(Photo by Simon Mather)

Annual Real Estate Forecast Breakfast Hears of More Diversification and Urbanization for City Future

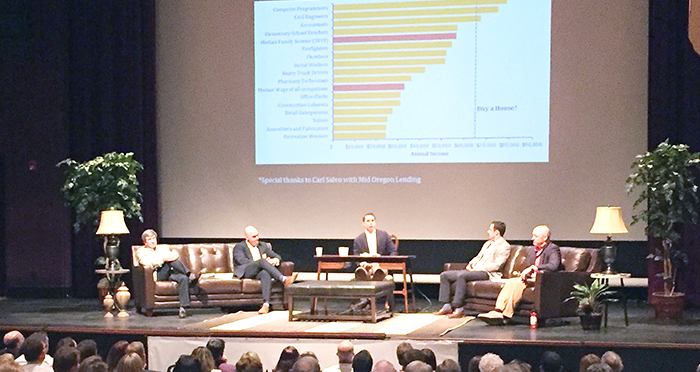

Increased urbanization will be a fact of Bend’s future, while a more diversified and stable current economy should see the city better able to weather any future downturns relative to the last major recession, a packed house of business and community leaders heard at the Chamber-hosted Real Estate Forecast 2016 event last month.

A panel of experts – including Taylor Northwest CEO Todd Taylor, Hayden Homes President Steve Klingman, Compass Commercial Real Estate Principal Broker Jay Lyons and Bend Assistant City Manager Jon Skidmore – moderated by Oregon Employment Department State Economist Damon Runberg, tackled the “Boom, Bubble or Bust” discussion of whether Central Oregon was experiencing another market surge akin to the frothy years of the mid 2000s.

Runberg framed the forum in the context of comparing the three-year period of 2005-07, generally recognized as the last boom era, to that of 2013-15 while also positing the question of what may lie ahead from that springboard which prompted guarded optimism for the near-term future.

He observed that ’05-’07 witnessed frenzied construction activity with home prices up 44 percent, while Deschutes County added 10,000 new jobs – though a relatively high proportion of such employment was in the housing-related sector – with 4 percent wage growth amid a tight labor market and a skyrocketing population climb of 11 percent.

A predictor of the crash to come, “the canary in the coal mine” as Runberg put it, was the plummeting of new building permits from some 160 a month in June 2016 to just 63 by September of that year with activity never recovering from that point through the recession.

He observed that period to be a real estate-driven expansion with many of the state’s workers leaving the construction industry in the aftermath never to return and often switching careers.

Lack of economic diversity in the area and high debt loads saw the recessionary headwinds impact population jobs and job growth with the “local shock” amplified by a workforce exodus and removal of local spending power.

One bright point that offset the challenges beyond 2010 was the resilience of the region’s tourism industry as one of the bigger labor force attractors.

Holding the mirror up to 2013-15 versus the previous rise, Runberg said similar trends could be observed – including home prices up 46 percent but still off the previous peak, employment levels increased by 18 percent or 12,000 new jobs, 5 percent population growth and rising wages in the light of a tight labor supply – but with several key differences.

Bend is still adding building permits today, up 14 percent in the last three years, but it is more of a “slow and steady” growth and consumers were in a “safer place” after being more conservative regarding leverage and debt loads.

The local economy lay on a more stable foundation, with features such as:

– Career wage growth on track;

– A more diversified environment, with housing-related jobs more in line with the national average of under 20 percent as opposed to over a third in the last boom, while tourism and professional services continued to increase, especially in the rapidly rising healthcare industry;

– A more conservative pace of building and development;

– Home price growth based on solid fundamentals of supply and demand.

Addressing the lack of rapid ramp up in building permits and what may be constraining construction, Lyons said on the commercial front rents were still not where they needed to be to trigger new speculative construction, and properties that were purchased during the downturn and able to offer relatively attractive rates were being absorbed through the market.

Klingman said that Hayden Homes operated in three states and one of the main lessons learned in the last dip was a more responsible homebuyer approach regarding access to credit. Land costs may be more in line but a doubling of development costs and extended entitlement timeframes as well as construction labor shortages were impacting prices for what have been predominantly local purchasers.

Taylor said that labor availability was a challenge across the board, and the future Urban Growth Boundary expansion would not be “a knight in shining armor” to address housing affordability issues as the anticipated additional land was about a tenth of the acreage deemed developable within the City limits and major infrastructure issues remained to be addressed.

He added: “Oregon is in the business of creating more urbanization, and the legislature is promoting ways to allow more diverse housing options.

“The state is shooting for relatively higher multifamily and workforce housing, and we will see more in the way of infill development locally.”

When asked what a future Bend may look like, Skidmore pointed to the Base Camp project off Colorado Avenue offering a more urban product with storage close to downtown and the evolving Galveston Avenue with a vibrant mix of uses and more ground floor commercial with living above as examples of what may lie ahead .

Taylor said infill development would demand more creativity but was excited to work with the City as it catalyses means, such as the Central Area Plan, to catalyze the transition to different products. Lyons added that we would likely see more mixed-use projects and creative development such as the 900 Tech building off Emkay Drive which features a more open setting with less square footage required per worker, with amenities close by.

Skidmore added that as the 7th fastest growing city in the US, Bend would inevitably face more traffic and parking issues, and could not “build our way out of congestion” but the growth management strategy would continue to feature land use programming to help alleviate pressure on existing infrastructure.

Klingman said there was a good foundation for the two-year horizon and he was optimistic as long as discipline was maintained in areas such as finances and development. Taylor added that the expansion needs of local companies needed to be taken care of, but the community had a great opportunity to have a say in how its community would look in the future.

Lyons anticipated commercial lease rates continue to climb and vacancy rates drop and Skidmore said people would have to adjust to a more urban environment as Bend’s population is forecast to hit 120,000 by 2028.