Image credit: Imagesource.io

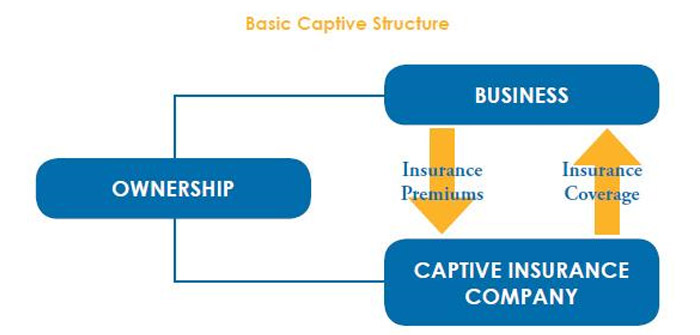

Building captive insurance is not to recreate, but to build another entity which is capable of managing your corporate risk. They are established by either an insurance or a non-insurance parent company, and are considered a separate legal entity in obedience with rules and regulation of insurance authorities.

The Aim of Captive Insurance

Its primary purpose is to insure and cover the risk of its parent company against specified losses.

It comprises various purposes like cost stability, customized insurance coverages, and it provides insurance which is unavailable through commercial insurers. It also helps save additional premium cost, which opens more earning opportunities.

Can Small Companies Create Captive?

It was initially believed that captives are only possible for those companies with high penetration rates and huge insurance premiums with at least 50+ employees, but that’s not really the case today.

With increasing innovative developments, specific insurance requirements, and unavailability of coverages, it is possible for even small businesses to build their own captives. Small captives legally avail advantage from “US Internal Revenue Code Section 831 B”, as it allows tax to be exempted or reduced.

Types of Captive Insurance

The prominent ones include:

- Single-parent captive: Captive handles all the coverages of its owner and its subsidiaries.

- Group captive: Different companies pool in their resources and share in

- Diversified captive: A captive which provides insurance for those other than their parent company.

- Industry captive: Different organizations from the same industry, come up with a captive to solve a common industrial problem of insurance coverage.

There are other types like “Rent-A-Captive” as offered by companies such as Talisman Casualty. You can discover what is Talisman Casualty suit to understand what types of captive are being practiced for further information.

Why Do Companies Form A Captive?

Captives help to anticipate the risk in which the company will be working with, and it provides insurance coverages accordingly.

Also, since reinsurance deals directly with insurance companies, captive gets direct access and avoids commercial insurers expenses with benefits from deduction of its markup cost.

Furthermore, captive allows companies to gain full control over their risk management, claims handling, and retain 100% of the underwriting profits. This saves additional costs and increases cash flow.

Keeping in Mind

To build a captive, the company needs sufficient capital in reserves and should maintain at a certain level to pay for any unforeseen claims or catastrophic losses. This is a big consideration where the company might have to withdraw their valuable assists if it’s the case otherwise.

Other than that, captive requires additional administration, management, and legal expertise to make the operations smooth, which takes time, capital and resources.

Conclusion

Captive comes with their own benefits and costs, which depends upon personalized requirements of a company, strictly keeping in view its practical achievability. It is a wise consideration to consult industry experts for being well-versed over its legal concepts before planning to build one.