Volatility Returns to the Stock Market

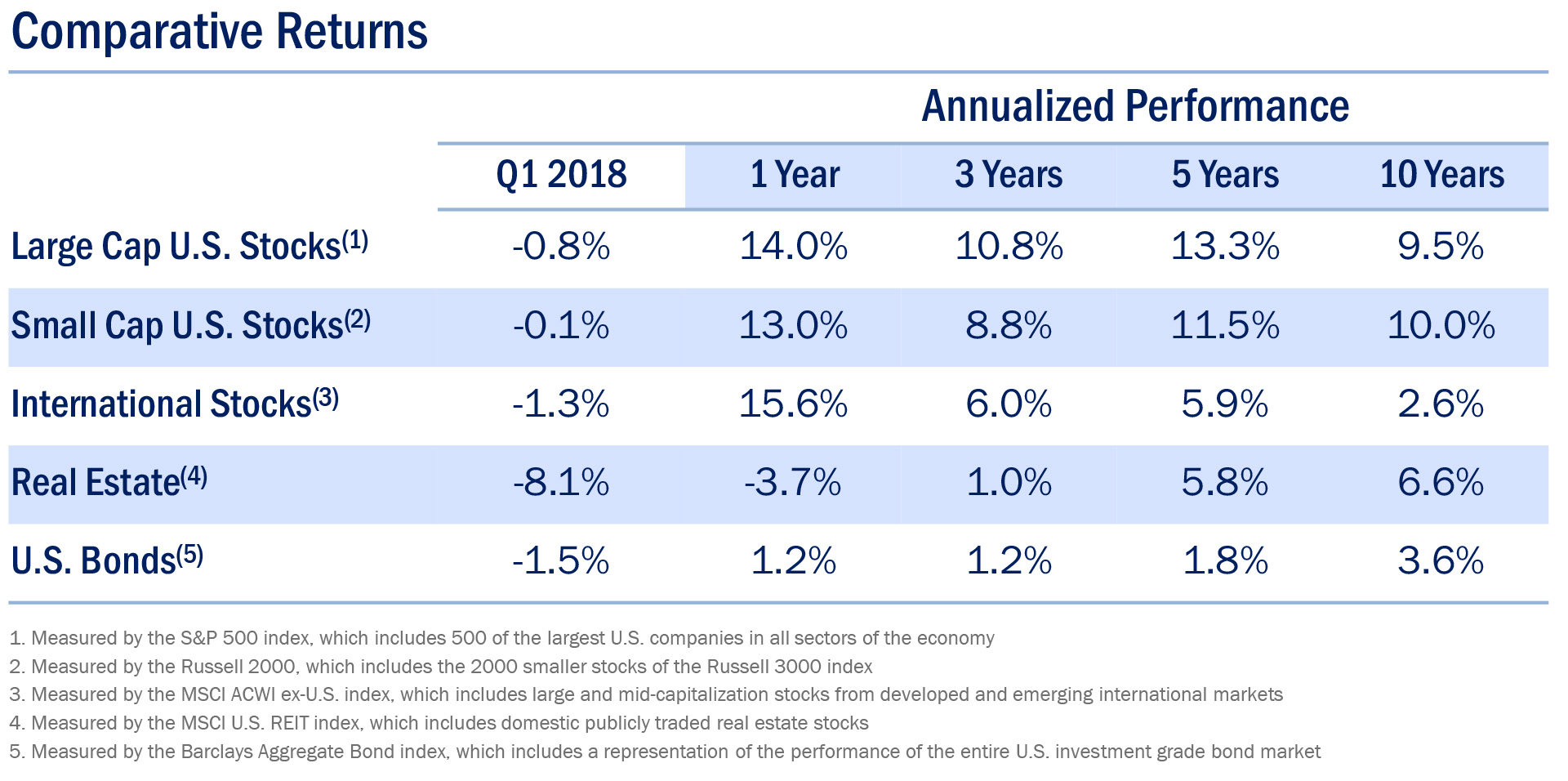

The stock market ended nearly two years of historically low volatility in the first quarter. Stocks started the year soaring 7.4% in the month of January. The euphoria quickly abated in February as fears of rising inflation caused the market to reverse course and decline by 8.5%. Then March brought protectionist trade policies and turmoil in the tech sector’s FAANG stocks (Facebook, Amazon, Apple, Netflix, and Google). Despite this volatility, the S&P 500 ended the quarter about where it began, down just 0.8%. International and small company stocks also declined slightly this quarter by 1.3% and 0.1%, respectively. Rising interest rates had a pronounced impact on real estate, which dropped 8.1%. Intermediate term bonds performed poorly as well, declining by 1.5%.

This volatility is a natural part of the stock market. Although the CBOE Volatility Index has more than doubled this year to 23, it is currently only slightly above its long-term average of 20. Many investors overreact to rising volatility as it tends to accompany fearful headlines and falling stock prices; however, once it subsides, stocks often return to previous highs. A negative emotional reaction toward volatility is normal since people tend to be risk averse and prefer to avoid uncertainty. Nevertheless, volatility is one of the few guarantees in the stock market. Investors are compensated for this uncertainty with historical stock market returns that are above most other asset classes. Therefore, the best long-term strategy is to maintain a risk appropriate investment portfolio and not be deterred by short-term market fluctuations.

