Getting engaged is an exciting time in any couple’s life. But between the ring, the perfect proposal location, and starting to save for the big day, it can be an expensive endeavor. The ring is indeed an investment, but it’s also a fact that the average cost of a wedding in the United States is approximately $30,000.

However, just because it’s expensive, you can’t compromise on the most beautiful moment of your life. For many couples, personal loans are a strategic choice to help make their engagement dreams a financial reality.

The Financial Landscape of Modern Engagements

Over the last decade, engagement costs have steadily risen. According to recent surveys, the average cost of an engagement ring alone is approximately $5,500.

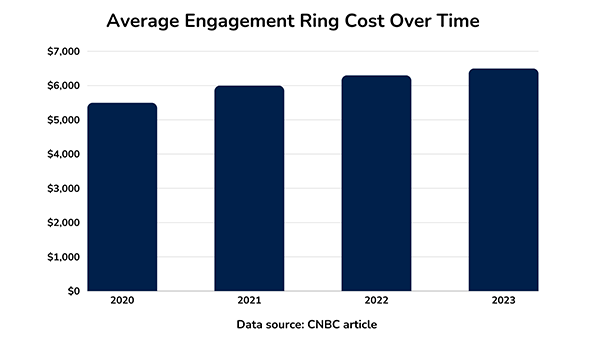

Take a look at the below chart for more clarity on engagement ring prices.

In addition to this, when you factor in expenses like travel, dinner, photography, and other elements to set the scene for the perfect, Instagram-worthy proposal moment, costs can easily exceed $10,000.

For couples starting their financial lives together, this can be a steep price to pay upfront. As a result, more and more couples are considering getting a personal loan specifically to cover engagement expenses. If you are a person with a good credit score for a personal loan, around 700 or higher, you will also get the advantage of the best interest rates possible.

Key Engagement Expense Statistics

- Average spent on an engagement ring: $5,500

- Average spent on travel/accommodations for proposing: $2,000+

- Average photography costs to capture the moment: $1500+

- Average dinner bills for proposal night: $500+

- Total average engagement costs: $10,000+

Considering these numbers, it’s no wonder that many choose to finance their engagements. A personal loan can help make managing these costs more feasible.

Personal Loans as a Strategic Choice

Using a personal loan as an engagement ring financing strategy offers several advantages:

- Fixed interest rates are usually lower than credit cards

- Option to spread repayment over multiple years

- Potential for better loan terms than high-interest retail financing

- It allows you to buy the ring you want instead of the ring you can just afford

Unlike emotional purchases made in the heat of the moment on a credit card, personal loans require research and planning. This makes them an intentional, responsible choice. Taking a strategic approach ensures you find the best loan for your engagement costs and your financial needs.

Below is a comparison of popular engagement financing options:

| Loan Type | Interest Rates | Repayment Timeline | Fees |

| Personal Loans | 5 – 36% | 1 – 7 years | Origination fees |

| Credit Cards | 14 – 30% typically | It depends on the minimum payment | Cash advance fees, annual fees, and penalties |

| Retail Financing | Usually, over 20% | Under 2 years, typically | Late fees, etc. |

Getting Preapproved for a Personal Loan

Before shopping for rings or proposing, first, take key steps to get preapproved for a personal loan:

- Check eligibility requirements like income, credit score, etc.

- Have needed documents ready for the application like paystubs, IDs, etc.

- Shop and compare rates from multiple quality lenders

- See if you prequalify with soft credit checks before formally applying

This upfront work will make securing financing faster and streamlier when the time comes to pop the question!

Navigating the Personal Loan Process

Once you decide that a loan is the right financing choice for your engagement, navigate the personal loan application process smoothly so that you meet eligibility requirements. Most lenders require a minimum credit score of 600+ along with steady income, a low debt-to-income ratio, and a history of on-time payments. Use online tools to check your eligibility before applying.

Next, research top lenders and compare interest rates, fees, loan amounts offered, and repayment timeline options. Weigh each carefully based on your budget and financial situation, avoiding those charging excess fees or requiring rigid repayment terms.

