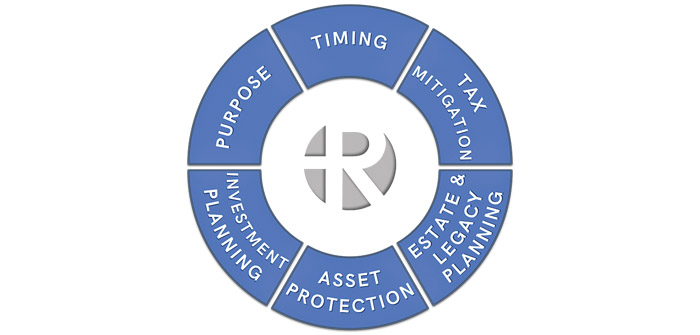

(Graphic courtesy of Rosell Wealth Management)

Just as we prepare for the impending Central Oregon winter by setting our clocks back, chopping firewood, winterizing irrigation systems, changing to winter tires, and securing our Mt Bachelor ski passes, planning for the future sale of your company well in advance shares a common thread of foresight and preparedness.

Selling a business is often one of the most significant financial transactions in an entrepreneur’s life. However, it’s astonishing to note that only 6% of business owners plan for the sale of their company more than two years in advance¹. For most, it becomes a fire sale with little planning, resulting in a substantial financial hit, including paying Uncle Sam much more than necessary. In this article, we will delve into the concept of the “6% Advantage” and explore the six critical risks that every business owner should navigate when selling their company.

The 6% Advantage highlights the small fraction of business owners who take proactive steps to plan their business exit strategy well in advance. These individuals maximize their returns, minimize tax liabilities, and ensure a smoother transition into retirement or their next venture. For the remaining 94%, more planning should be considered to avoid unnecessary financial losses and increased stress during the sale process.

Navigating the 6 Critical Risks

- Timing: Timing is crucial when selling your company, particularly in the pre-Letter of Intent (LOI) phase. This period presents a unique window of opportunity to implement strategic actions that can significantly impact the outcome of the sale. Discounting is one of numerous strategies that must be done in the very early stages. Obtaining a discount on a business valuation due to making a portion of the shares non-voting shares can be a savvy tax-saving strategy. This discount, often called a “lack of control” or “minority interest” discount, recognizes that non-voting shares typically carry fewer rights and less influence over corporate decisions than voting shares. As a result, potential buyers and appraisers perceive these non-voting shares as less valuable. The tax-saving advantage arises because the IRS and tax authorities generally allow for discounts on the business’s overall value when calculating estate and gift taxes. If you plan to pass on or sell a portion of your business through non-voting shares, the discounted value may reduce the tax liability associated with the transfer. It’s important to note that the specific rules and regulations governing these discounts can vary by jurisdiction and change over time, so it’s crucial to consult with a well-versed tax professional in these matters.

- Tax Mitigation: One of the most significant risks during a business sale is the potential tax burden. Careful tax planning can help business owners reduce their tax liabilities and retain more proceeds. Strategies such as structuring the sale as an installment sale or utilizing tax-efficient structures can make a substantial difference. Tax mitigation often goes hand in hand with Philanthropy and Legacy planning, which is the subsequent risk. There are two different types of philanthropy: voluntary and involuntary. Voluntary philanthropy is when you choose who receives your money, often nonprofit organizations near and dear to your heart. Involuntary philanthropy is when Uncle Sam taxes you in the form of income tax, capital gains tax after selling your company, and once you have died in the form of estate tax.

- Legacy & Estate Planning: Selling a business often has significant implications for your estate and legacy. Business owners should consider how the sale will impact their heirs and beneficiaries. Proper estate planning can minimize estate taxes and ensure a smooth wealth transition to the next generation. Strategies such as Charitable Remainder Trusts, Grantor Trusts, and Donor Advised Funds are often effective. A remarkable surge in wealth transfer is underway, and it’s not exclusive to the extremely wealthy. We are presented with an exceptional opportunity to execute tax-free transfers. In 2017, the Trump tax cuts temporarily doubled the threshold for individuals to give away assets without incurring estate taxes, raising it to $10 million. However, these tax cuts are set to expire in 2026, prompting affluent individuals to take swift action. For 2023, the combined exemption for gift and estate taxes stands at $12.92 million for individuals and $25.84 million for married couples — allowing this amount to be transferred without tax implications during one’s lifetime or at the time of death. These numbers are scheduled to drop by half in 2026 to around $7 million. This impending reduction signifies that 2026 is the final opportunity to leverage these historically high exemption levels before they expire on December 31, 2025.

- Asset Protection: Protecting your assets during the sale process is crucial. With proper safeguards, you avoid losing hard-earned wealth to unforeseen liabilities. Implementing asset protection strategies well in advance can shield your assets and reduce exposure to potential lawsuits. An example would be having 7 rental properties under their own LLC versus all seven properties under one LLC.

- Investment Planning: Many business owners initially focus on investing their sale proceeds but must pay more attention to the abovementioned risks. In this order, I suggest focusing on the essential process of creating a comprehensive investment plan. Effective investment planning should align with your financial goals, risk tolerance, and time horizon, ensuring your wealth continues to grow post-sale. Tax Loss Harvesting can mitigate capital gains taxes in your non-qualified accounts where your business sales proceeds often get invested.

- Purpose in Retirement: Lastly, having a clear sense of purpose in retirement is often underestimated. People often know what they’re retiring from yet often need more clarity of what they are retiring into. Your spouse or partner often did not sign up for you 24-7 in your home! Retirement comes from the Latin word retirer, which means to end or be put out of use. None of us want to be put out of service! Beyond the financial aspects, consider what you want to achieve in retirement and how your sale proceeds can support those goals. A well-defined purpose can lead to a more fulfilling post-business life.

The 6% Advantage illustrates the importance of planning for the sale of your business well in advance. By addressing the six critical risks of Timing, Tax Mitigation, Legacy & Estate Planning, Asset Protection, Investment Planning, and Purpose in Retirement, business owners can navigate the sale process with confidence and maximize their financial gains. Please don’t wait until it’s too late. Start planning for your business sale today, and you’ll be in the elite 6% who can genuinely enjoy the fruits of their labor without unnecessary financial setbacks. Remember, your business exit should be a well-orchestrated symphony, not a fire sale with missed opportunities. If you’re looking to sell your company in the next one to five years, feel free to reach out with any questions you may have and as you set your clocks back, chop firewood, winterize your irrigation systems, change to winter tires, and secure your ski passes, remember that planning will enable you to navigate your business sale with confidence and foresight.

¹City National Rochdale

David Rosell is president of Rosell Wealth Management in Bend. RosellWealthManagement.com. He is the host of Recession-Proof Your Retirement Podcast and author of three books: Failure is Not an Option-Creating Certainty in the Uncertainty of Retirement, Keep Climbing- A Millennial’s Guide to Financial Planning and In The Know-Turning Your Unneeded Life Insurance Policy Into Serious Cash. Find David’s books at local bookstores, Amazon, Audible, and the Redmond Airport. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. The services of an appropriate professional should be sought regarding your individual situation. Investment advisory services offered through Valmark Advisers, Inc. an SEC Registered Investment Advisor Securities offered through Valmark Securities, Inc. Member FINRA, SIPC 130 Springside Drive, Ste. 300 Akron, Ohio 44333-2431. 800-765-5201. Rosell Wealth Management is a separate entity from Valmark Securities, Inc. and Valmark Advisers, Inc.