There seem to always be pundits claiming that we’re in recession already. How could we be in recession and not know it? What do the data show about a possible recession right now? And what is the track record of those who make the claim?

Two time lags create uncertainty about whether we are in a recession now. Data on the economy invariably come out with a time lag. As I write, in mid-January, we know almost nothing about January except what we see in financial markets. We just got December employment data, which will be revised next month. Fourth quarter GDP is weeks away from release—and that’s not data for now, it’s data for last quarter. So nobody can prove or disprove a claim that we are now in recession.

The second time lag is evaluation of whether the data constitute a recession. That’s not as easy as it sounds. What do we say if employment and personal income are up, but industrial production and business sales are down? That happens to be the case right now. A recession is when weakness is widespread. A dynamic economy always has some sectors softening while others expand.

He recognized arbiter of recessions in the U.S. is the Business Cycle Dating Committee of the nonprofit, non-governmental National Bureau of Economic Research. The committee makes business cycle judgments to help academic researchers, not to help current investors or business managers. They are what I call forecast agnostic. They don’t look at two months of data and assume that they know what the next month will look like. Instead, in a weakening economy they ask themselves, “If the next data reports were very positive, would we declare the recent period a recession?”

That question prevents them from crying recession after every little blip down. Similarly, when we are in recession but getting some good news, they ask how they would treat the current rebound if future data came in negative; would that be a new recession or a continuation of the old recession?

Judgment is required, and the committee members are human, so don’t expect perfection. On the positive side, they apply a decision criteria consistently over a 162-year time period. Their decisions are free from political influence, and the decisions seem to me to be unbiased.

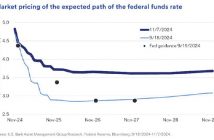

What do today’s data show? Four coincident indicators play a large role in the committee’s decisions. The chart shows the most recent data available as of January 11. It’s certainly not clear that we were in recession in November, but two of the four indicators have declined in recent months.

Because I hear others say that we are already in recession, I’m going to start compiling reports. The first appears on my Businomics blog and I’ll update it monthly.

I do not believe that we are now in recession — but nobody has data on that question.

Bill Conerly advise businesses on business strategies, finance and economics and speaks frequently on these subjects.

Be Skeptical of The Pundits Crying That We Are in Recession Already

0

Share.