With research complete, submit a formal application with personal details, income verification, credit check authorization, and bank account information. Many lenders allow convenient online applications.

Before accepting the loan, ensure you fully understand the exact interest costs over the repayment period, including fees, consequences for late/missed payments, and any early repayment penalties. Read the fine print to avoid surprises. Taking these steps helps you find and manage the ideal personal loan for your special moment.

Personal Loan Documents & Application Process

When applying for a personal loan, having the right documentation ready streamlines the approval process.

Here are the key items needed:

Identification Documents

- Driver’s License or Other Valid ID

- Social Security Number

- Proof of Address (utility bill, etc.)

Income Verification Documents

- Pay Stubs

- Tax Returns

- Bank Account Statements

Credit Score Information

- Credit Report or authorization for the lender to pull a report

With these documents handy, the application process follows these typical steps:

- Compare interest rates and loan terms from top lenders

- Start the application online or in person with the chosen lender

- Provide the requested documentation from the above

- Get matched to the final loan offer based on eligibility

- Review and sign the loan contract if the offer is acceptable

- Receive the loan amount disbursed to the bank account on record

Following this process with prepared documents allows for a smooth, efficient loan application, resulting in quick financing for couples ready to take this next step together.

Having the right paperwork ready accelerates approval, allowing you to swiftly access funds for the perfect proposal. With documents in order and an organized application, securing financing to create lasting memories feels like a breeze!

Smart Financial Planning for Loan Repayment

An engagement loan allows you to buy the ring and create proposal memories comfortably. But repaying it responsibly is key to starting a marriage on strong financial footing.

Create a Repayment Plan

Factor your new loan payment into your monthly budget. Reduce discretionary spending if needed to accommodate this new fixed cost.

Also, discuss with your partner and agree on a repayment strategy. Communicating about finances early is vital!

Anticipate All Costs

An attractive low-interest rate only holds up if you avoid penalties and fees. So include these projections in your total repayment plan costs. Budgeting with a buffer room helps you withstand financial surprises that may otherwise trigger fees.

Balance Savings Goals Too

While redirecting repayment funds from discretionary categories, also keep steadily building emergency and other big-picture savings. This balance ensures you manage the personal loan responsibly without sacrificing your long-term financial health.

The Bigger Picture: Financial Foundation for Marriage

However you cover engagement stage costs, this chapter ushers in financial habits and communication patterns that lay the groundwork for every chapter henceforth.

- What expenses take priority, and how do you handle conflict over financial decisions?

- What role do partners play in managing day-to-day finances versus long-term planning?

- How much does financial independence versus interdependence suit your relationship?

The engagement period plants these seeds of aligned priorities and accountability that blossom into unified marital money management. While personalized loans offer a path to the perfect proposal now, ensure the decision sets you up for financial clarity, cooperation, and stability in the long run.

The First Step Together

Getting engaged marks an exciting turning point in any relationship. And the perfect ring and proposal should reflect what your love means. Personal loans offer a responsible way to fund this special moment, even if the budget currently falls short. But do your due diligence – assess options thoroughly and maximize financial health as you embark on a lifelong partnership together. The ideal ring symbolizes commitment in every sense, forging a strong foundation.

Frequently Asked Questions

Still, have some questions? Here are answers to some commonly asked questions about engagement financing.

1. Is it common to finance engagement rings with personal loans?

Yes – in fact, a growing number of couples use personal loans to cover costs beyond their current budget. With the average ring costing over $5,000, loans help ease the burden, especially for younger couples building careers.

2. What are the risks of personal loans for engagements?

The main risks borrowers run include racking up interest costs and overextending without the means to repay quickly. This can mean starting married life with debt as opposed to savings. But when used strategically, loans offer reasonable overall risks.

3. How do we decide on the loan amount?

Have an honest talk about your current financial situation, including income, debts, assets, and typical expenses. With strong insight into your combined status, decide the portion of total engagement costs loans can reasonably cover while allowing repayment on schedule without overreach.