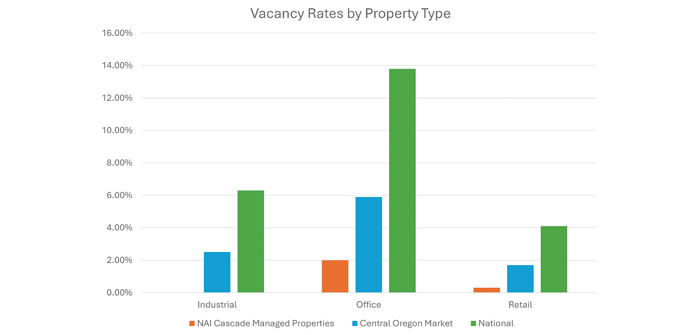

(Vacancy Rates by Property Type | Graph courtesy of NAI Cascade)

Perspectives from Management Professionals

Commercial property management ensures the ongoing value of a leased property through financial management, physical asset management and tenant relations and retention. Trish Parkes, LPM, senior property manager at NAI Cascade has more than 20 years of commercial real estate experience in Central Oregon. Her longevity in the market allows her the ability to accurately gauge market headwinds without rocking the boat over minor fluctuations.

Parkes weighed in on the current conditions in Central Oregon:

What are current vacancy rates in Central Oregon?

A notable trend is the increasing inquiries from tenants about subleasing their spaces—a telltale sign of economic cycles at play. While vacancy rates remain low compared to national averages, the fact that tenants are exploring alternative options hints at a potential shift towards a tougher market. Periphery uses such as boutique retail, specialty fitness centers, and coffee shops are among the businesses seeking to sublease their premises.

From a brokerage perspective, subleased spaces are turning over swiftly due to low inventory, particularly in the retail sector. Parkes coins this the “I have a better dream” philosophy. With Central Oregon’s relatively high median income, there is always someone with a dream and capital.

Owners are wary of those uses that aren’t considered recession-proof though. As part of the due diligence process before placing a tenant, some property owners are requiring 12-18 month reserves, recognizing the importance of financial preparedness in uncertain times.

How have lease rates evolved over the last year?

Rates were on a healthy incline that is starting to see more of a plateau. With low vacancy, rates should remain fairly steady. The vertical which has experienced the most cooling is office outside of the downtown areas of Bend and Redmond. “As a resident of Redmond, I think Chuck Arnold has done a great job in the downtown corridor of Redmond,” says Parkes. “But so much of the office is outside of that core.”

Medical rates have also evened where they had previously been on a rapid rise. It remains to be seen if the massive increase in Bend’s SDC costs will dampen medical development and revert existing space rates to their steady upward trajectory.

What are tenants asking for right now?

Tenants are requesting rent abatements rather than tenant improvement allowances. Owners are reluctant to deploy capital for “I have a better dream.” Tenants are paying for their own TIs but owners are granting 30-90 days of abated rent to get the work done.

What factors are affecting CAMs/NNN charges?

Property insurance increases are the top line item for increased expenses. Some insurance premiums have more than doubled and a 25% increase is considered bearable. Older properties with deferred maintenance are deemed uninsurable as insurers aren’t willing to risk replacement costs.

Property managers are working with the owners to keep expenses as low as possible, weighing the cost of apathy against the cost of tenant turnover.

What is the secret sauce for maximizing occupancy rates and minimizing vacancy?

Parkes’ philosophy has been and always will be, to be proactive. NAI Cascade’s property managers spend a minimum of 50% of their work week on-site to familiarize themselves with the tenants and properties. Parkes cites, “If tenants know our faces, we can have informal, positive relationships during good times which makes it easier to have the conversations during hard times. Tenants let us know ahead of time where they are so we’re able to prelease spaces before they sit vacant.”

Parkes’ outlook is cautiously optimistic. Uncertainties loom, especially in the lead-up to the significant political and social events surrounding the election. Non-commodity tenants on the periphery may face tougher times ahead, highlighting the need for vigilance and adaptability.

By staying attuned to market trends, maintaining strong tenant relationships, and implementing sound financial practices, NAI Cascade will continue to navigate the challenges and seize opportunities in the evolving landscape.