There are so many reasons and opportunities to donate money for both businesses and the average American. Donations make such proper occasions to expose consideration towards their values and mission. Aside from the process of giving money away to charity, there are documents which need to be taken care of. The essential one is the donation receipt – which companies later need for the tax deduction.

Charitable contributions are subjected to IRS regulations which involve attention every step of the process. Meanwhile, the entire action of deducting taxes seems challenging and impossible to understand. There are professionals who decipher the IRS regulations for Americans. However, the process is more natural and involves less work for companies who choose to contribute to a cause. We compiled the below guide to outline what you need to do when donating money or goods. As a business, these steps will turn out to be both necessary and useful.

What Are Donation Receipts?

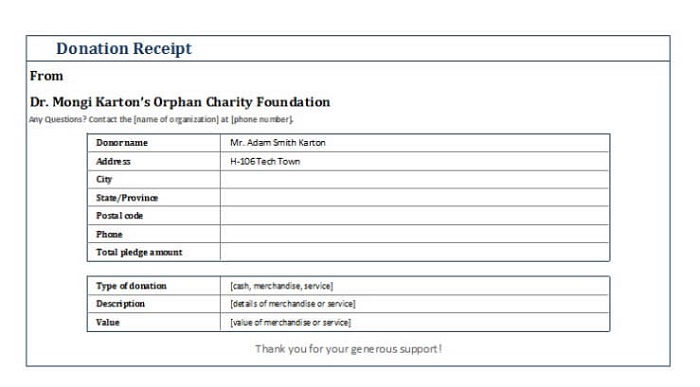

Donation receipts are documents that companies receive after contributing with money and/or goods. We cannot further discuss a record without giving details about what the document is and what it should contain. There are formats that nonprofit charity organizations usually use for all donors. You can research donation receipts templates that you can review by clicking here. Templates work to help you to find the receipts among other documents quicker and to have a glimpse of how they look like.

Such receipts may have different formats or be personalized with the organizations’ logos and mottos. They may come as physical letters or as parts of digital emails. There’s a custom among nonprofits to send receipts in December or January of the following year.

Some organizations send the receipts out right away as donors usually give again if their contributions are confirmed within 48 hours. Therefore, they also ensure better communication with organizations that businesses partner with.

In the end, receipts make the documentation that IRS requests for a tax deduction in two situations.

- For financial donations of over $250.

- For all non-cash donations.

- When the donor receives goods or services in exchange for their contribution greater than $75.

What Donation Receipts Need to Contain

There’s more to donation receipts than the tax deduction. As per any financial documentation, receipts make it easier to have accurate financial records within the accounting department. Here’s what the letter should contain to stand as valid as an economic and accounting document, as per the IRS.

- The donor’s name or company name.

- The amount of the cash contribution or a description of the non-cash contribution – without specifying the value of the objects.

- A statement that no services or goods were provided to the receiving organization in return for the contribution.

- If the receiver provided services or goods, the receipt should include a description and a reasonable faith estimate of the value of the above.

- Churches should provide businesses with a statement indicating that there were intangible religious benefits supplied with no monetary value – if it’s the case.

Donating Objects or Services

Vehicles: If the value of the object is around $250 – $500, the standard donation receipt is enough. However, when the car is sold, you also need the date of sale and the gross profit you made – which must stand below the tax deduction. Also, if the nonprofit keeps the vehicle, the donation receipt should also include the period it will be used and its intended purpose.

Objects: If you donate objects that have a value higher than $5,000, the objects need an appraisal made by a qualified professional.

Properties: If you donate a house or other kind of property worth of $5,000 to a nonprofit, then you will need written documentation indicating whether the receiver will use or sell it.

Unreimbursed donations: There are transportation costs to perform donated services and other unreimbursed contributions you will need a receipt for – if they exceed $250. You should also keep a record of these expenses.

Which Organizations Don’t Qualify for Charity Deductions

- Sports and social clubs, labor unions, chambers of commerce and civic leagues.

- For-profit organizations.

- Foreign organizations – except Canadian, Mexican and Israeli nonprofits.

- Lottery, bingo, raffle tickets.

- Lawmaking or lobbying organizations.

- Homeowners’ associations or individuals.

- Recreational or social clubs – for dues, bills, and fees.

- Political groups or candidates.

Exceptions to the Rule

- Memberships: You need a receipt if the annual cost of membership exceeds $75 in goods or services provided in exchange.

- Tokens: If the symbol includes goods or services offered by the nonprofit in return for value over $106 or payment above $53 – if the value of the goods/services exceeds $10.60.

Following the Donation Receipt Guidelines

The IRS also requests for a bank record which proves that you’ve contributed to documenting financial donations.

Most of the above guidelines are already part of the routine work that your accountants usually do. However, they apply to both businesspeople and citizens who donate for personal purposes. If you leave work and plan to donate, you can see whether you need a receipt for a tax deduction or not. In terms of business documents, they should be kept in registers that explain each of your company’s financial initiatives.

These documents are easy to make, if you eventually set up a nonprofit and receive donations. Donation receipt templates are useful and ensure you of accuracy. Until then, the IRS regulation includes the above information. Deducting taxes is not difficult once you have a clear view of the entire process. Make sure you read everything you need to know before donating, to make sure that you don’t need to pay taxes for your kind deed.