. Accordingly, CDCs should not submit Loan Authorization modification requests to the SBA Sacramento Loan Processing Center (SLPC) solely to reflect the fee elimination. SLPC will not take any action on such requests.

CDCs are not permitted to cancel loans approved prior to December 27, 2020 and resubmit them in order for the loan to qualify for the temporary fee relief described in this Notice.

Questions

Questions concerning this Notice may be directed to the Lender Relations Specialist in the local SBA Field Office, which can be found at https://www.sba.gov/tools/local-assistance/districtoffices.

John A. Miller

Acting Associate Administrator

Office of Capital Access