(Graph | Courtesy of Rosell Wealth Management)

Last week, I had the opportunity to address the business class at Bend Tech Academy at Marshall High School. I am always impressed with how this school proactively connects their students with local community partners and employers to offer them a variety of learning resources, high engagement experiences and opportunities to build lasting relationships.

I feel strongly that one of the keys to creating a brighter financial future for our nation is to have financially knowledgeable kids. Most schools do not teach our children the lessons of financial responsibility, or even simple lessons about compound interest and the difference between working for money and having money work for them. I’m always charged with excitement when I witness students learn a few basic lessons that can ultimately change their financial futures.

Of the many theories, formulas and principles that Albert Einstein studied, I find the most interesting revelation is his statement: Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it. In this day and age, ignorance of compound interest is dangerous, especially with those looming credit card bills and student loans. For this reason, I always feature this topic in my annual presentations to Bend Tech and inform students on the importance of earning compound interest rather than paying it.

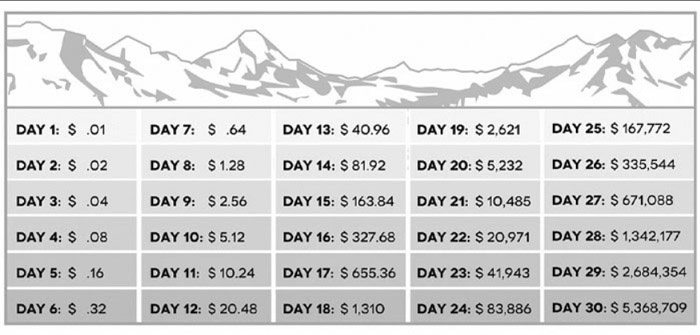

So, what is compound interest? Compound interest occurs when interest is added to the principal (your original investment), so that from that moment on, the interest that has been added also earns interest. This addition of interest to the principal is called compounding. To help illustrate this powerful formula, I asked the class the question: If you were given a choice to receive one million dollars in one month or a penny doubled every day for 30 days, which one would you choose? At first glance, almost everyone in the class chose the million dollars. I then shared with them the alternative:

They were astonished as they saw in front of their eyes the remarkable effect of receiving over five million dollars with a penny doubled every day for 30 days. This is the power of compounding! If one had missed the last five days, they would have ended up with only $335,544 instead of $5,368,709. This is when I shared with them how imperative it is to start planning and investing early in life. Investing can be compared to NASA’s Perseverance rover that touched down on Mars recently. When it took off for outer space it used 80 percent of its fuel during takeoff and once it reached a certain point it flew smoothly with minimal consumption.

The moral of the story is that the students at Bend Tech now know that one doesn’t need to do anything extraordinary to accumulate a considerable savings over time. One just needs to do some ordinary things extraordinarily well. Saving ten percent of your income is not remarkable — doing so, over every pay period for 40 years, is. The tougher they are on themselves today, the easier life will be on them later, which is a lesson we can all benefit from.

David Rosell is president of Rosell Wealth Management in Bend. RosellWealthManagement.com. He is the creator of Recession-Proof Your Retirement Podcast and author of Failure is Not an Option — Creating Certainty in the Uncertainty of Retirement and Keep Climbing — A Millennial’s Guide to Financial Planning. Find David’s books on Audible and iBooks as well as Amazon.com

Investment advisory services offered through Valmark Advisers, Inc. an SEC Registered Investment Advisor Securities offered through Valmark Securities, Inc. Member FINRA, SIPC 130 Springside Drive, Ste 300 Akron, Ohio 44333-2431. (800) 765-5201. Rosell Wealth Management is a separate entity from Valmark Securities, Inc. and Valmark Advisers, Inc. All investing involves risk, including the possible loss of principal. The example given is hypothetical and for illustrative purposes. Actual results may vary from those illustrated.