If you’re considering the purchase of an individual bond or even a bond mutual fund, one of your first concerns will be its yield. However, when comparing various yields, you need to make sure you’re not comparing apples to oranges. The yield on a tax-free bond may be lower than that paid by a taxable bond, but you’ll need to look at its tax-equivalent yield to compare them accurately.

What’s taxable? What’s not?

The interest on corporate bonds is taxable by local, state, and federal governments. However, interest on bonds issued by state and local governments (generically called municipal bonds, or munis) generally is exempt from federal income tax. If you live in the state in which a specific muni is issued, it may be tax free at the state or local level as well.

Unlike munis, the income from Treasury securities, which are issued by the U.S. government, is exempt from state and local taxes but not from federal taxes. The general principle is that federal and state/local governments can impose taxes on their own level, but not at the other level; for example, states can tax securities of other states but not those of the federal government, and vice versa.

The impact of freedom from taxes

In order to attract investors, taxable bonds typically pay a higher interest rate than tax-exempt bonds. Why? Because of governmental bodies’ taxing authority, investors often consider munis safer than corporate bonds and are more likely to accept a lower yield. Even more important is the associated tax exemption, which can account for a difference of several percentage points between a corporate bond’s coupon rate–the annual percentage rate it pays bondholders–and that of a muni with an identical maturity period.

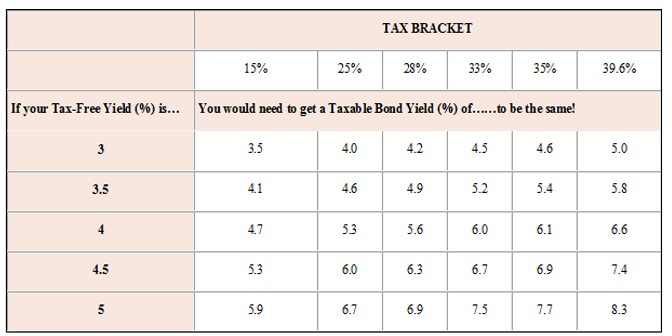

Still, depending on your tax bracket, a tax-free bond could actually provide a better net after-tax return. Generally, the higher your tax bracket, the higher the tax-equivalent yield of a muni bond will be.

It’s not what you get, it’s what you keep

To accurately evaluate how a tax-free bond compares to a taxable bond, you’ll need to look at its tax-equivalent yield. The tax-equivalent yield of a municipal bond is the yield of a taxable bond that is needed to deliver the same after-tax income. The table below shows the taxable equivalents of various tax-free yields for various tax brackets. To calculate the taxable equivalent of a tax-free yield, subtract your marginal tax rate from 1, then divide the tax-free yield by the result.

If a taxable bond also is subject to state and local taxes and the tax-exempt one isn’t, the tax-exempt bond’s coupon rate could be even lower and still provide a higher tax-equivalent yield.

Munis are tax free, except when they’re not

As is true of almost anything that’s related to taxes, munis can get complicated. A bond’s tax-exempt status applies only to the interest paid on the bond; any increases in the bond’s value are taxable if and when the bond is sold. You also may owe taxes when you sell shares of a muni bond mutual fund.

Also, specific munis may be subject to federal income tax, depending on how the issuer will use the proceeds. If a bond finances a project that offers a substantial benefit to private interests, it is taxable at the federal level unless specifically exempted. For example, a new football stadium may serve a public purpose locally but provide little benefit to federal taxpayers. As a result, a muni bond that finances it is considered a so-called private-purpose bond. Other public projects whose bonds may be federally taxable include housing, student loans, industrial development, and airports.

Even though such bonds are subject to federal tax, they still can have some advantages. For example, they may be exempt from state or local taxes. And you may find that yields on such taxable municipal bonds are closer to those of corporate bonds than they are to tax-free bonds.

Agencies and GSEs (government-sponsored enterprises) vary in their tax status. Interest paid by Ginnie Mae, Fannie Mae, and Freddie Mac is taxable at federal, state, and local levels. The bonds of other GSEs, such as the Federal Farm Credit Banks, Federal Home Loan Banksare subject to federal tax but exempt from state and local taxes. Before buying an agency bond, verify the issuer’s tax status.

Don’t forget the AMT

To even further complicate matters, the interest from private-purpose bonds may be specifically exempted from regular federal income tax, but still may be considered when calculating whether the alternative minimum tax (AMT) applies to you. A financial professional can determine the likelihood that a bond will affect your AMT liability.

Pay attention to muni bond funds

Just because you’ve invested in a municipal bond fund doesn’t mean the income you receive is automatically tax free. Some muni funds invest in both public-purpose and private-purpose munis. Those that do must disclose on their yearly 1099 forms how much of the tax-free interest they pay is subject to AMT.

Note: Before investing in a mutual fund, carefully consider its investment objectives, risks, fees, and expenses, which are in the prospectus available from the fund; read it carefully before investing.

Use your tax advantage where it counts

Be careful not to make a mistake that is common among people who invest through a tax-deferred account, such as an IRA. Because those accounts automatically provide a tax advantage, you receive no additional benefit by investing in tax-free bonds within them. By doing so, you may be needlessly forgoing a higher yield from a taxable bond. Tax-free munis are best held in taxable accounts.

Provided by Ed Wettig, CFP, Wettig Capital Management which offers investment management, financial planning and retirement income strategies. Securities and investment advisory services offered through Royal Alliance Associates, Inc. Member FINRA/SIPC and a Registered Investment Advisor. Wettig Capital Management is independent of Royal Alliance Associates, Inc. and not registered as a broker/dealer or investment advisor.

Ed Wettig, CFP

Financial Advisor

Wettig Capital Management

1051 NW Bond Street, Ste. 210

Bend, OR 97701

541-706-9336

ed@wettigcapital.com

www.wettigcapital.com