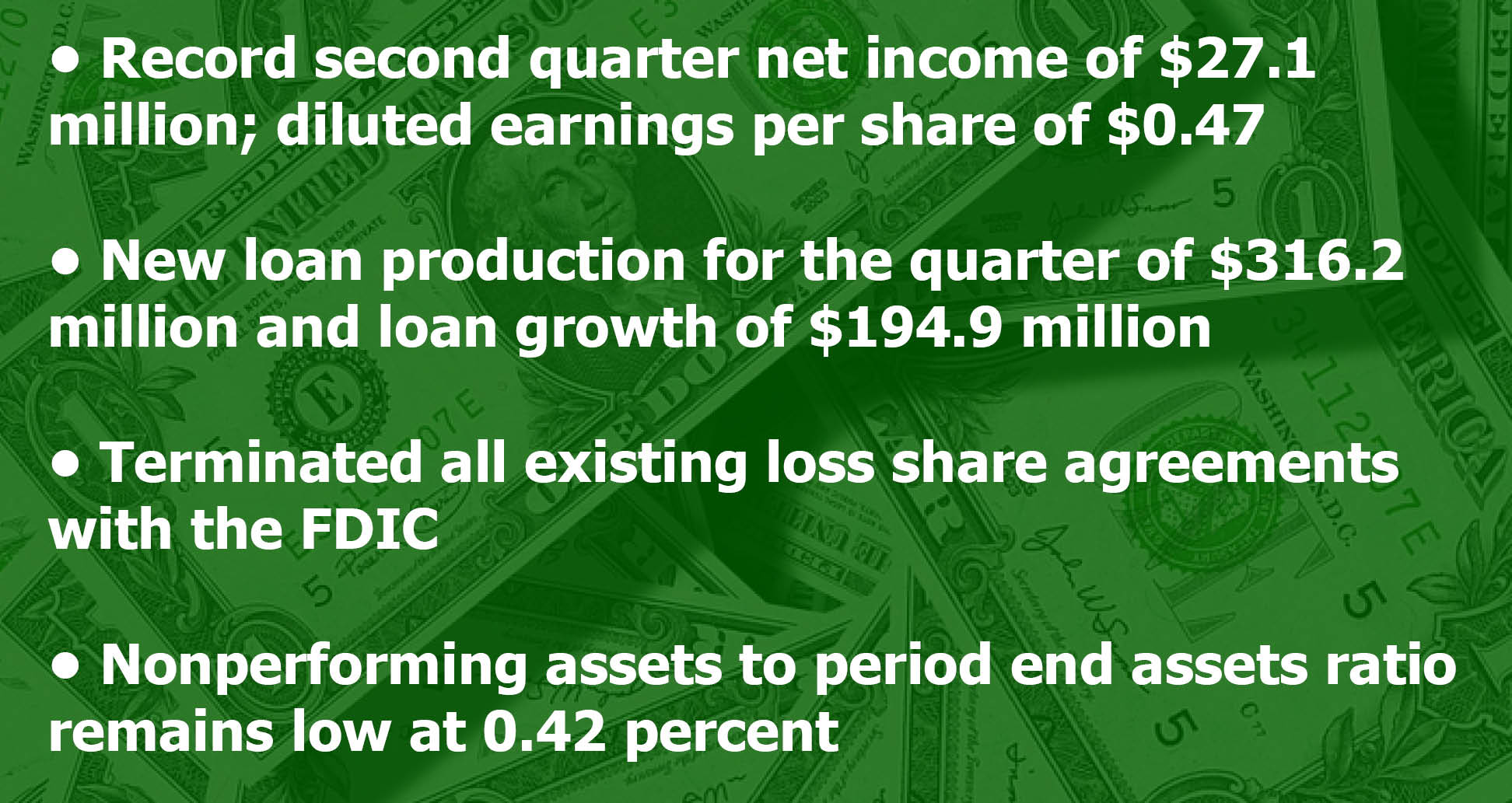

Hadley Robbins, president and chief executive officer of Columbia Banking System and Columbia Bank, said upon the release of Columbia’s second quarter 2017 earnings, “I’m pleased with our record setting earnings for the quarter, especially in light of the impact of the $2.4 million expense we recognized to terminate our FDIC loss sharing agreements, which when combined with the $1.0 million of acquisition-related expense recorded in the quarter, reduced our earnings per share by $0.04.

“Our record first half 2017 earnings is a direct reflection on the efforts of our bankers, who remain focused on developing new relationships while deepening existing ones.”

Total assets at June 30, 2017 were $9.69 billion, an increase of $157.8 million from March 31, 2017. Loans grew $194.9 million during the quarter due to strong loan originations of $316.2 million and seasonal increases in line utilization. Securities available for sale were $2.26 billion at June 30, 2017, a decrease of $66.7 million, or 3 percent from $2.33 billion at March 31, 2017. Total deposits at June 30, 2017 were $8.07 billion, a decrease of $16.4 million from March 31, 2017. Core deposits comprised 96 percent of total deposits and were $7.72 billion at June 30, 2017, a decrease of $72.8 million from March 31, 2017.

The average cost of total deposits for the quarter was 0.05 percent, an increase of one basis point from the first quarter of 2017.

