Dovish statements from Jerome Powell and other Federal Reserve officials buoyed investor confidence that the Federal Reserve is prepared to lower interest rates to preserve the economic expansion. The Federal Reserve’s increasingly accommodative stance helped stocks shrug off continued trade tensions, a rising risk of recession, and turmoil with Iran. The S&P 500 followed a bumpy path this quarter, including a 6.7% drop in May, to notch a 4.3% increase. As a result, the S&P 500 finished the first half of the year up 18.5%, its best first-half performance since 1997. Small capitalization and international stocks performed similarly and gained 2.1% and 3.0% in the quarter, respectively.

Interest rate sensitive investments shined in the second quarter, propelled by a drop in the 10- year Treasury yield to 2.0% from 2.4% in the prior quarter (bond yield and price are inversely related). Declining yields contributed to a healthy 3.1% gain for bonds, but lower yields imply less cash interest for investors going forward. Fueled by lower rates, real estate remained one of the top performing asset classes this year, posting a 17.8% return year-to-date.

Economic indicators slightly weakened this quarter including declines in manufacturing surveys, housing data, and new job growth. In addition, global economic growth is expected to soften over the next several quarters. However, consumer confidence remains high and European and Japanese central banks appear ready to provide further economic stimulus if growth continues to falter. Although stock market volatility will undoubtedly persist, over the long-run, stocks have historically been a tremendous wealth-building investment.

- Measured by the S&P 500 index, which includes 500 of the largest S. companies in all sectors of the economy.

- Measured by the Russell 2000, which includes the 2000 smaller stocks of the Russell 3000

- Measured by the MSCI ACWI ex-U.S. index, which includes large and mid-capitalization stocks from developed and emerging international

- Measured by the MSCI S. REIT index, which includes domestic publicly traded real estate stocks.

- Measured by the Bloomberg Barclays Aggregate Bond index, which includes a representation of the performance of the entire S. investment grade bond market.

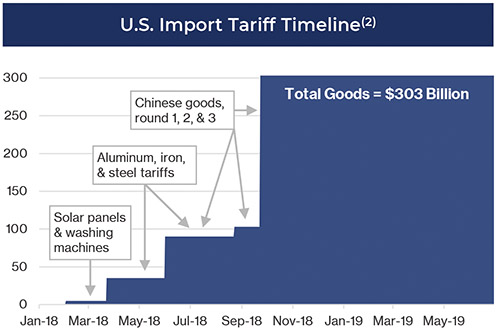

Trade Tensions Continue

Since early 2018, protectionist rhetoric and tariffs have escalated between the U.S. and China, dampening investor enthusiasm and suppressing upward stock market momentum. In fact, U.S. tariffs ranging from 10% to 50% have been levied on goods totaling $303 billion, amounting to 13% of total U.S. imports and causing an estimated $79 billion in annualized economic loss.(1)

Economic theory suggests that tariffs act as a tax paid by consumers in the form of higher costs and cause negative economic consequences including higher inflation, slower growth, and lower employment. If a favorable deal can be reached with China, the global stock market should receive a tailwind from rising economic growth and corporate profits. President Trump and China’s Xi Jinping recently made another truce in their trade war at the G-20 Summit, removing an immediate threat looming over the global economy even as a lasting peace remains elusive.

Economic theory suggests that tariffs act as a tax paid by consumers in the form of higher costs and cause negative economic consequences including higher inflation, slower growth, and lower employment. If a favorable deal can be reached with China, the global stock market should receive a tailwind from rising economic growth and corporate profits. President Trump and China’s Xi Jinping recently made another truce in their trade war at the G-20 Summit, removing an immediate threat looming over the global economy even as a lasting peace remains elusive.

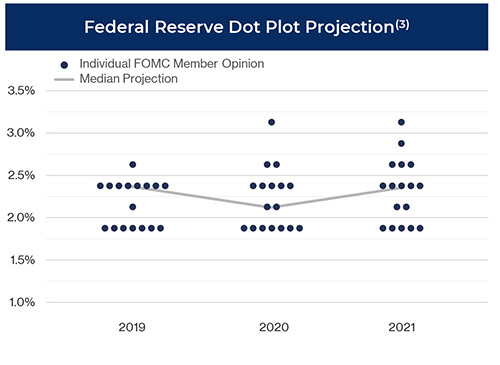

Federal Reserve Hits the Brakes on Interest Rates

The Federal Reserve’s short-term interest rate projections have shifted dramatically over the last six months. In December, the consensus from the Fed was that they would raise rates twice in 2019 by a total of 0.5%. However, as illustrated below by the median “dot plot” expectations from its June meeting, the Fed’s next move may be to reduce interest rates.

Each dot on the graph represents the interest rate expectation for one of the 17 Federal Open Market Committee Members for each year-end. The current target range for the Fed Funds rate is 2.25% to 2.50% and the median projection for year-end 2019 indicates maintaining this range; however, seven of the 17 members believe rates will decline by 0.5% by year-end. Furthermore, the median dot plot projection for 2020 dropped by 0.5% from the projections made at the Fed’s March meeting. This about-face helped push stocks up 9% from their mid-quarter low in May by showing the Fed’s willingness to be accommodative and help stimulate economic growth if necessary.

Each dot on the graph represents the interest rate expectation for one of the 17 Federal Open Market Committee Members for each year-end. The current target range for the Fed Funds rate is 2.25% to 2.50% and the median projection for year-end 2019 indicates maintaining this range; however, seven of the 17 members believe rates will decline by 0.5% by year-end. Furthermore, the median dot plot projection for 2020 dropped by 0.5% from the projections made at the Fed’s March meeting. This about-face helped push stocks up 9% from their mid-quarter low in May by showing the Fed’s willingness to be accommodative and help stimulate economic growth if necessary.

