(Graphs courtesy of Oregon Office of Economic Analysis)

Oregon’s economic recovery from the pandemic has been strong compared to recent recessions. The state is at an all-time high for employment and the unemployment rate is near a record low. Central Oregon has the fastest recovery within the state. Encouragingly there is little permanent economic damage from the pandemic when it comes to business activity, employment and income. Better yet, the recovery has been inclusive. To be sure, historical disparities remain when looking at employment and income by educational attainment, gender, race and ethnicity, or across the urban-rural divide. However, these disparities are no wider today than prior to the pandemic, and many have declined. The one exception is wealth inequality which widened in recent years.

This relatively strong economic vantage point is at risk this year and next. The combination of high inflation, expected slowing growth and rising interest rates is potent. The majority of U.S. economic forecasters, and members of the Governor’s Council of Economic Advisors — our office’s advisory group — believe a recession this year is the most likely outcome for the economy. There has been no fundamental deterioration in the economy, but there has been a relative shift in assessing the risks, which many believe now favor a recession being more likely than not. Or at least as of our most recent forecast released in November.

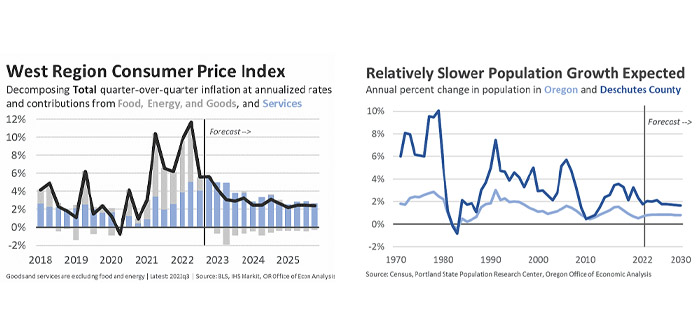

Let’s start first with the bad news. Inflation is still high. Inflation is not costless. It raises the cost of living for Oregonians and the cost of production for Oregon businesses. If incomes, wages and sales are not keeping pace, inflation erodes our standard of living. The challenge for the Federal Reserve is fine-tuning the economy by adjusting short-term interest rates. Historically, inflationary economic booms do not end well, which is why forecasters are pessimistic. The Fed is actively communicating they will risk a recession to ensure inflation comes down.

The encouraging news is that inflation slowed to end 2022. Supply chains are no longer overloaded, and the oil shock from Russia’s invasion of Ukraine faded. These factors are slowing headline inflation sooner, and by more than expected. Even so, the real risks lie with the underlying trend in inflation which remains elevated relative to the Fed’s target. The combination of actual inflation, underlying wage growth and how the Federal Reserve responds are the key issues to weigh in the coming months.

Given this macroeconomic setup, the silver lining is that should the U.S. economy fall into recession this year, as many economists expect, it will likely be a mild recession for three reasons. First, inflation expectations remain well anchored. Surveys show that businesses and households believe inflation will slow in the years ahead. If the recent hot inflation is not being built into longer-term decisions and planning, it is less entrenched in the broader economy.

Second, the labor market is very tight. It is hard to find workers and even as sales slow, firms will not want to lay of employees. Without massive job losses, it is hard to have a deep recession. Third, and most importantly, household finances are strong. Income, savings and wealth are all up, and debt levels as a share of income or assets remain tame. If consumers can continue to spend it short-circuits the traditional negative feedback loop of a recession as firms’ revenues do not slow as much as expected, and therefore will not lay off as many workers.

In terms of the workforce, there is both good and bad news for businesses. The good news is that the workers have fully returned in recent years. The share of working-age Oregonians of all levels of educational attainment with a job today is higher than pre-pandemic. The bad news for businesses looking to hire is that the labor market is structurally tight due to demographics. Retirements are up as the large Baby Boomer cohort ages. And the inflow of young workers into the labor market is increasing at a slower rate. This is the result of both Oregon’s low birthrate and slower migration. As such, the labor market is structurally tight for the foreseeable future.

While inflation is the key macroeconomic issue to watch, population growth is the key Oregon issue to watch. Population growth is the primary reason Oregon’s economy, and Central Oregon’s in particular, outpaces the typical state over time. The large influx, of mostly younger workers who tend to have higher levels of educational attainment, provides Oregon businesses with an ample supply of labor to hire and expand.

Typically migration is a demographic and economic tailwind for Oregon. However, during the pandemic population growth slowed, like it always does in recessions, but so far in expansion, it has not picked up like it used to. Some of this lack of a rebound could still be pandemic-related, or due to increased working from home where households can live farther afield. However, some could be due to other factors related to quality of life, family reasons and the like. It is still too early to tell and the full details of the 2022 migration data are not yet available in terms of who moved.

Central Oregon is not immune to the slowdown either. Recent estimates are for roughly two percent annual population growth in Deschutes County, compared to three or four percent in recent decades.

Looking forward, the outlook calls for a modest rebound in population growth. The regional economy is strong and job opportunities are plentiful. However, a key concern remains housing affordability. To the extent fewer households can afford to live in and move to Oregon, or choose to live in a relatively more affordable state like those in the Intermountain West, then the baseline outlook will need to be revised lower. If housing supply and affordability does not improve, the resulting slower growth would translate into relatively fewer workers, customers and sales for local firms than expected. Less economic activity would also result in less taxes paid to state and local governments to fund public services.