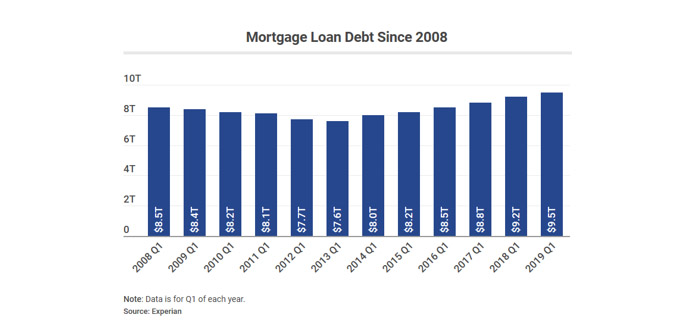

Outstanding U.S. mortgage balances increased for the seventh straight quarter, reaching a new high of $9.5 trillion, according to Experian data from the Q1 of 2019. This amount is well above the outstanding balances reported during the mortgage crisis of 2008.

Additional highlights:

- The number of available homes for sale remained flat year-over-year in Q1 2019, the first time home inventory hasn’t decreased in three years.

- Interest rates are expected to remain below 5 percent in 2019, with 30-year mortgage rates averaging 4.3 percent during Q2 2019 and staying around 4.4 percent during the second half of 2019.

- The average U.S. mortgage debt per borrower was $202,284 in Q1 2019, a 2.4 percent year-over-year increase.

- Oregon residents had an average mortgage debt of $224,503 per borrower.

- The Bend mortgage market had a debt average of $237,403.

Check out the full story at experian.com/blogs/ask-experian/how-much-americans-owe-on-their-mortgages-in-every-state