Income Statement

Net Interest Income

Net interest income for the second quarter of 2017 was $86.2 million, a decrease of $514 thousand from the linked period and an increase of $4.0 million from the prior year period. The linked quarter decrease was principally from taxable securities income, whose yields during the first quarter of 2017 benefited from a market-driven reduction in premium amortization. Also contributing to the decrease was incremental accretion from purchased loans, which was $956 thousand lower than the linked period. The increase from the prior year period was due to higher loan and securities volumes, partially offset by lower incremental accretion. Incremental accretion income from purchased loans in the current period was $1.3 million lower than the prior year period. For additional information regarding net interest income, see the “Average Balances and Rates” table.

Noninterest Income

Noninterest income was $24.1 million for the second quarter of 2017, a decrease of $724 thousand compared to $24.9 million for the first quarter of 2017. The linked quarter decrease was principally due to lower bank owned life insurance (BOLI) benefits in the current period as well as a $573 thousand benefit from re-measuring our mortgage repurchase liability in the linked period. Both the BOLI and mortgage repurchase benefits were recorded to other noninterest income. Compared to the second quarter of 2016, noninterest income increased by $2.2 million due to lower expenses from the FDIC loss-sharing asset as well as higher other noninterest income, principally from a current quarter BOLI benefit of $430 thousand, with no such BOLI benefit in the prior year period.

Noninterest Expense

Total noninterest expense for the second quarter of 2017 was $68.9 million, a decrease of $119 thousand from the first quarter of 2017. The small improvement resulted from lower compensation costs being offset by the $2.4 million charge from early termination of our FDIC loss-sharing agreements; the early termination charge was recognized in other noninterest expense. The lower compensation costs stemmed from additional stock compensation expense recognized in the linked quarter due to the immediate vesting of certain restricted share awards as well as additional payroll taxes.

Compared to the second quarter of 2016, noninterest expense increased $5.1 million, or 8 percent, $63.8 million. The increase was due to the previously noted charge from early termination of loss sharing agreements as well as $1.0 million of acquisition-related expenses recognized in the current quarter. In addition, legal and professional fees were higher due to costs from both our investment in a customer relationship management application and the search for a permanent chief executive officer.

Net Interest Margin

Columbia’s net interest margin (tax equivalent) for the second quarter of 2017 was 4.12 percent, a decrease of 8 basis points from the linked quarter and an increase of 2 basis points from the prior year period. The decrease from the linked quarter was due to higher linked quarter interest income from taxable securities, which was driven by reduced amortization of premiums as well as lower incremental accretion in the current quarter. The increase from the prior year quarter was due to higher loan and security volumes, partially offset by lower incremental accretion. Columbia’s operating net interest margin (tax equivalent)(1) was 4.09 percent for the second quarter of 2017, unchanged from the linked quarter and an increase of 9 basis points from the prior year period due to higher loan and security volumes.

Asset Quality

At June 30, 2017, nonperforming assets to total assets were 0.42 percent compared to 0.32 percent at March 31, 2017 and 0.35 percent at December 31, 2016. Total nonperforming assets increased $10.8 million from the linked quarter due to an $11.3 million increase in nonaccrual loans, partially offset by a decrease in other real estate owned.

The allowance for loan losses to period end loans was 1.14 percent at both June 30, 2017 and March 31, 2017. For the second quarter of 2017, Columbia recorded a net provision for loan and lease losses of $3.2 million compared to a net provision of $2.8 million for the linked quarter and $3.6 million for the comparable quarter last year. The net provision for loan and lease losses recorded during the current quarter consisted of $3.9 million of provision for loan losses for loans, excluding PCI loans, partially offset by a provision recovery of $738 thousand for PCI loans.

Andy McDonald, Columbia’s Executive Vice President and Chief Credit Officer, commented, “Our nonperforming assets ratio of 42 basis points reflects the strength of our regional economy and the diversification within our loan portfolio.”

Organizational Update

Robbins commented, “Our pending acquisition of Pacific Continental Corporation is

progressing. As announced last month, we have received the required shareholder approvals to complete the merger. Once the remaining regulatory approvals are obtained, we look forward to joining these two great companies together to the benefit of our customers, shareholders and the communities we serve.

In addition, we regularly evaluate the alignment of our products and services with the needs of our clients. Given rapid technology changes in the payments industry, we are shifting our merchant card services business to an industry leading, third-party provider. We believe this transition will better serve our business clients via a broad selection of competitive, best-in-class payment processing solutions. This transaction will result in a one-time $14.0 million gain which will be recognized in the third quarter of 2017.

“I’m pleased to have recently announced some organization changes that are occurring at the Company. Clint Stein’s transition from chief financial officer to chief operating officer provides a great opportunity for leadership continuity as the two of us and our teams, have worked closely on the majority of our recently completed and in process strategic business initiatives. In addition to the national search for our next CFO, we have a search underway for an executive level Chief Risk Officer. This role will oversee the maturation of our existing enterprise risk management program and position us for future growth.”

Cash Dividend Announcement

Columbia will pay a regular cash dividend of $0.22 per common share on August 23, 2017 to shareholders of record as of the close of business on August 9, 2017.

Headquartered in Tacoma, Washington, Columbia Banking System, Inc. is the holding company of Columbia Bank, a Washington state-chartered full-service commercial bank with locations throughout Washington, Oregon and Idaho. For the eleventh consecutive year, the bank was named in 2017 as one of Puget Sound Business Journal’s “Washington’s Best Workplaces.” Columbia ranked in the top 30 on the 2017 Forbes list of best banks

www.ColumbiaBank.com