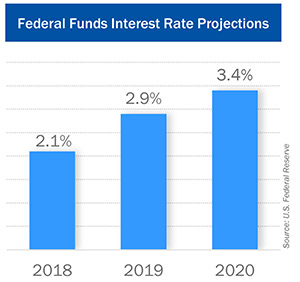

Federal Reserve Continues Plan to Raise Interest Rates

The Federal Reserve raised the federal funds rate by 0.25% at its March meeting to a range of 1.5% to 1.75% as previously planned. However, the tone of the meeting was slightly more hawkish than expected. While the Fed reiterated its intention to raise rates by 0.25% two more times this year, it modified 2019 estimates to include three rate increases instead of the two it previously predicted. This more aggressive stance originates from a stronger economic growth outlook in 2018 and 2019 and unemployment falling to a generational low of 3.6% next year.

Bond investors who own short-term maturities have benefited from rising interest rates and can now purchase 3-month Treasuries that yield 1.7% annually, up from 0.2% just two years ago. However, as interest rates rise, bond values tend to fall, sometimes substantially for longer-term bonds. For example, in the first quarter, yields on 10-year Treasuries rose by 0.3% to 2.7%, causing their value to drop by over 2%, which amounts to nearly a full year’s worth of interest payments. Given the current rising rate environment, it is imperative that bond investors analyze and understand their bond investments and consider the risk/return trade-off between short and long- term bonds.

Bond investors who own short-term maturities have benefited from rising interest rates and can now purchase 3-month Treasuries that yield 1.7% annually, up from 0.2% just two years ago. However, as interest rates rise, bond values tend to fall, sometimes substantially for longer-term bonds. For example, in the first quarter, yields on 10-year Treasuries rose by 0.3% to 2.7%, causing their value to drop by over 2%, which amounts to nearly a full year’s worth of interest payments. Given the current rising rate environment, it is imperative that bond investors analyze and understand their bond investments and consider the risk/return trade-off between short and long- term bonds.

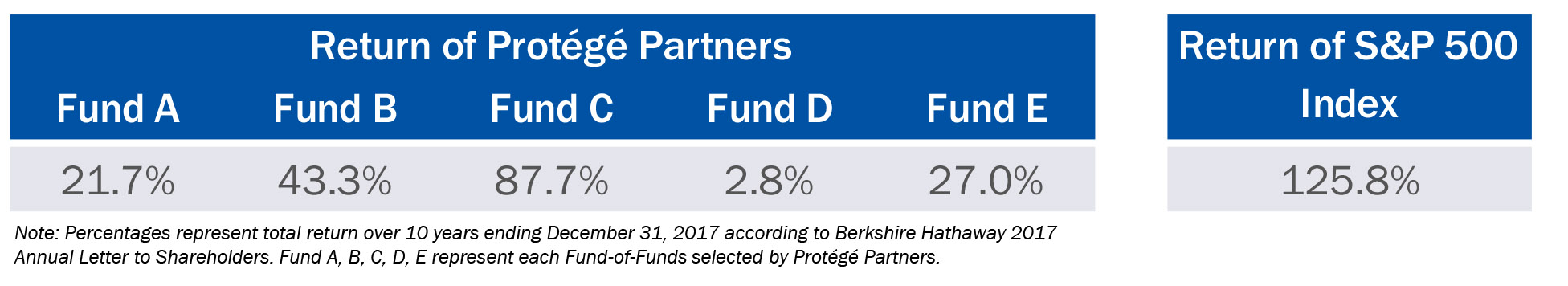

Buffett Bets Index Fund will Outperform Hedge Funds – Wins by Landslide

For many years, Warren Buffett has been an advocate of low-cost index investing. In fact, he has mentioned his affinity for index funds many times in his widely read annual reports. This year, he emphasized this conviction by detailing the outcome of his $1.0 million bet with Protégé Partners, a hedge fund that invests in other hedge funds. In 2007, Buffett bet Protégé Partners that a simple S&P 500 index fund would outperform any hedge funds they chose over the next 10 years. Protégé Partners selected five fund-of-funds that invested in over 200 different hedge funds. Armed with the knowledge that 90% of stock pickers underperform the S&P 500 over the long-run, Buffett was very confident he would be victorious.

The results are detailed in Berkshire’s 2017 annual report, and he states, “The five funds-of- funds got off to a fast start, each beating the index fund in 2008. Then the roof fell in. In every one of the nine years that followed, the funds-of-funds as a whole trailed the index fund.” Over the duration of Buffett’s wager, the S&P 500 averaged an 8.5% annual return while the hedge funds averaged just a 3.0% annual return. One of the five fund-of-funds did so poorly that it closed its doors nine years into the bet. We believe it is hard to argue with Buffett and the mounting statistical evidence that indicates index investments are ideal for most people.