- Mary Amiti, Stephen Redding, and David Weinstein, “New China Tariffs Increase Costs to S. Households,” Federal Reserve Bank of New York Liberty Street Economics, May 23, 2019.

- National Bureau of Economic Research, May 2019 Digest

- Federal Reserve June 2019 Projections

Social Security Overview

The Social Security system was created in 1935 by the Social Security Act to provide a safety net for retired and disabled workers. Social Security is now the largest governmental program in the world, providing benefits to over 60 million people. To fund the program, a payroll tax of 12.4% is levied on wages, with employees and employers splitting the cost. Benefits increase each year according to a cost of living adjustment and provide valuable guaranteed monthly income for retirees. The benefit system is flexible and allows recipients to choose when they start receiving benefits between the ages of 62 and 70.

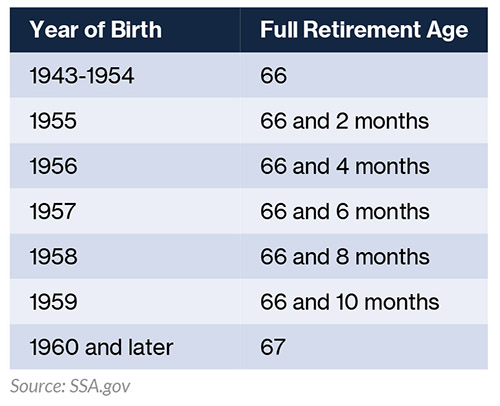

One’s monthly payment is largely based on how much was paid into the system and the age one starts receiving benefits. Social Security payments are calculated using the 35 highest earning years of one’s career, which are adjusted annually for inflation. If one works for more than 35 years, the lowest earning years are excluded from the calculation, which results in a higher payment. The standard retirement age or Full Retirement Age (“FRA”) changes based on birth year and ranges between 66 and 67 years of age.

One’s monthly payment is largely based on how much was paid into the system and the age one starts receiving benefits. Social Security payments are calculated using the 35 highest earning years of one’s career, which are adjusted annually for inflation. If one works for more than 35 years, the lowest earning years are excluded from the calculation, which results in a higher payment. The standard retirement age or Full Retirement Age (“FRA”) changes based on birth year and ranges between 66 and 67 years of age.

Implications of Social Security Timing

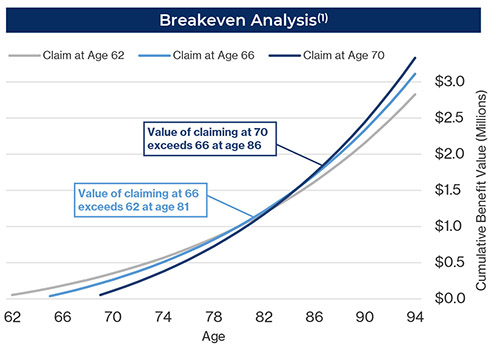

To allow participants the flexibility to begin collecting benefits at various ages and be equitable for all recipients, benefits are decreased for individuals who choose to collect benefits before their FRA and increased for those choosing to delay benefits beyond their FRA. For example, individuals collecting benefits early can face payment reductions of up to 25%. On the other hand, for each year one waits beyond their FRA to collect benefits, payments will increase by 8%, up to a total increase of 32% by delaying benefits for four years. As the graph below shows, choosing when to collect benefits has a dramatic impact on monthly payment amounts and is a crucial component of retirement planning.

Social Security benefits, which last as long as you live, provide valuable protection against outliving savings and other sources of retirement income. More than one in three 65 year olds today will live to age 90, and more than one in seven will live to age 95.

The Social Security Administration

Optimizing Social Security Benefits

The Social Security benefit system was designed to provide a similar benefit for all recipients based on an average life expectancy. However, if one expects to live longer than average, it often makes sense to wait until age 70 to collect benefits to receive a payment 32% larger than the one received at FRA. The graph below shows a breakeven comparison among collecting benefits at ages 62, 66, and 70. If life expectancy surpasses the breakeven intersections in the chart, it may be optimal to delay benefit payments. For example, if one’s life expectancy is less than 81, collecting at age 62 is likely the best strategy. Alternatively, if life expectancy is between 81 and 86, collecting at 66 will should provide the highest benefit. Finally, people with significant longevity who expect to live beyond 86 will maximize their value by collecting at 70.

For married people, the decision regarding when to start collecting benefits becomes more complicated. Married people can choose to collect benefits based on their own earnings record or collect half of the benefits earned by their spouse. In addition, if the higher earning spouse dies first, the surviving spouse can collect the full benefit amount of the deceased spouse if the surviving spouse has reached FRA.

For married people, the decision regarding when to start collecting benefits becomes more complicated. Married people can choose to collect benefits based on their own earnings record or collect half of the benefits earned by their spouse. In addition, if the higher earning spouse dies first, the surviving spouse can collect the full benefit amount of the deceased spouse if the surviving spouse has reached FRA.

Other Considerations

- The Social Security trust fund is expected to run out of money in 2034, which may necessitate an increase in the FRA.

- Depending on one’s taxable income, up to 85% of Social Security benefits may be taxed.

- Payments can be claimed based on an ex-spouse’s work record if the marriage lasted for at least 10 years and the claimant has not remarried.

- If benefits are taken before one’s FRA, those who are between the FRA and age 70 can suspend payments to increase benefits by 8% per year in the future.

- Within 12 months of receipt, benefits can be paid back to qualify for higher future benefits.

- (1) Source: SSA.gov. Note: Assumes 2% cost of living adjustment, 5% annual rate of return, FRA of 66, and maximum wage base for a monthly benefit at FRA of $2,861.