(Table | Courtesy of ASI Wealth Management)

Financial markets continue their upward march and we continue to see record highs for stocks and very low yields for bonds. While COVID-19 also continues to be a challenge in many parts of the world, progress is being made around the globe. Unemployment rates continue to improve, but we have a long way to go to get back to the pre-COVID levels of less than five percent.

Given the uncertainty of our economy, overlayed with ongoing coronavirus concerns and a proposed tax law overhaul, what could possibly be coming next? More new highs for stocks? A correction in stock prices? Higher inflation? Interest rate increases?

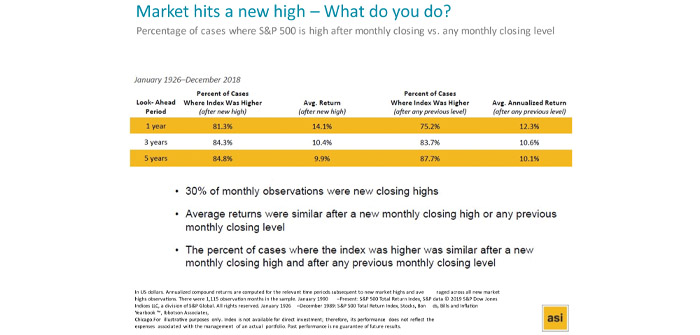

I have a crystal ball sitting on my desk. It was a gift from the ASI team at our ten-year anniversary. Unfortunately, I cannot seem to get it to work. I occasionally reach over and dust it off, but nothing. Luckily, we can look to history to help guide us towards wise decisions that will impact our future. The table below sheds some light on how markets have performed after reaching record highs and compares them to all other periods. The majority of the time, markets have gone up in value over one-, three- and five-year periods, regardless of whether they are coming off a new high or not.

So, if we cannot predict the future, what should investors do in times of such uncertainty? We counsel our clients to stay disciplined and diversified. Continue to talk to your financial advisor to understand why you are taking the risks in your portfolio and what the long-term plan is. Trust your advisor to take advantage of market volatility by rebalancing, both when stocks are up and when stocks are down. We love buying stocks when they are on sale!

So, what else should we be doing? This is a perfect time to revisit your cash reserves and replenish or increase them as needed. It also may make sense to look at pulling out cash for vacation plans, a house remodel, a new house, new car, boat or any other quality-of-life desires.

Stock market corrections, while not predictable as to when exactly, happen frequently. Stocks frequently sell off over 10 percent, 15 percent and 20 percent. This is precisely why it makes sense to revisit cash needs when markets are at all-time highs as well as systematically rebalancing portfolios as stocks rise over time. We know there will be a correction at some point, we just do not know the timing, duration or magnitude.

Who would have predicted the coronavirus would still be infecting people in all regions of the world, yet investment returns would be overwhelmingly positive! Although there are still many challenges ahead of us, in most cases they are challenges that investors have constantly faced: taxes, interest rates, budget deficits, national debt and policy.

The principal owner of ASI Wealth Management, Randy Miller helps clients make smart money decisions so they can live the life of their dreams and help others do the same.